- Hong Kong

- /

- Transportation

- /

- SEHK:525

Guangshen Railway (SEHK:525) Margin Compression Challenges Value Bull Case Despite Deep Discount to Fair Value

Reviewed by Simply Wall St

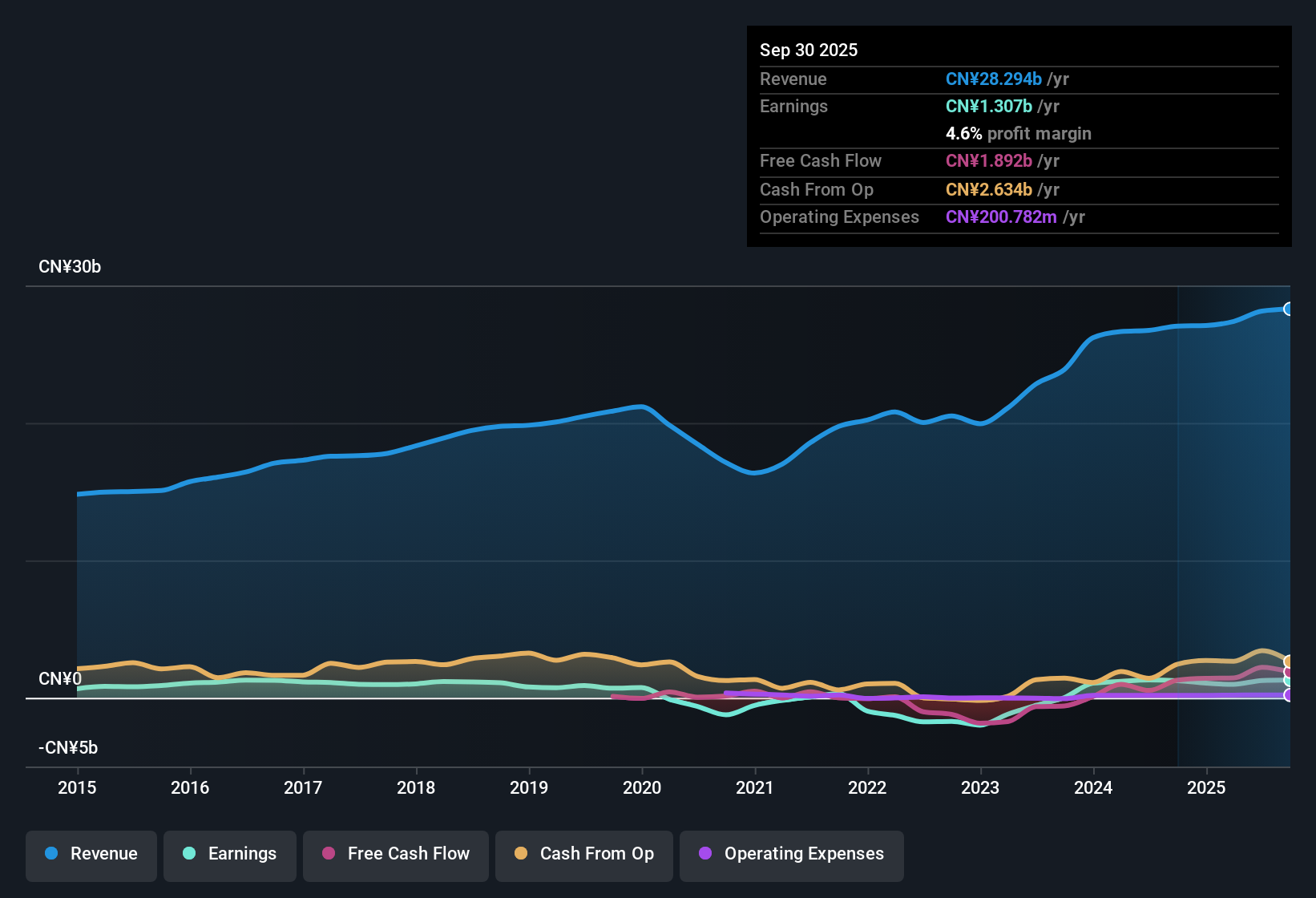

Guangshen Railway (SEHK:525) remains profitable, with average earnings growth of 50.7% per year over the past five years, though earnings declined in the most recent year. Looking ahead, the company is forecasting annual earnings growth of 6.11%, and revenue is expected to rise by 3.7% per year. Net profit margin currently stands at 4.5%, just below last year's 4.8%, signaling some margin compression despite past gains for long-term holders.

See our full analysis for Guangshen Railway.To put these results in perspective, let's see how they match up with the widely held narratives from the Simply Wall St community. This may also indicate where the conversation might shift based on these numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Valuation Suggests Room for Upside

- Guangshen Railway currently trades at HK$2.28, which is well below its DCF fair value estimate of HK$5.16. This indicates a significant value gap for investors to consider.

- Bulls see this valuation discount as a compelling entry point, rooted in the company’s established profitability and ongoing forecast for growth, even with net profit margin moving to 4.5% from last year’s 4.8%.

- Despite slowing earnings growth projections of 6.11% per year, the combination of a price-to-earnings ratio of 11.8x, which is below the peer average of 46.3x and the regional industry average of 14.9x, provides tangible support for bullish arguments.

- What stands out is that the stock trades at less than half its estimated DCF fair value. This reinforces optimism among investors attracted to relative bargains in the transportation sector.

Profit Margins Tighten After Years of Fast Growth

- After averaging a robust 50.7% earnings growth annually over the past five years, the latest net profit margin sits at 4.5%. This is a modest reduction from last year's 4.8% and a sign that the recent period has brought some margin contraction.

- Prevailing analysis notes that while a multi-year growth trend is still clear, margin compression introduces new questions for holders.

- Guidance for ongoing profit and revenue growth remains positive, yet earnings have turned negative for the most recent 12-month period. This has surprised investors who expected outperformance to continue uninterrupted.

- Instead of steady expansion, the latest numbers highlight the cyclical nature of transport and the importance of monitoring operating costs as sector conditions evolve.

Valuation Ratios Underpin Defensive Appeal

- The company’s price-to-earnings ratio of 11.8x is meaningfully below both peer (46.3x) and regional transportation averages (14.9x). This sets the stock apart as a lower-priced alternative within the sector.

- Looking at these valuation levels, the prevailing view is that Guangshen Railway’s defensive characteristics, marked by steady if unspectacular growth, are fitting for investors favoring lower-risk transportation stocks.

- The significant discount to DCF fair value gives the stock room to re-rate should sector momentum strengthen. It may also make margin slippage less of a concern for value-driven investors.

- Broadly, the resilience of core operations despite some softness in margins shows why lower-multiple transportation plays like this maintain appeal in volatile environments.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Guangshen Railway's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Slowing earnings growth, margin compression, and a surprise decline in profits this year highlight the cyclical risks facing Guangshen Railway investors.

If you’d prefer companies showing steady, reliable performance, focus on stable growth stocks screener (2108 results) where earnings and revenue trends are more consistent through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:525

Guangshen Railway

Engages in the railway passenger and freight transportation businesses in the People’s Republic of China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives