- Hong Kong

- /

- Renewable Energy

- /

- SEHK:991

Datang International Power Generation (SEHK:991): Valuation Insights Following Strong Profit Growth and New Dividend

Reviewed by Simply Wall St

Datang International Power Generation (SEHK:991) just delivered its latest earnings update, revealing a sizable jump in net income for the first nine months of 2025. In addition, the company approved a fresh interim dividend at its recent shareholder meeting.

See our latest analysis for Datang International Power Generation.

The upbeat results and new dividend announcement appear to have reignited investor enthusiasm, helping Datang’s shares build impressive momentum in 2025. The share price closed at HK$2.52, notching a 12.0% gain over the past month and surging 81.3% year-to-date. The total shareholder return has soared nearly 188% over five years, showing that the market’s positive outlook is not just a recent phenomenon but part of a longer-term trend.

If you’re watching Datang’s rally and feeling ready to explore more beyond the usual suspects, it could be the perfect opening to discover fast growing stocks with high insider ownership

With such strong gains and a new dividend in play, investors may wonder if Datang’s shares are still trading below their true value or if the recent rally means future growth is already priced in.

Price-to-Earnings of 6.3x: Is it justified?

With Datang International Power Generation currently trading at HK$2.52, its price-to-earnings (P/E) ratio stands out at just 6.3x. This level is well below both peer and industry averages, hinting at a substantial undervaluation by the market.

The price-to-earnings ratio serves as a quick yardstick for valuing a company in relation to its recent profits. In Datang's case, a P/E of 6.3x means investors are paying just over six times trailing earnings for each share. This reflects market expectations about future profits and growth stability within the context of the utilities sector.

Compared to the peer group’s average P/E of 8.4x and the wider Asian Renewable Energy industry’s P/E of 17.8x, Datang is clearly trading at a steep discount. This deep discount suggests that investors are either underestimating the company’s recent profit growth or assigning lower expectations to future earnings potential despite robust financial progress.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.3x (UNDERVALUED)

However, weak short-term returns or changing industry sentiment could quickly dampen Datang’s momentum. Investors should remain alert to upcoming shifts.

Find out about the key risks to this Datang International Power Generation narrative.

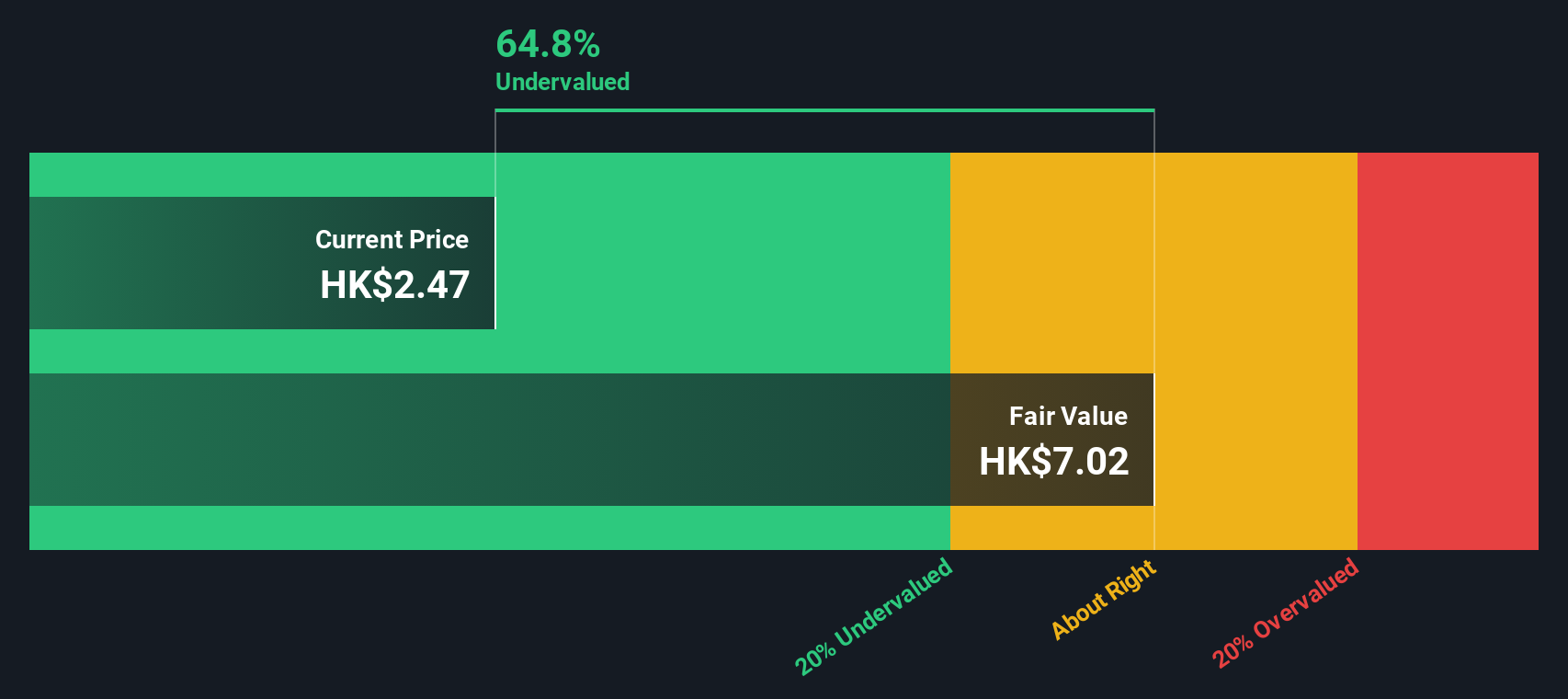

Another View: SWS DCF Model Signals Even Deeper Value

Taking a different approach, our SWS DCF model suggests Datang International Power Generation may be even more undervalued than what simple earnings multiples show. The DCF points to a fair value of HK$7.02. Shares trade at just HK$2.52, indicating a potential discount of over 64%.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Datang International Power Generation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 859 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Datang International Power Generation Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own story in just a few minutes. Do it your way

A great starting point for your Datang International Power Generation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Unmissable Stock Opportunities?

Don't stop with just one winning idea. The Simply Wall Street screener puts a whole world of promising stocks at your fingertips. You could uncover tomorrow's top performers right now.

- Supercharge your returns by tapping into these 859 undervalued stocks based on cash flows, packed with companies poised for a price catch-up based on strong fundamentals and attractive valuations.

- Boost your income stream and stability by checking out these 17 dividend stocks with yields > 3%, featuring reliable stocks that deliver yields above 3% for steady growth.

- Break new ground in a future-facing sector when you browse these 25 AI penny stocks. This can put you ahead in the AI revolution with firms leading the way in innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:991

Datang International Power Generation

Engages in power generation business in the People’s Republic of China.

Solid track record and good value.

Market Insights

Community Narratives