Stock Analysis

- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1798

The Market Doesn't Like What It Sees From China Datang Corporation Renewable Power Co., Limited's (HKG:1798) Earnings Yet

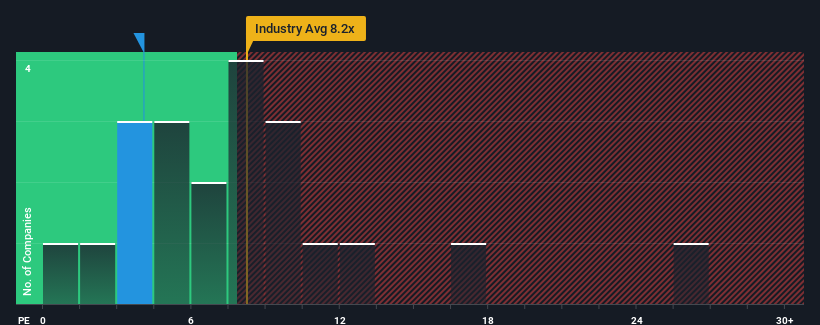

With a price-to-earnings (or "P/E") ratio of 4.1x China Datang Corporation Renewable Power Co., Limited (HKG:1798) may be sending very bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 9x and even P/E's higher than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, China Datang Corporation Renewable Power has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for China Datang Corporation Renewable Power

Is There Any Growth For China Datang Corporation Renewable Power?

In order to justify its P/E ratio, China Datang Corporation Renewable Power would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 105% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 16% per annum, which is noticeably more attractive.

With this information, we can see why China Datang Corporation Renewable Power is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On China Datang Corporation Renewable Power's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of China Datang Corporation Renewable Power's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for China Datang Corporation Renewable Power you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether China Datang Corporation Renewable Power is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1798

China Datang Corporation Renewable Power

China Datang Corporation Renewable Power Co., Limited, together with its subsidiaries, engages in the development, investment, construction, and management of wind, solar, hydro, and biomass power sources the People's Republic of China.

Undervalued with moderate growth potential.