- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3

What Hong Kong and China Gas (SEHK:3)'s Green Hydrogen Partnership Means For Shareholders

Reviewed by Sasha Jovanovic

- The Construction Industry Council announced a partnership with The Hong Kong and China Gas Company Limited (Towngas) to promote hydrogen and other green energies in the construction sector, including installing a hydrogen power generation unit at the CIC-Zero Carbon Park in Kowloon Bay.

- This collaboration leverages green hydrogen produced from biogas at a local landfill to demonstrate new approaches toward zero-carbon buildings in Hong Kong.

- We'll explore how Towngas's expanded use of locally-sourced green hydrogen could influence its investment narrative and role in sustainable construction.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Hong Kong and China Gas' Investment Narrative?

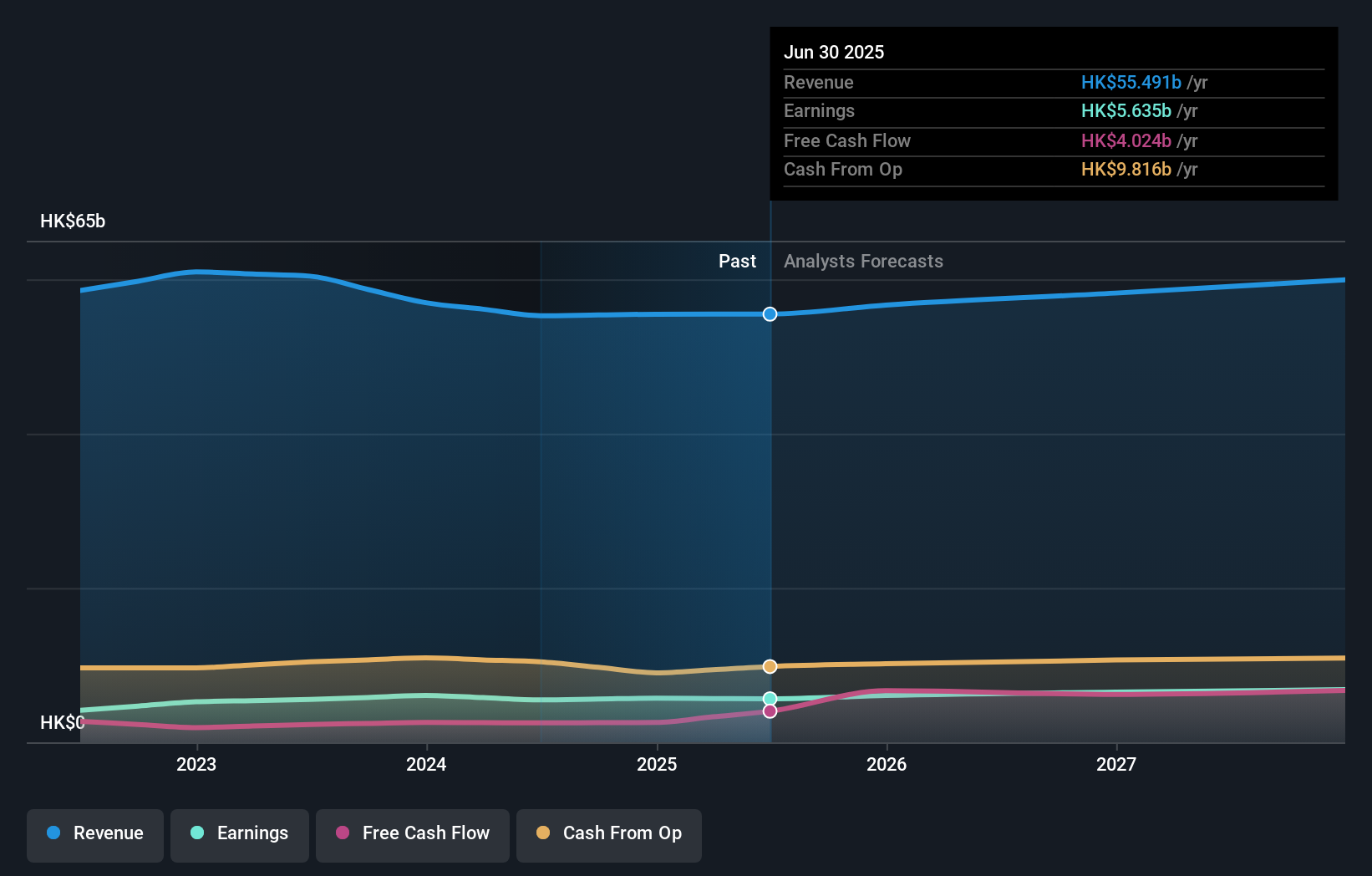

To be a shareholder in Hong Kong and China Gas, you need to believe in its steady position as a key player in utilities, while also recognizing the ongoing challenges in growth and profitability. The recent partnership to promote green hydrogen offers a fresh narrative, especially as the company’s sales have remained stable and earnings have slipped slightly over the past year. While this move into hydrogen presents a long-term sustainability story, it is unlikely to meaningfully shift the core drivers, such as slow revenue growth, a high price-to-earnings ratio, and tight dividend cover, over the short term. Risks like underperforming Hong Kong’s broader market, high debt coverage needs, and modest profit improvement in 2025 still stand out. However, hydrogen initiatives do support a greener image, which could influence future sentiment and open doors for additional partnerships. In contrast, debt coverage remains a pressure point investors should be aware of.

Hong Kong and China Gas' shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Hong Kong and China Gas - why the stock might be worth as much as HK$7.22!

Build Your Own Hong Kong and China Gas Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hong Kong and China Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hong Kong and China Gas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hong Kong and China Gas' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong and China Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives