- Hong Kong

- /

- Water Utilities

- /

- SEHK:6839

Yunnan Water Investment's (HKG:6839) Shareholders Will Receive A Smaller Dividend Than Last Year

Yunnan Water Investment Co., Limited (HKG:6839) is reducing its dividend to HK$0.07 on the 30th of July. The dividend yield will be in the average range for the industry at 5.4%.

Check out our latest analysis for Yunnan Water Investment

Yunnan Water Investment's Dividend Is Well Covered By Earnings

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Yunnan Water Investment was earning enough to cover the dividend, but it wasn't generating any free cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

EPS is set to fall by 14.2% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 68%, which is definitely feasible to continue.

Yunnan Water Investment's Dividend Has Lacked Consistency

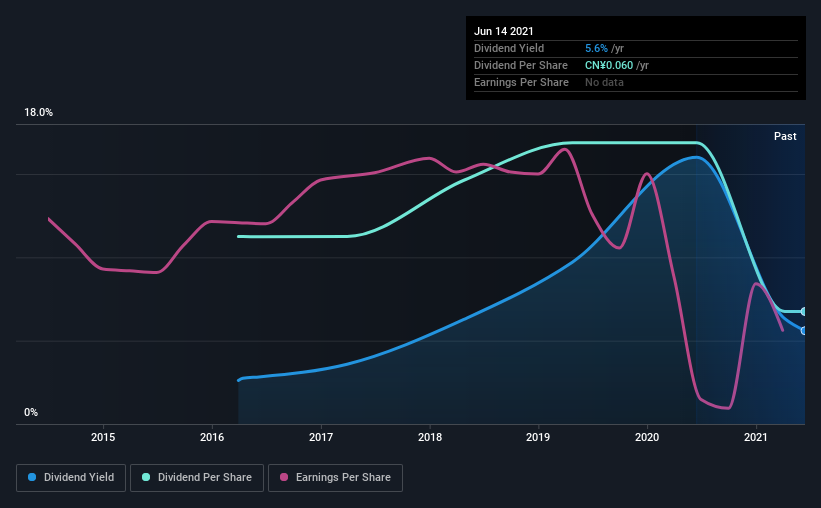

Even in its relatively short history, the company has reduced the dividend at least once. This suggests that the dividend might not be the most reliable. Since 2016, the first annual payment was CN¥0.10, compared to the most recent full-year payment of CN¥0.06. This works out to be a decline of approximately 9.7% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Earnings per share has been sinking by 14% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Yunnan Water Investment's Dividend Doesn't Look Sustainable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 5 warning signs for Yunnan Water Investment (3 don't sit too well with us!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6839

Yunnan Water Investment

An investment holding company, designs, develops, constructs, operates, and maintains municipal water supply, and wastewater and solid waste treatment facilities in the People’s Republic of China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives