Sinotrans (SEHK:598) Valuation in Focus After Nine-Month Earnings Reveal Decline in Sales and Profit

Reviewed by Simply Wall St

Sinotrans (SEHK:598) has just released its nine-month earnings report, revealing a decline in both sales and net income from the previous year. Investors are now weighing how this shift might impact the stock’s outlook.

See our latest analysis for Sinotrans.

Despite the recent dip in sales and earnings, Sinotrans has delivered robust momentum over the past year, with a 44% year-to-date share price return and an impressive 61% total shareholder return for the last twelve months. Long-term holders have seen gains compound even further. The five-year total shareholder return tops 225%, highlighting the stock’s strong run despite occasional setbacks.

If you’re exploring what’s capturing investors’ attention lately, now could be the perfect opportunity to broaden your perspective and discover fast growing stocks with high insider ownership

With shares having jumped this year, but earnings slipping, investors are left wondering whether Sinotrans is currently trading at a bargain or if the recent rally means future growth is already reflected in the price.

Most Popular Narrative: 14.2% Overvalued

Sinotrans is trading at HK$5.20, but the most-followed narrative pegs its fair value at just HK$4.55. This sets up a clear tension between current market optimism and more conservative forward-looking outlooks.

Ongoing investment in digital transformation, such as CRM system deployment, smart warehouses, and successful commercial rollout of autonomous driving fleets (over 3 million km operated), is supporting operational efficiency gains and cost controls, which should translate into higher margins and improved net profit over time.

Eager to know what underpins this cautious fair value? The narrative forecasts a future shaped by ambitious tech investments, evolving profit margins, and a closely watched earnings target. Find out which forecasts tip the scales and how much conviction analysts really have about Sinotrans’s long-term profits. Don’t miss the full valuation breakdown.

Result: Fair Value of $4.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global supply chain restructuring and weak domestic logistics demand could present challenges to Sinotrans’s expected profit growth and market share gains.

Find out about the key risks to this Sinotrans narrative.

Another View: Looking Through the Earnings Lens

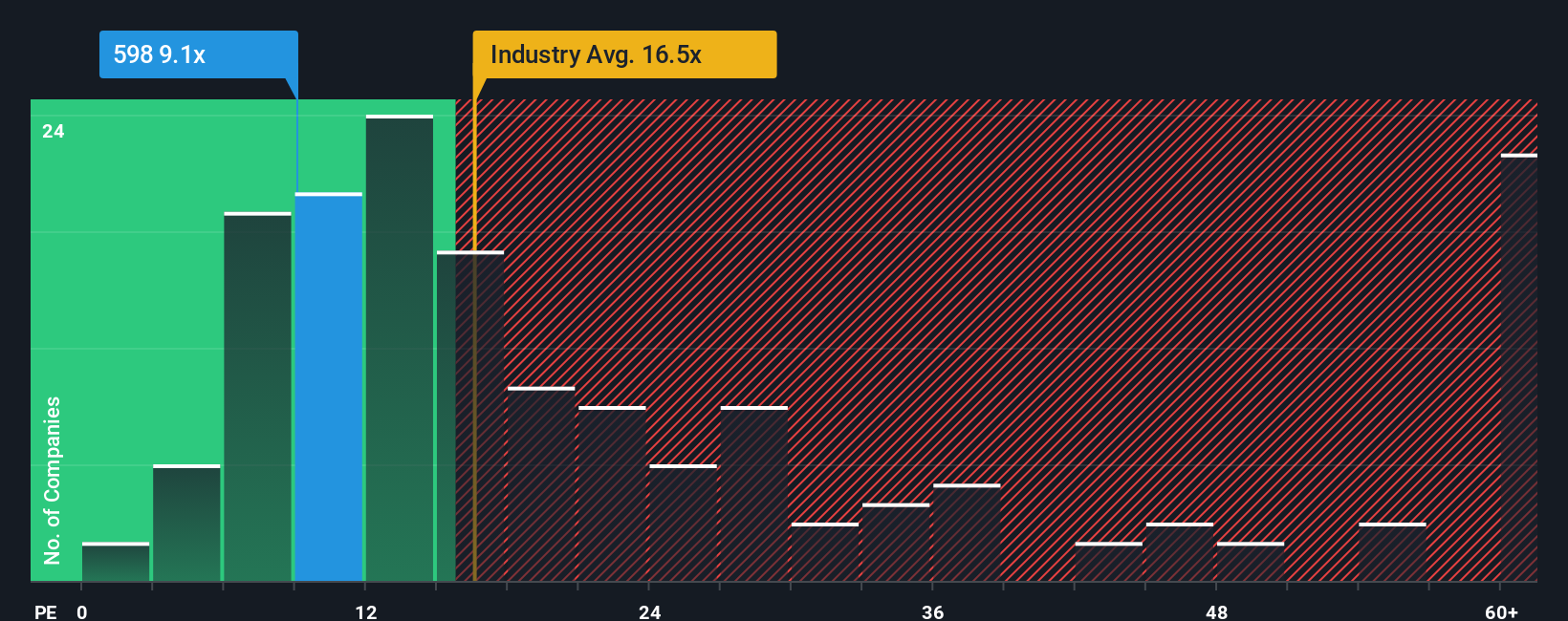

Stepping away from analyst targets, the company’s trading valuation tells a different story. Sinotrans is priced at 9.1 times earnings, considerably lower than the Asian logistics industry average of 16.6 and also below peer averages of 34.9. However, the current valuation is slightly above its fair ratio of 8.6, suggesting less upside if the market reverts to fundamentals. Is the stock still a true bargain, or has the easy value already been captured?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sinotrans Narrative

If you see the story unfolding differently or want to dive into the data on your own terms, you can craft a personalized view of Sinotrans in just a few minutes, so why not Do it your way?

A great starting point for your Sinotrans research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Unlock new angles for your portfolio by using screeners that spotlight trends the market is talking about right now.

- Accelerate your gains with these 861 undervalued stocks based on cash flows which highlight top stocks trading at attractive prices based on real cash flow potential.

- Capitalize on disruptive innovation by checking out these 25 AI penny stocks designed to benefit from the explosive growth in artificial intelligence.

- Stay ahead of the curve and secure strong income streams with these 17 dividend stocks with yields > 3% that offer yields above 3% for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:598

Sinotrans

Provides integrated logistics services primarily in the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives