Stock Analysis

- Hong Kong

- /

- Consumer Services

- /

- SEHK:839

Steering Clear Of China Education Group Holdings For One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often sought after for their potential to provide a steady stream of income. However, the attractiveness of these investments can be significantly undermined when companies, like China Education Group Holdings, display unstable dividend patterns. Such instability can signal underlying financial difficulties or a lack of commitment to shareholder returns, making it crucial for investors to scrutinize the stability and sustainability of dividends before committing their capital.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| CITIC Telecom International Holdings (SEHK:1883) | 9.48% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.41% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.77% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.14% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.03% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.63% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.10% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.24% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 7.84% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

Anhui Expressway (SEHK:995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Expressway Company Limited engages in the construction, operation, management, and development of toll roads and associated service areas in Anhui Province, China, with a market capitalization of approximately HK$22.52 billion.

Operations: The company generates its revenue primarily from the construction and management of toll roads in Anhui Province.

Dividend Yield: 6.6%

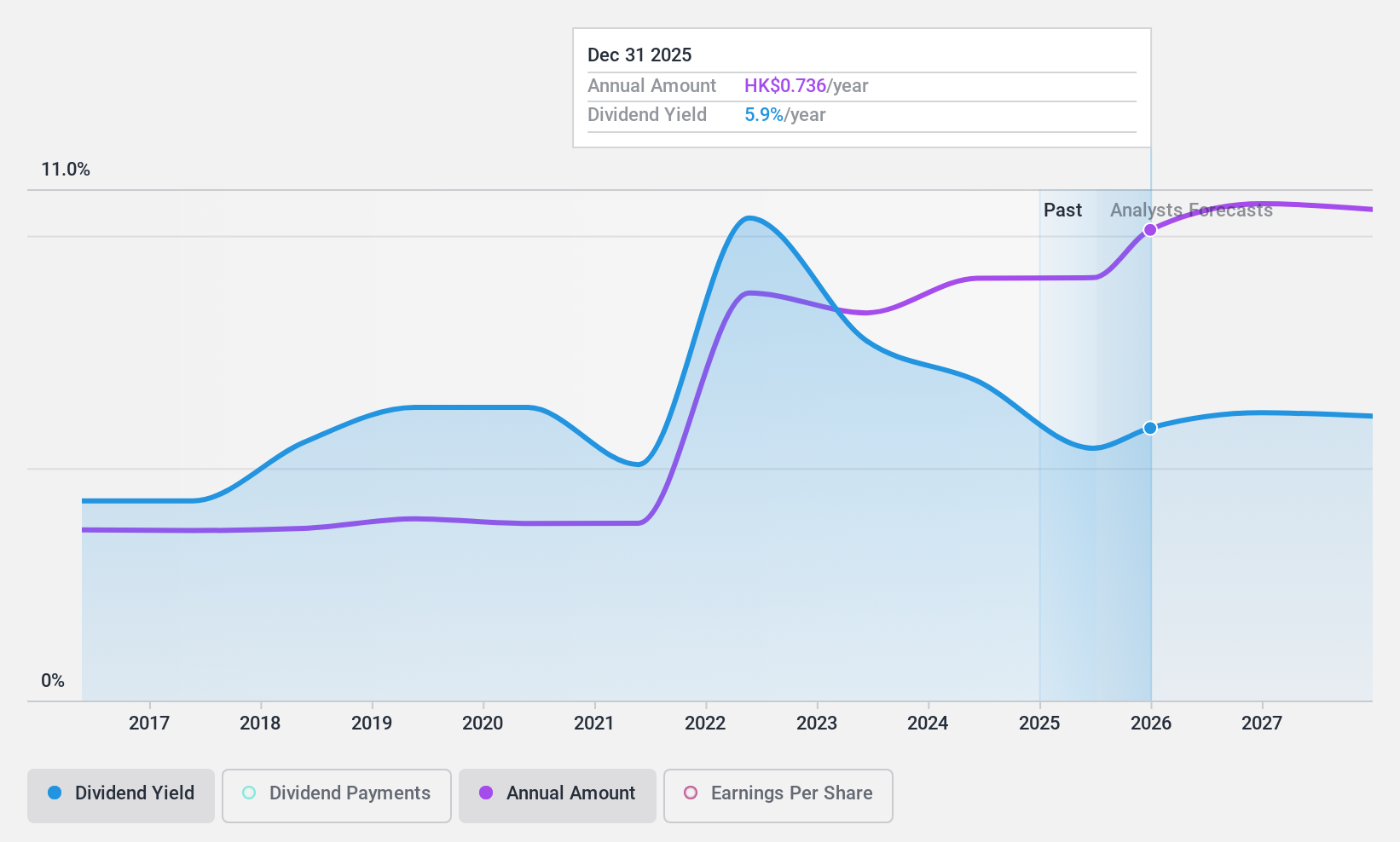

