- Hong Kong

- /

- Infrastructure

- /

- SEHK:548

Shenzhen Expressway (SEHK:548) Net Profit Margin Drops Sharply, Challenging Stable-Growth Narrative

Reviewed by Simply Wall St

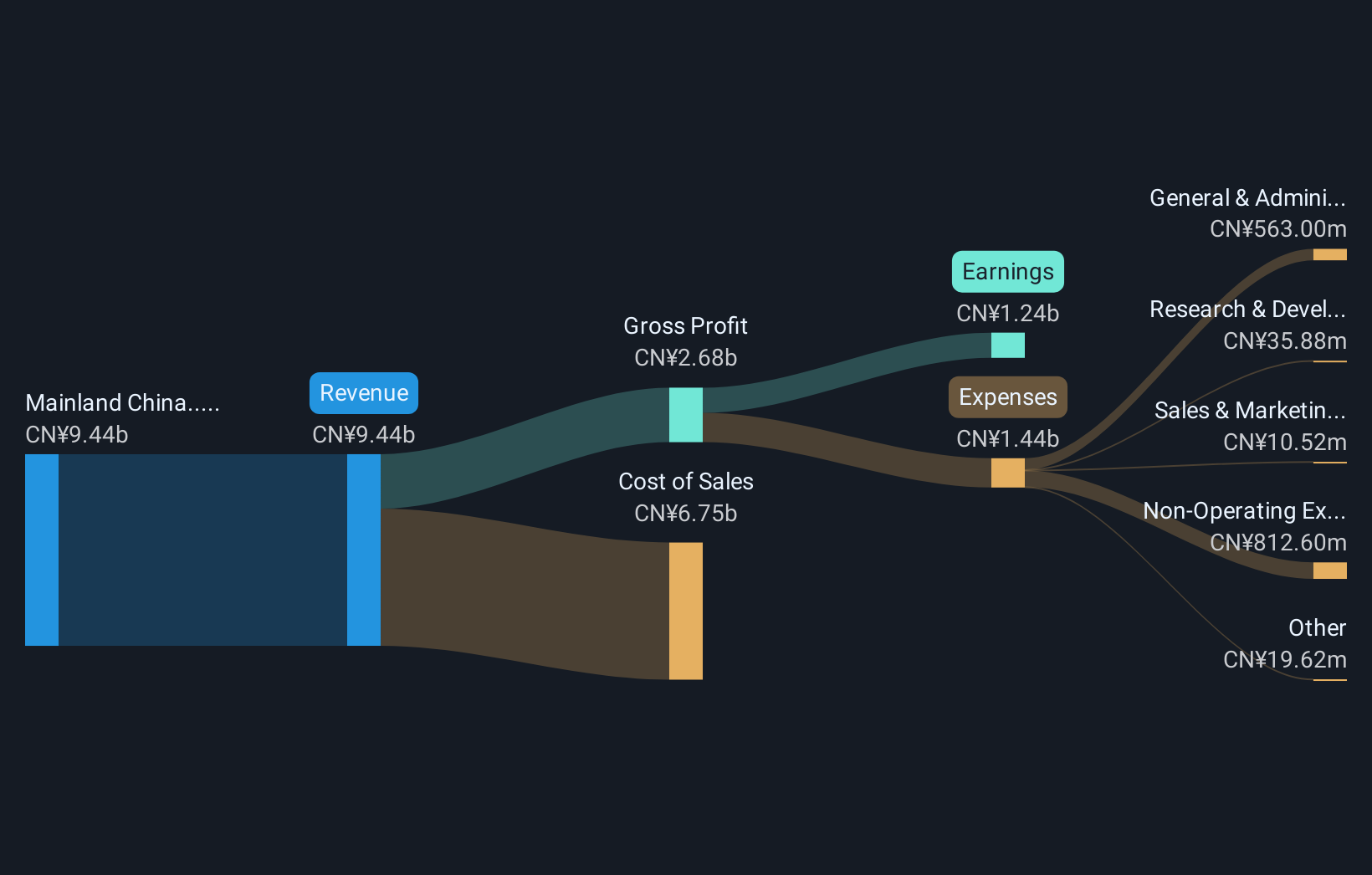

Shenzhen Expressway (SEHK:548) reported earnings that have declined by 10.8% per year over the past five years, and its net profit margin dropped to 13.2% from last year’s 24.6%. While revenue is forecast to grow at 5.5% per year, that is notably behind the Hong Kong market’s 8.7% average, and expected earnings growth of 8.02% still lags the wider market’s 12.4% pace. Margins have come under pressure, highlighting ongoing headwinds despite growth forecasts that suggest some upside potential for investors.

See our full analysis for Shenzhen Expressway.Now, let’s see how these numbers measure up against the dominant narratives that investors are following. This is where the consensus holds and where the data may tell a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium Price-to-Earnings Ratio Stands Out

- Shenzhen Expressway trades at a price-to-earnings (P/E) ratio of 13.6x, which is significantly higher than the Hong Kong infrastructure industry average of 9x and above peer companies at 8.2x.

- The current pricing creates a tension. While robust infrastructure exposure is often prized for stability, the premium P/E multiple may limit upside, as prevailing market analysis cautions that stability alone may not fully justify paying much more than sector peers.

- Despite sector-wide government support and cash-flow strength, the pronounced P/E premium raises the bar for future growth to justify the valuation.

- If earnings growth stays behind market averages, as forecast, investors could question the ongoing rationale for the higher-than-peer P/E multiple.

DCF Fair Value Gap Signals Opportunity

- The share price of HK$7.26 sits well below the estimated DCF fair value of HK$13.70, indicating a sizeable value gap if longer-term forecasts play out.

- From a market perspective, this discount to DCF fair value heavily underpins the argument that Shenzhen Expressway is a stable, cash-generating business with room for rerating. Yet, the ability to close this gap depends on both delivering on profit growth and overcoming concerns about lagging margins and competition.

- With forecasts for 8.02% earnings growth per year, lower than the 12.4% Hong Kong market pace, investors may require visible progress on operating efficiency before re-rating the stock closer to DCF valuation.

- The presence of both discounted valuation and sector support makes this a closely watched metric for patient investors weighing stable yield versus growth potential.

Net Profit Margin Compression Raises Flags

- The company's net profit margin has dropped from 24.6% last year to 13.2% most recently, signaling a notable contraction in profitability within twelve months.

- This squeeze in margins gives weight to the idea that, while the company retains critical infrastructure status, its earnings power faces pressure from rising costs and soft traffic growth. These are two factors flagged by prevailing analysis as needing active monitoring for any turnaround case.

- The falling margin, paired with forecast growth still behind broader market expectations, increases scrutiny on whether operational improvements can reverse the trend.

- Persistent margin pressure may temper enthusiasm even among investors seeking stability if cost headwinds outweigh policy-driven support.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shenzhen Expressway's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Shenzhen Expressway’s falling net profit margins and below-market earnings growth raise concerns about its ability to justify a premium valuation compared to sector peers.

If missing out on stronger value frustrates you, consider these 833 undervalued stocks based on cash flows to discover companies trading at steeper discounts with better upside based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:548

Shenzhen Expressway

Primarily invests in, constructs, operates, and manages toll highways and roads, as well as other urban and transportation infrastructure in the People’s Republic of China.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives