- Hong Kong

- /

- Transportation

- /

- SEHK:66

How Does MTR Stack Up After Q1 Ridership Surge and Latest Dividend?

Reviewed by Simply Wall St

If you’ve been eyeing MTR lately and wondering whether it deserves a place in your portfolio right now, you are definitely not alone. With a last close at $26.52, MTR has kept investors on their toes with its recent price movements. Over the past week, the stock managed a modest 0.5% gain, yet over the last 30 days, it’s dipped by 6.4%. Zooming out, this year brings a nearly flat performance, off by just 0.1%. If you stretch the timeline to one year, you’ll find a 4.0% climb. However, holding for the longer term presents a more complicated picture, with three- and five-year returns showing declines of 25.1% and 20.2% respectively.

These mixed signals can make it tricky to figure out what’s next for MTR, especially as markets shift in response to macro events and investor sentiment. Some of the recent moves can be attributed to evolving market conditions rather than company-specific news, which can sometimes overshadow the fundamentals. Despite this, MTR’s valuation score stands at 2 out of 6, suggesting the company is seen as undervalued on two major checks, but not across the board.

What do these valuation metrics actually tell us about MTR’s true worth, and how can they help shape your investment decision? Let’s break down the company’s standing through various valuation approaches before wrapping up with a fresh perspective that might give you an even better way to think about whether MTR is fairly priced today.

MTR scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: MTR Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation method that estimates a company's intrinsic value by focusing on the expected growth and sustainability of its future dividend payments. In summary, it aims to determine what MTR is worth today based on the dividends it is likely to pay out in the years ahead, considering both the payment amounts and the expected rate of growth.

