- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Guangdong Investment's (HKG:270) Dividend Will Be Increased To HK$0.43

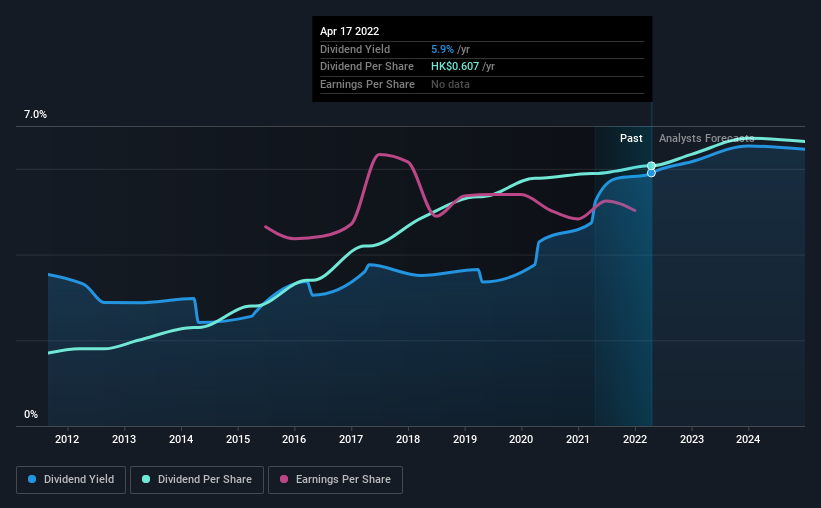

Guangdong Investment Limited's (HKG:270) dividend will be increasing to HK$0.43 on 28th of July. The announced payment will take the dividend yield to 5.9%, which is in line with the average for the industry.

Check out our latest analysis for Guangdong Investment

Guangdong Investment's Earnings Easily Cover the Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last payment made up 85% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

EPS is set to grow by 9.2% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 85% which is a bit high but can definitely be sustainable.

Guangdong Investment Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from HK$0.17 in 2012 to the most recent annual payment of HK$0.61. This means that it has been growing its distributions at 14% per annum over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, Guangdong Investment's EPS was effectively flat over the past five years, which could stop the company from paying more every year. Slow growth and a high payout ratio could mean that Guangdong Investment has maxed out the amount that it has been able to pay to shareholders. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We don't think Guangdong Investment is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Earnings growth generally bodes well for the future value of company dividend payments. See if the 10 Guangdong Investment analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Is Guangdong Investment not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Good value with adequate balance sheet and pays a dividend.