- Hong Kong

- /

- Infrastructure

- /

- SEHK:576

How Steady Profit Growth at Zhejiang Expressway (SEHK:576) Shapes Its Resilience Amid Economic Shifts

Reviewed by Sasha Jovanovic

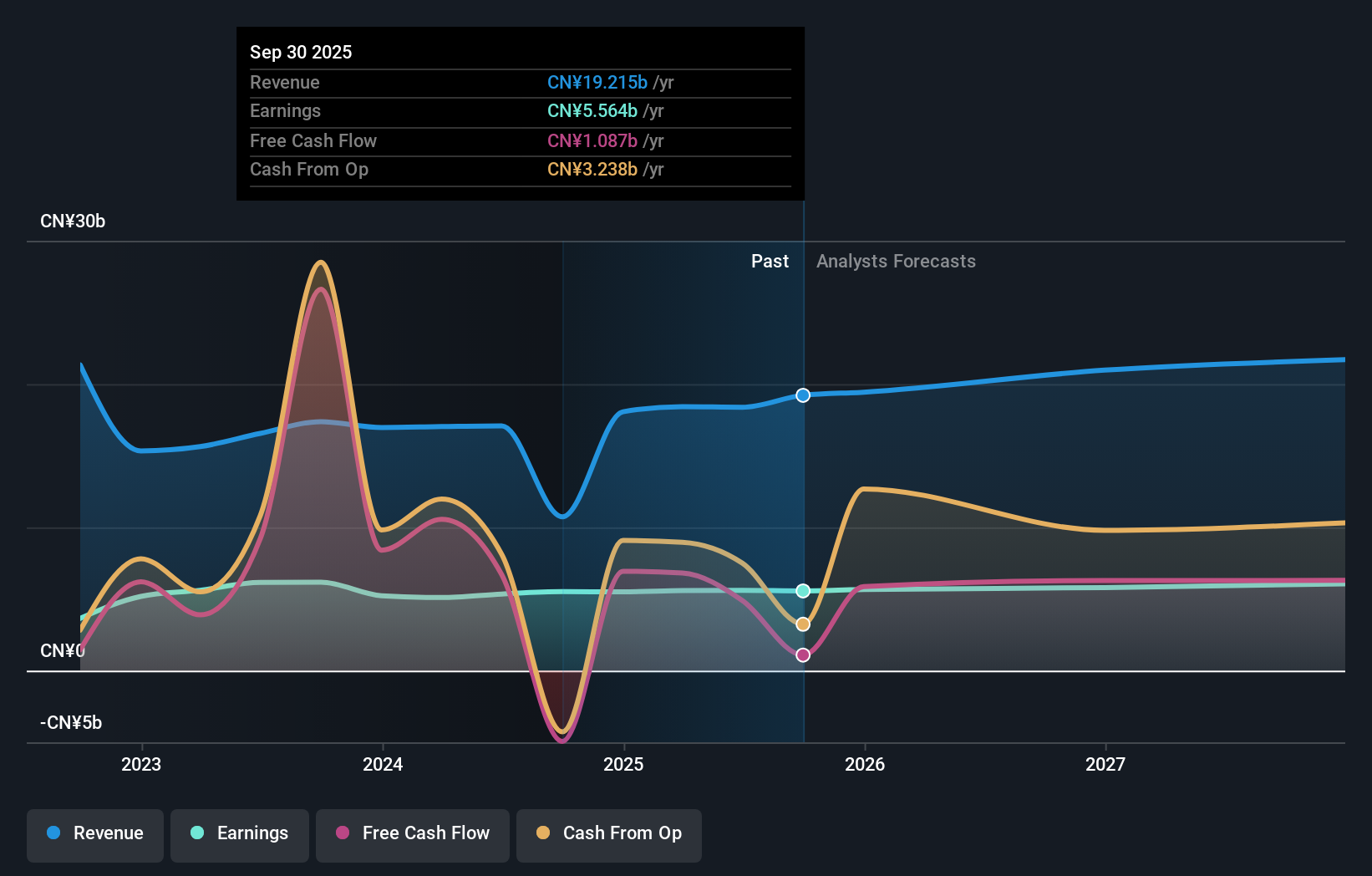

- Zhejiang Expressway Co., Ltd. reported its earnings for the nine months ended September 30, 2025, indicating sales of CNY 14.13 billion and net income of CNY 4.19 billion, both higher than the previous year's figures for the same period.

- Even with modest growth in both sales and earnings per share, Zhejiang Expressway maintained earnings stability amidst a changing economic landscape.

- We'll explore how Zhejiang Expressway's steady revenue and profit growth enhances the company's broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Zhejiang Expressway's Investment Narrative?

For Zhejiang Expressway, the investment case has often centered on its steady cash generation, infrastructure pipeline and value-priced shares. The latest earnings update, which showed both sales and net income up slightly year-on-year, reinforces the theme of resilience rather than breakout growth. Investors were watching to see if recent bylaw changes, new executive appointments, and digital toll initiatives would meaningfully shift the outlook, so far, these results suggest major short-term catalysts are unchanged. While operational stability has helped keep revenue trends predictable, the subdued pace of profit growth and the presence of large one-off items continue to temper expectations for rapid earnings upside. The recent numbers simply keep the story ticking along, maintaining the focus on longer term dividend payouts and value potential rather than triggering a significant re-rating or a material change in risk outlook.

Unlike earnings, dividend sustainability is now a key question for potential shareholders. Despite retreating, Zhejiang Expressway's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Zhejiang Expressway - why the stock might be worth just HK$7.66!

Build Your Own Zhejiang Expressway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zhejiang Expressway research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Zhejiang Expressway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zhejiang Expressway's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Expressway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:576

Zhejiang Expressway

An investment holding company, invests, develops, maintains, and operates roads in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives