- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

High Insider Ownership Growth Companies On SEHK For August 2024

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainties and market volatility, the Hong Kong Stock Exchange (SEHK) has shown resilience, with the Hang Seng Index gaining 0.85% recently. In this environment, companies with high insider ownership often stand out as they indicate strong confidence from those closest to the business. When evaluating growth stocks in such conditions, it's crucial to consider firms where insiders have significant skin in the game. This alignment of interests can be particularly reassuring for investors navigating today's fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 18.8% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 74.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

| DPC Dash (SEHK:1405) | 38.2% | 91.4% |

Here we highlight a subset of our preferred stocks from the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuaishou Technology, an investment holding company with a market cap of HK$196.19 billion, offers live streaming, online marketing, and other services in the People’s Republic of China.

Operations: The company generates revenue primarily from its domestic operations (CN¥114.72 billion) and overseas activities (CN¥2.94 billion).

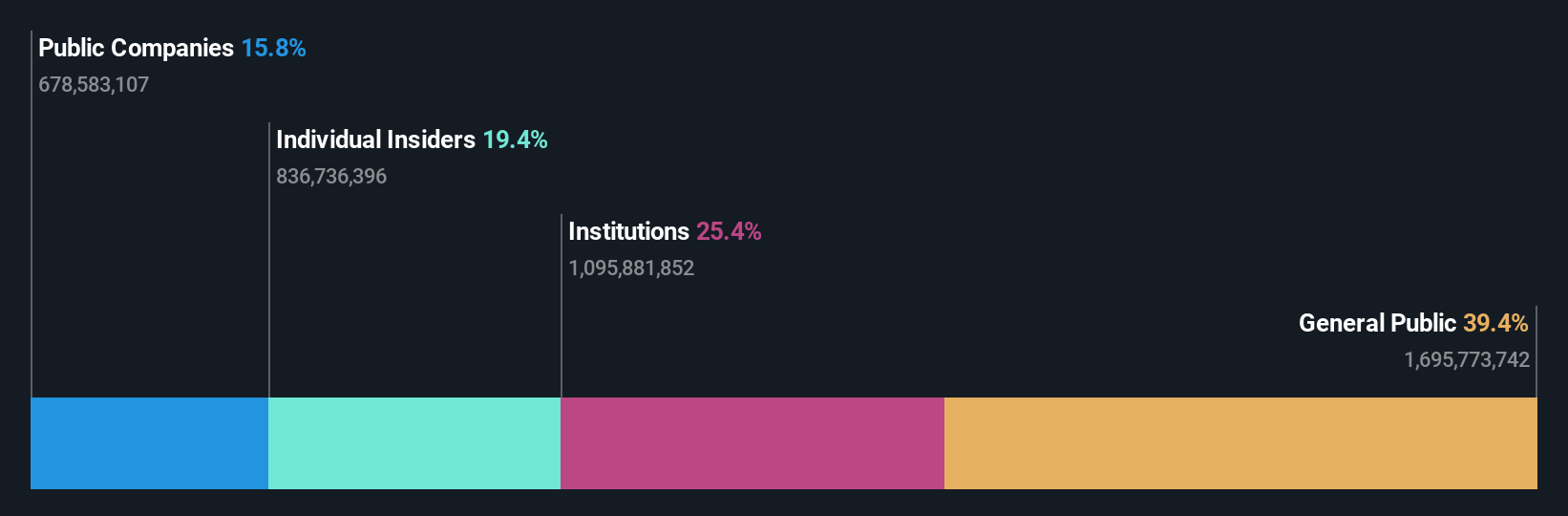

Insider Ownership: 19.2%

Kuaishou Technology, a growth company with high insider ownership, has shown promising advancements in AI technology with its Kling AI video generation model. Recent upgrades have significantly improved video quality and motion performance. The company's financials are strong, having turned profitable this year with Q1 2024 net income of CNY 4.12 billion. Earnings are forecast to grow at 22.41% annually over the next three years, outpacing the Hong Kong market's average growth rate.

- Click to explore a detailed breakdown of our findings in Kuaishou Technology's earnings growth report.

- Our valuation report unveils the possibility Kuaishou Technology's shares may be trading at a discount.

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, an investment holding company with a market cap of HK$57.37 billion, offers express delivery services.

Operations: Revenue Segments: The company generates revenue primarily from its air freight transportation services, amounting to $8.85 billion.