Anhui Expressway's dividend reliability shines compared to some peers, marked by a decade of stable dividends and a reasonable 60% payout ratio, ensuring payouts are well-covered by earnings. Recent adjustments in the company's bridge maintenance contracts, increasing the annual cap to RMB 53.64 billion for 2024, reflect operational flexibility and financial planning acumen. However, its dividend yield of 6.59% trails behind Hong Kong's top dividend payers, indicating potential room for improvement in shareholder returns.

- Dive into the specifics of Anhui Expressway here with our thorough dividend report.

- Upon reviewing our latest valuation report, Anhui Expressway's share price might be too optimistic.

One To Reconsider

China Education Group Holdings (SEHK:839)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: China Education Group Holdings Limited operates private higher and secondary vocational education institutions in China, Australia, and the United Kingdom, with a market capitalization of HK$11.39 billion.

Operations: The company generates revenue primarily from its domestic market, totaling CN¥5.91 billion, and from international operations, which contribute CN¥0.22 billion.

Dividend Yield: 6.7%

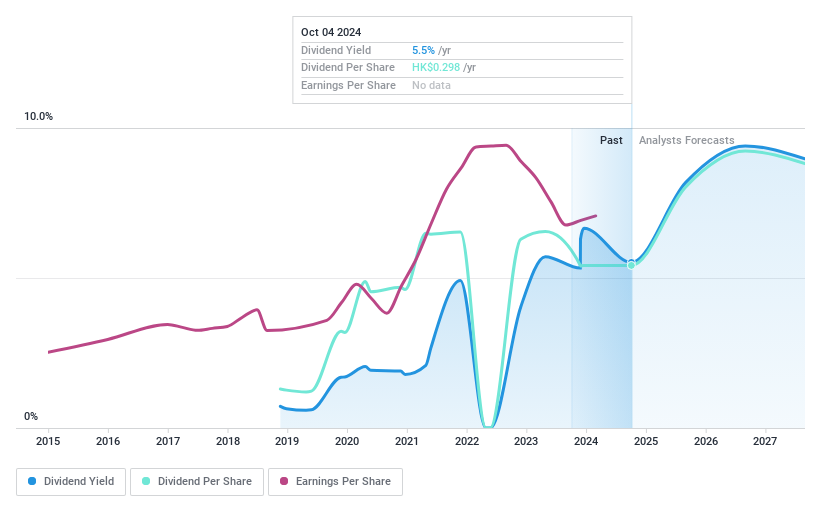

China Education Group Holdings has shown recent improvements, with a reported interim dividend of RMB 0.1877 and an earnings increase in the first half of 2024. However, the company's dividend history is marred by instability, having experienced significant drops in payments over the past six years. Despite a reasonable payout ratio of 55.9%, its dividend yield at 6.68% remains below the Hong Kong market's top quartile of 8.02%. This inconsistency and relatively low yield suggest caution for dividend-focused investors.

Next Steps

- Explore the 89 names from our Top Dividend Stocks screener here.

- Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether China Education Group Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:839

China Education Group Holdings

An investment holding company, engages in the operation of private higher and secondary vocational education institutions in China, Australia, and the United Kingdom.

Good value with moderate growth potential.