- Hong Kong

- /

- Infrastructure

- /

- SEHK:177

What Do Falling Profits Mean for Jiangsu Expressway’s (SEHK:177) Long-Term Strategy?

Reviewed by Sasha Jovanovic

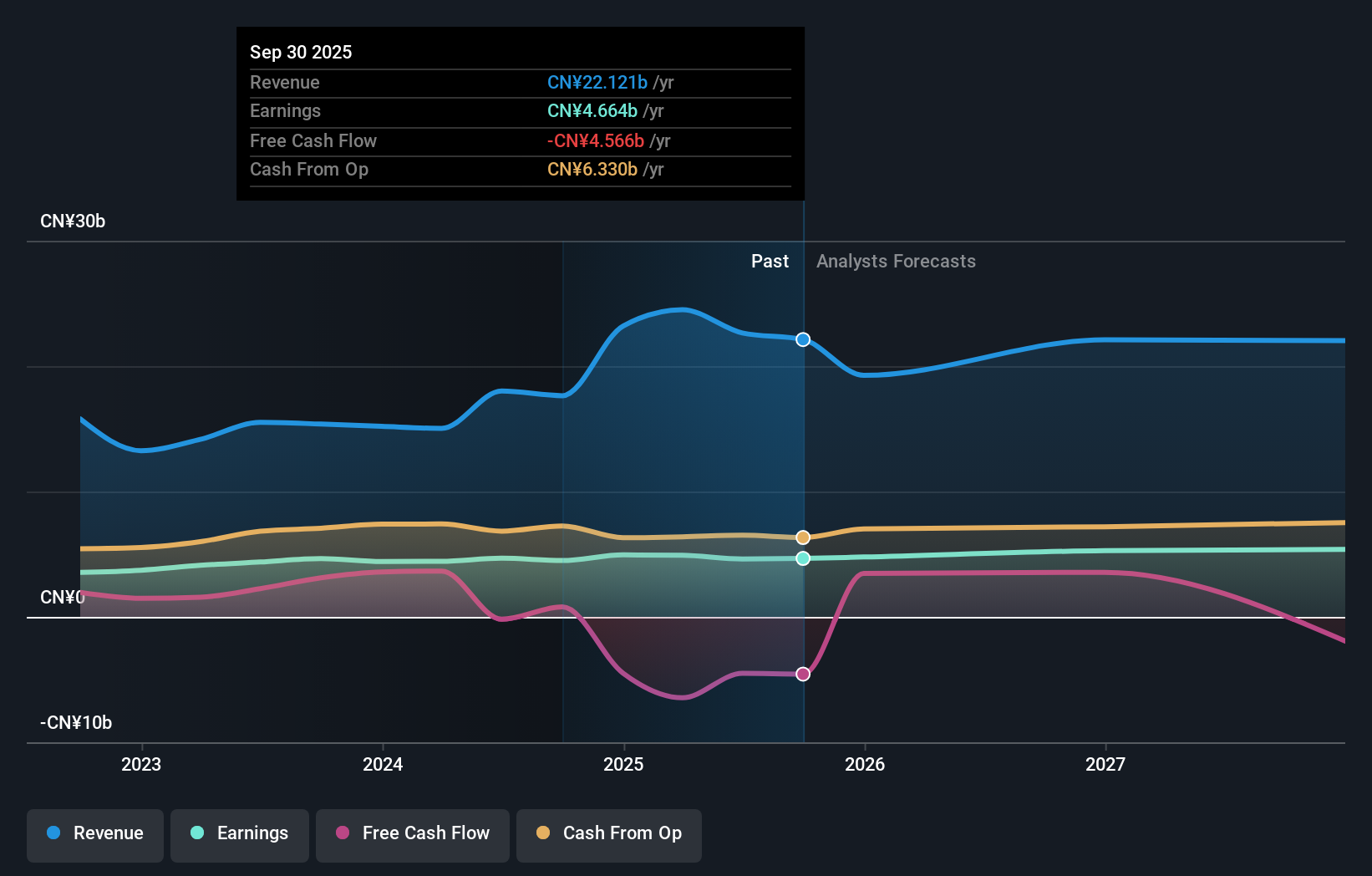

- On October 29, 2025, Jiangsu Expressway Company Limited announced board approval of amendments to its Articles of Association and reported financial results for the nine months ended September 30, 2025, showing sales of CNY 12,981.38 million and net income of CNY 3,837.1 million, both down from the prior year.

- The consecutive declines in both revenue and net income highlight shifts in the company’s operating environment and could draw increased investor focus to its future plans.

- We'll explore how the reported decrease in net income informs Jiangsu Expressway’s broader investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Jiangsu Expressway's Investment Narrative?

For investors considering Jiangsu Expressway, the big picture often rests on the stability and predictability that infrastructure assets can provide, particularly in markets like Hong Kong’s where such companies hold strong positions and consistent traffic streams. However, the recent earnings update showing consecutive declines in both revenue and net income may prompt some to reassess expectations for near-term growth, especially as earlier analysis had forecast steady, but not rapid, improvements. While the board’s amendments to the Articles of Association signal a focus on governance, this move alone seems unlikely to materially shift the main short-term catalysts, namely, toll road volume growth, dividend stability, and potential macroeconomic headwinds affecting transport. Yet the drop in earnings does impact confidence in sustainable margin recovery and puts a spotlight on risks surrounding cost control and market competition. For now, the value appeal and solid historical returns remain, but ongoing declines in profitability introduce new questions about the company’s ability to deliver on previous expectations.

But, returns could be influenced if pressure on profit margins persists. Jiangsu Expressway's shares have been on the rise but are still potentially undervalued by 16%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Jiangsu Expressway - why the stock might be worth as much as 19% more than the current price!

Build Your Own Jiangsu Expressway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jiangsu Expressway research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jiangsu Expressway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jiangsu Expressway's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:177

Jiangsu Expressway

Engages in investment, construction, operation, and management of toll roads and bridges in the People’s Republic of China.

Average dividend payer with acceptable track record.

Market Insights

Community Narratives