- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Guangdong Investment (HKG:270) Is Increasing Its Dividend To HK$0.43

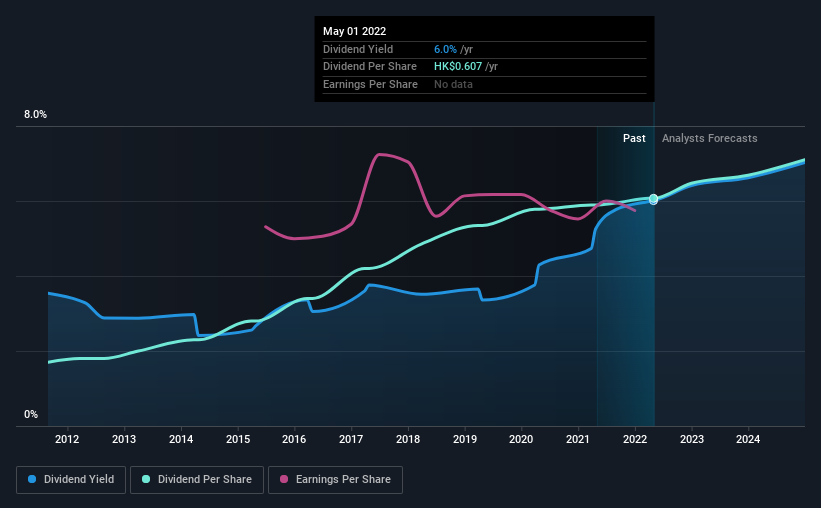

Guangdong Investment Limited's (HKG:270) dividend will be increasing to HK$0.43 on 28th of July. This takes the annual payment to 6.0% of the current stock price, which is about average for the industry.

View our latest analysis for Guangdong Investment

Guangdong Investment's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. The last dividend made up quite a large portion of free cash flows, and this was made worse by the lack of free cash flows. We think that this practice can make the dividend quite risky in the future.

EPS is set to grow by 9.7% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 84% which is a bit high but can definitely be sustainable.

Guangdong Investment Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The first annual payment during the last 10 years was HK$0.17 in 2012, and the most recent fiscal year payment was HK$0.61. This means that it has been growing its distributions at 14% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Guangdong Investment May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. There are exceptions, but limited earnings growth and a high payout ratio can signal that a company has reached maturity. This isn't the end of the world, but for investors looking for strong dividend growth they may want to look elsewhere.

Guangdong Investment's Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Guangdong Investment that investors need to be conscious of moving forward. Is Guangdong Investment not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Good value with adequate balance sheet and pays a dividend.