Insider Ownership: 20.2%

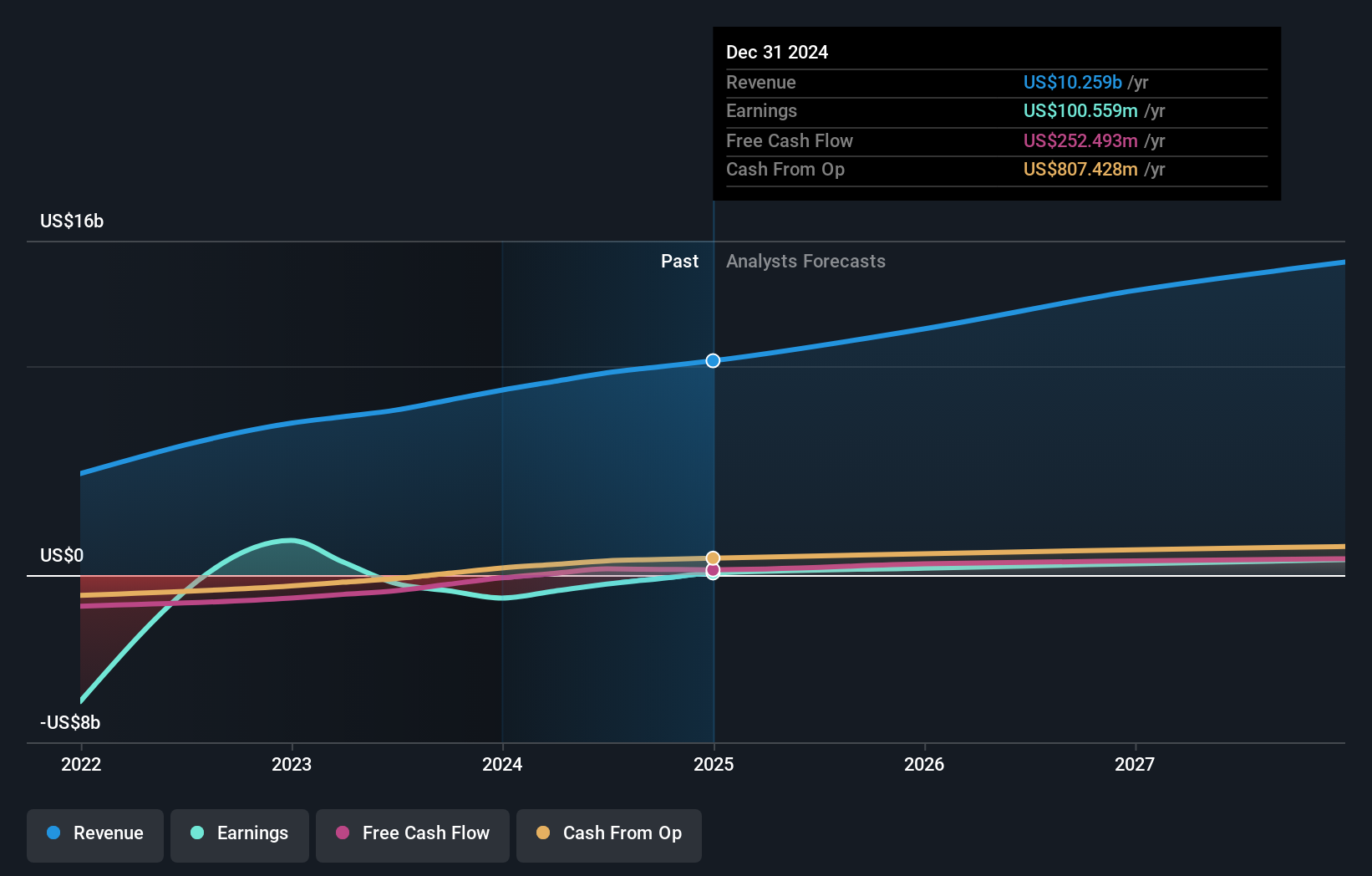

J&T Global Express, with significant insider ownership, has been added to the FTSE All-World Index. The company is forecast to become profitable within three years, with earnings expected to grow 105.7% annually. Revenue grew by 21.8% last year and is projected to increase by 16.8% per year, outpacing the Hong Kong market's average growth rate of 7.4%. Recent board changes include the appointment of Peter Lai Hock Meng as an independent non-executive director and audit committee chairman.

- Get an in-depth perspective on J&T Global Express' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that J&T Global Express is priced higher than what may be justified by its financials.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$176.93 billion.