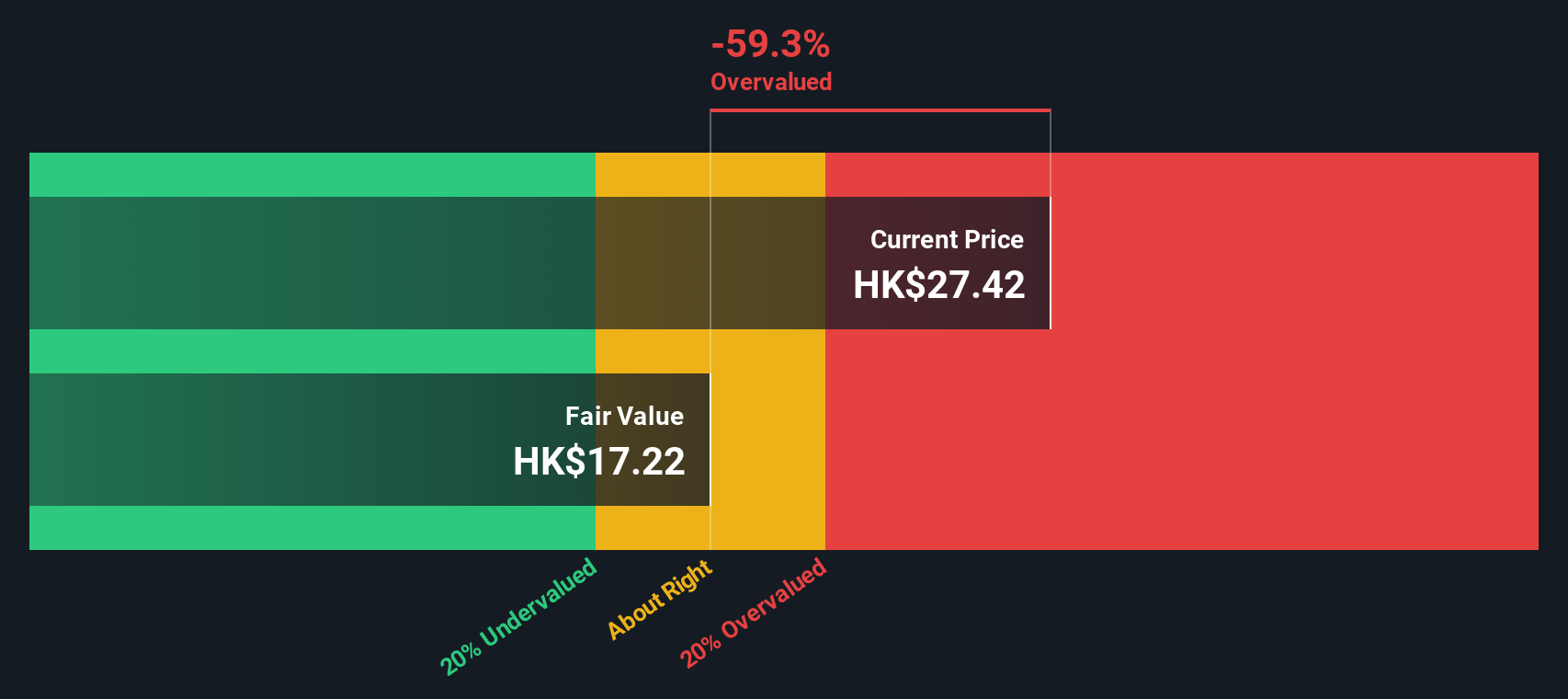

For MTR, recent data shows the annual dividend per share is HK$1.31. The company has a return on equity (ROE) of 5.63% and a high payout ratio of nearly 78.7%, with calculated dividend growth of about 1.2% per year. This moderate growth rate reflects both the company’s ongoing commitment to shareholder payouts and a relatively mature business profile. The DDM suggests that, based on these metrics, a fair value for the stock is about HK$17.53 per share.

With shares recently trading at HK$26.52, the DDM intrinsic value indicates that MTR is roughly 51.3% overvalued.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for MTR.

Approach 2: MTR Price vs Earnings (PE Ratio) Analysis

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies like MTR because it benchmarks how much investors are willing to pay for each dollar of current earnings. Companies with stable profits and future growth prospects are often valued with reference to their earnings, making the PE ratio especially relevant here.

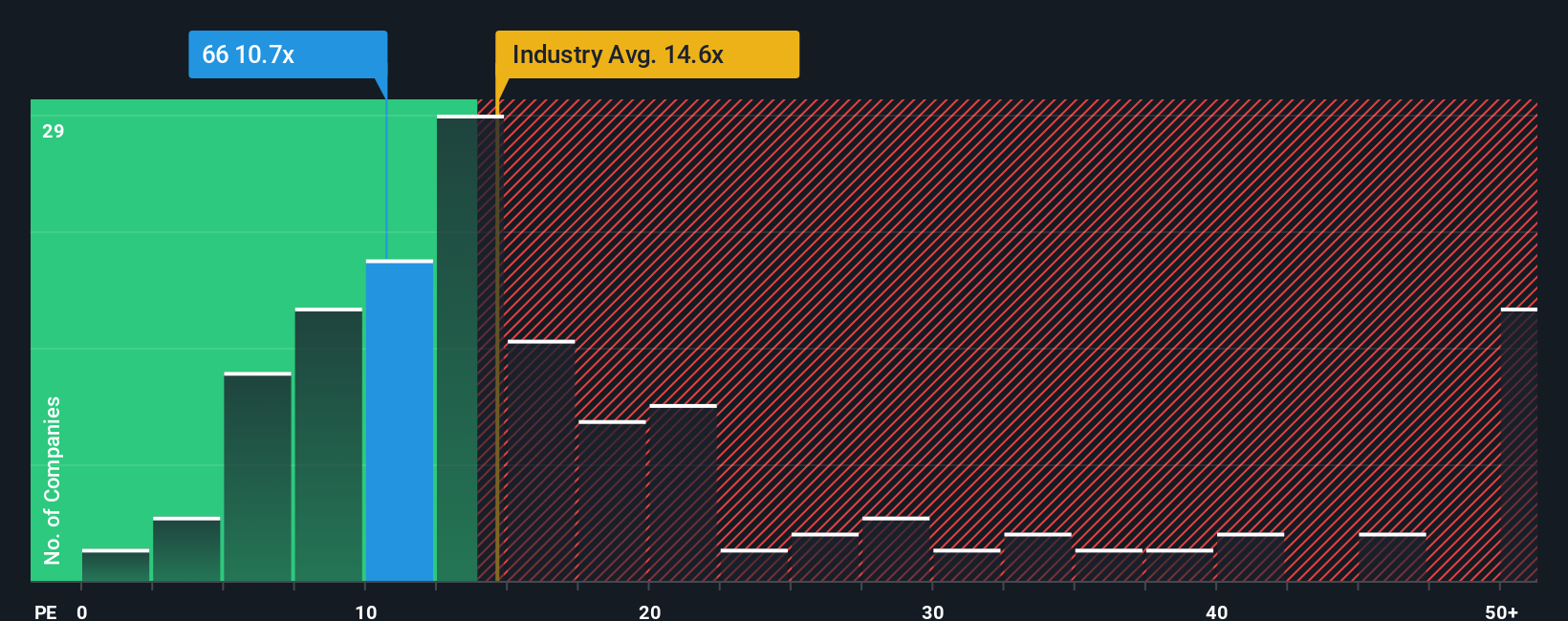

A company’s “normal” or “fair” PE ratio depends on how fast it is expected to grow relative to its risks. Higher growth and lower risk tend to justify a higher PE multiple, while businesses with little growth or greater risk generally trade at lower multiples. For MTR, the current PE ratio stands at 9.5x. This is significantly below the peer average of 43.1x and also well under the transportation industry average of 15.6x. While this may suggest MTR is cheap compared to peers, the context matters.

