- Hong Kong

- /

- Transportation

- /

- SEHK:306

Kwoon Chung Bus Holdings (HKG:306 investor five-year losses grow to 60% as the stock sheds HK$100m this past week

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Kwoon Chung Bus Holdings Limited (HKG:306) share price dropped 62% over five years. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 28% in the last year. And the share price decline continued over the last week, dropping some 11%.

Since Kwoon Chung Bus Holdings has shed HK$100m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Kwoon Chung Bus Holdings

Kwoon Chung Bus Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Kwoon Chung Bus Holdings saw its revenue shrink by 21% per year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 10% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

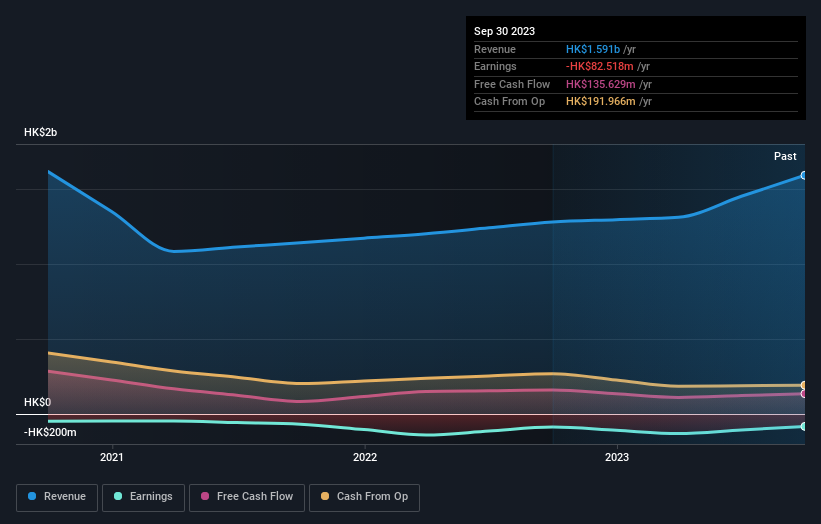

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Kwoon Chung Bus Holdings' financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Kwoon Chung Bus Holdings shareholders are down 28% for the year. Unfortunately, that's worse than the broader market decline of 17%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Kwoon Chung Bus Holdings , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kwoon Chung Bus Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:306

Kwoon Chung Bus Holdings

An investment holding company, provides bus and bus-related services in Hong Kong, Macau, and Mainland China.

Low with questionable track record.