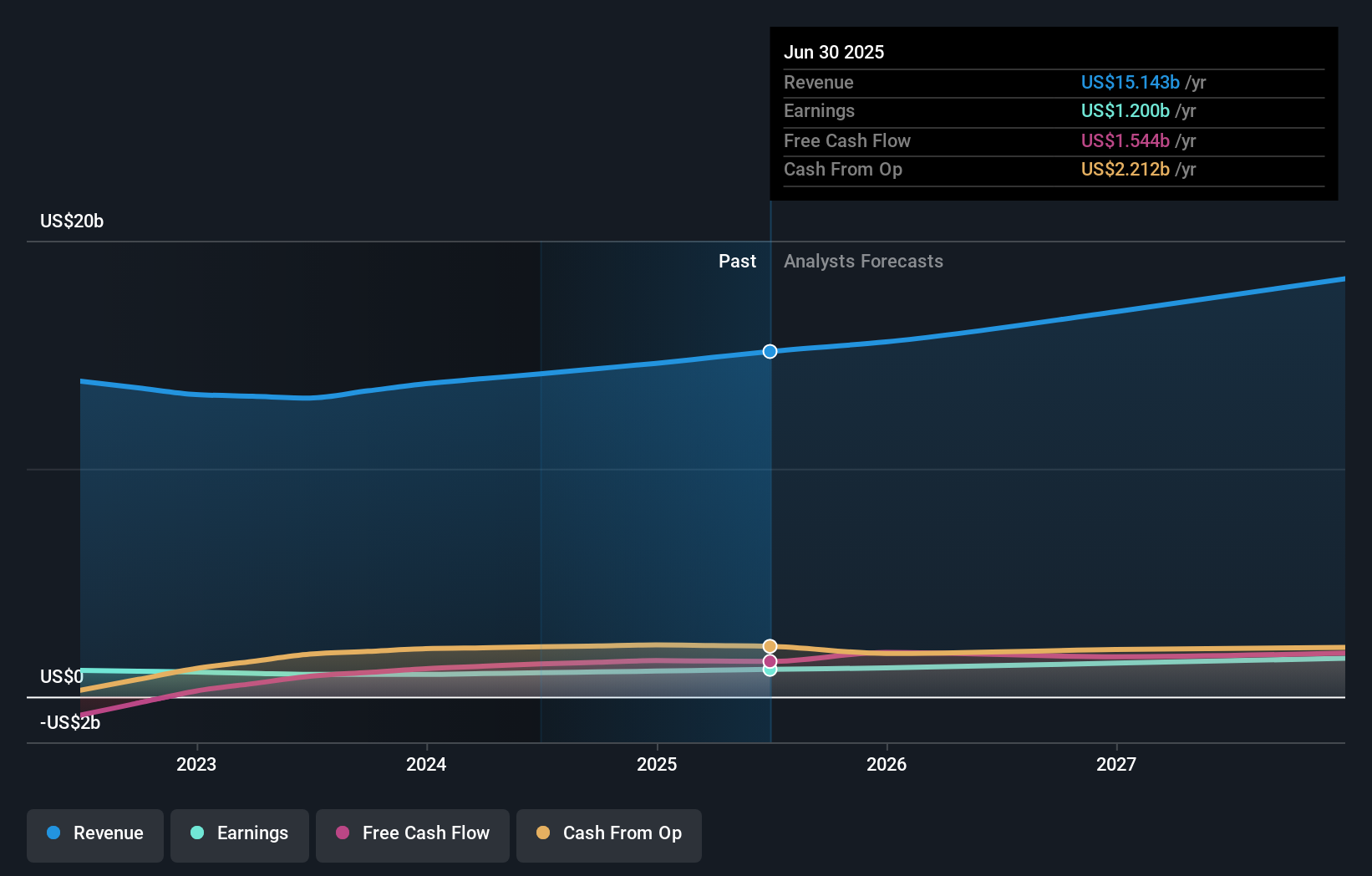

Operations: The company's revenue segments include $13.23 billion from Power Equipment and $965.09 million from Floorcare & Cleaning.

Insider Ownership: 25.4%

Techtronic Industries, with substantial insider ownership, reported strong earnings for H1 2024, including net income of US$550.37 million and sales of US$7.31 billion. The company announced an interim dividend of HKD 1.08 per share and appointed Steven Richman as CEO, highlighting his extensive industry experience. Earnings are forecast to grow at 15.3% annually, outpacing the Hong Kong market's average growth rate of 11.3%, while trading at a significant discount to its estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of Techtronic Industries.

- According our valuation report, there's an indication that Techtronic Industries' share price might be on the cheaper side.

Key Takeaways

- Investigate our full lineup of 51 Fast Growing SEHK Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Very undervalued with flawless balance sheet.