This is where Simply Wall St's proprietary Fair Ratio becomes crucial. The Fair Ratio calculates what would be a sensible multiple for MTR, considering earnings growth, risks, profit margins, and its position within the industry and market. This nuanced approach is more reliable than using industry or peer averages, as it actually tailors its estimate to the realities of MTR’s business profile. For MTR, the Fair Ratio is 9.2x, almost identical to the company’s actual multiple of 9.5x. This close alignment indicates that, by this measure, MTR is about fairly valued relative to its fundamentals.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your MTR Narrative

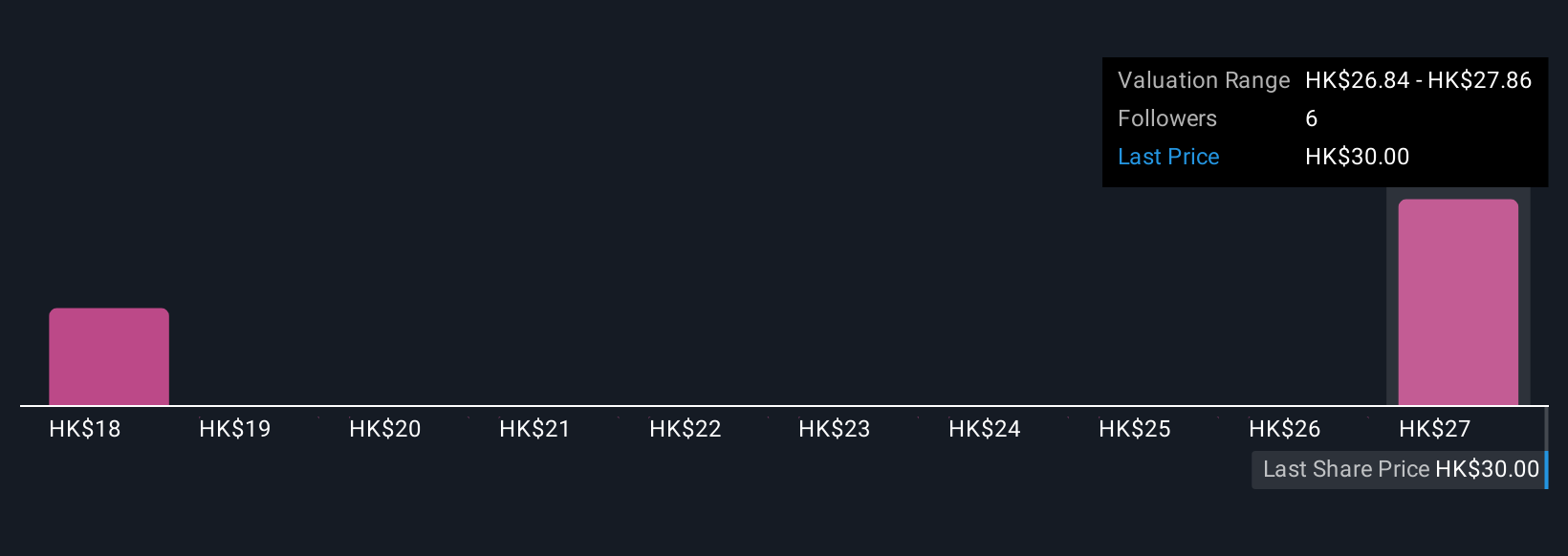

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Put simply, a Narrative is your story or perspective about a company’s future. It’s your view of what MTR will achieve, and how those plans translate into numbers such as future revenue, earnings, margins, and ultimately a fair value per share. Rather than just accept a single set of assumptions or one “fair value,” Narratives let every investor create their own scenario, linking the company’s story to a financial forecast and a tangible fair value estimate.

Narratives are easy to use, available right now on the Community page of Simply Wall St’s platform (used by millions of investors), and can help you frame your investment decision by comparing your calculated Fair Value to the current Price. Additionally, these Narratives update dynamically as new information, such as news or earnings, is released, keeping your story and numbers relevant without the need for constant manual revision.

For example, among MTR Narratives, some investors expect aggressive infrastructure investments and international expansion to drive long-term growth, resulting in a fair value as high as HK$32.0. Others believe mounting costs and dependence on property markets will hurt margins and bring the fair value down to HK$22.0. This way, you can easily see multiple perspectives and find which story and valuation align with your own view.

Do you think there's more to the story for MTR? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:66

MTR

Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives