The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies ENN Energy Holdings Limited (HKG:2688) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for ENN Energy Holdings

How Much Debt Does ENN Energy Holdings Carry?

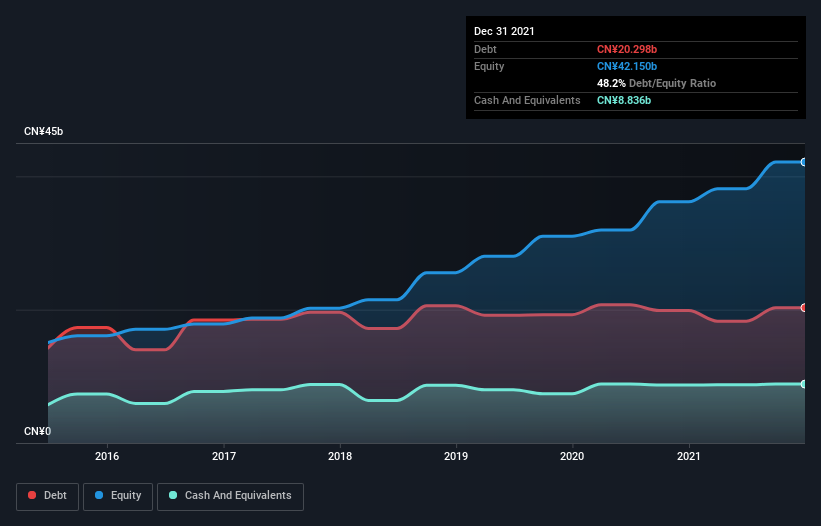

The chart below, which you can click on for greater detail, shows that ENN Energy Holdings had CN¥20.3b in debt in December 2021; about the same as the year before. However, it also had CN¥8.84b in cash, and so its net debt is CN¥11.5b.

How Healthy Is ENN Energy Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that ENN Energy Holdings had liabilities of CN¥41.6b due within 12 months and liabilities of CN¥16.3b due beyond that. Offsetting this, it had CN¥8.84b in cash and CN¥10.9b in receivables that were due within 12 months. So it has liabilities totalling CN¥38.1b more than its cash and near-term receivables, combined.

This deficit isn't so bad because ENN Energy Holdings is worth a massive CN¥115.6b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

ENN Energy Holdings's net debt is only 1.0 times its EBITDA. And its EBIT covers its interest expense a whopping 53.2 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also good is that ENN Energy Holdings grew its EBIT at 13% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if ENN Energy Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, ENN Energy Holdings produced sturdy free cash flow equating to 52% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

ENN Energy Holdings's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And we also thought its net debt to EBITDA was a positive. We would also note that Gas Utilities industry companies like ENN Energy Holdings commonly do use debt without problems. When we consider the range of factors above, it looks like ENN Energy Holdings is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. We'd be motivated to research the stock further if we found out that ENN Energy Holdings insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if ENN Energy Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2688

ENN Energy Holdings

An investment holding company, engages in the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China.

Very undervalued with excellent balance sheet and pays a dividend.