Stock Analysis

High Growth Tech Stocks In Hong Kong This October 2024

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East have led to volatile oil prices and mixed sentiment across global markets, Hong Kong's tech sector has shown resilience with the Hang Seng Index climbing 10.2% amid optimism over Beijing's support measures. In such a dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to leverage technological advancements and adapt to shifting economic conditions while maintaining robust financial health.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Akeso | 33.22% | 52.58% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on developing and commercializing monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China, with a market cap of approximately HK$77.31 billion.

Operations: Innovent Biologics generates revenue primarily from its biotechnology segment, totaling CN¥7.46 billion. The company operates in the biopharmaceutical sector, focusing on monoclonal antibodies and drug assets across various therapeutic areas in China.

Innovent Biologics, a key player in the biotech sector, has been making significant strides with its recent strategic collaboration for limertinib's commercialization in China, highlighting its potential market impact. This move aligns with their R&D focus where they invested 22.2% of their revenue last year, underscoring a robust commitment to innovation. Moreover, the company's R&D expenses have surged by 59.4%, reflecting an aggressive pursuit of breakthroughs in cancer treatment and other areas. These figures not only demonstrate Innovent's dedication to advancing healthcare solutions but also position it as a forward-thinking entity in high-growth tech within Hong Kong’s competitive landscape.

- Unlock comprehensive insights into our analysis of Innovent Biologics stock in this health report.

Understand Innovent Biologics' track record by examining our Past report.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors both in Taiwan and internationally, with a market capitalization of HK$19.77 billion.

Operations: The company generates revenue primarily from consumer products and intermediate products, with the latter contributing significantly more at $3.94 billion compared to $690.95 million for consumer products.

FIT Hon Teng has demonstrated a robust turnaround with its latest earnings report, showcasing a significant recovery with sales jumping to USD 2.07 billion from USD 1.78 billion year-over-year and swinging from a net loss to a profit of USD 32.52 million. This performance is underpinned by an aggressive growth strategy in the tech sector, where the company's forecasted annual earnings growth rate stands at an impressive 32.2%, outpacing the broader Hong Kong market's expectation of 12.2%. Moreover, their commitment to innovation is evident as they channel substantial resources into R&D, which is crucial for sustaining long-term competitiveness in high-growth technological environments.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to meet unmet medical needs both in China and internationally, with a market cap of HK$42.85 billion.

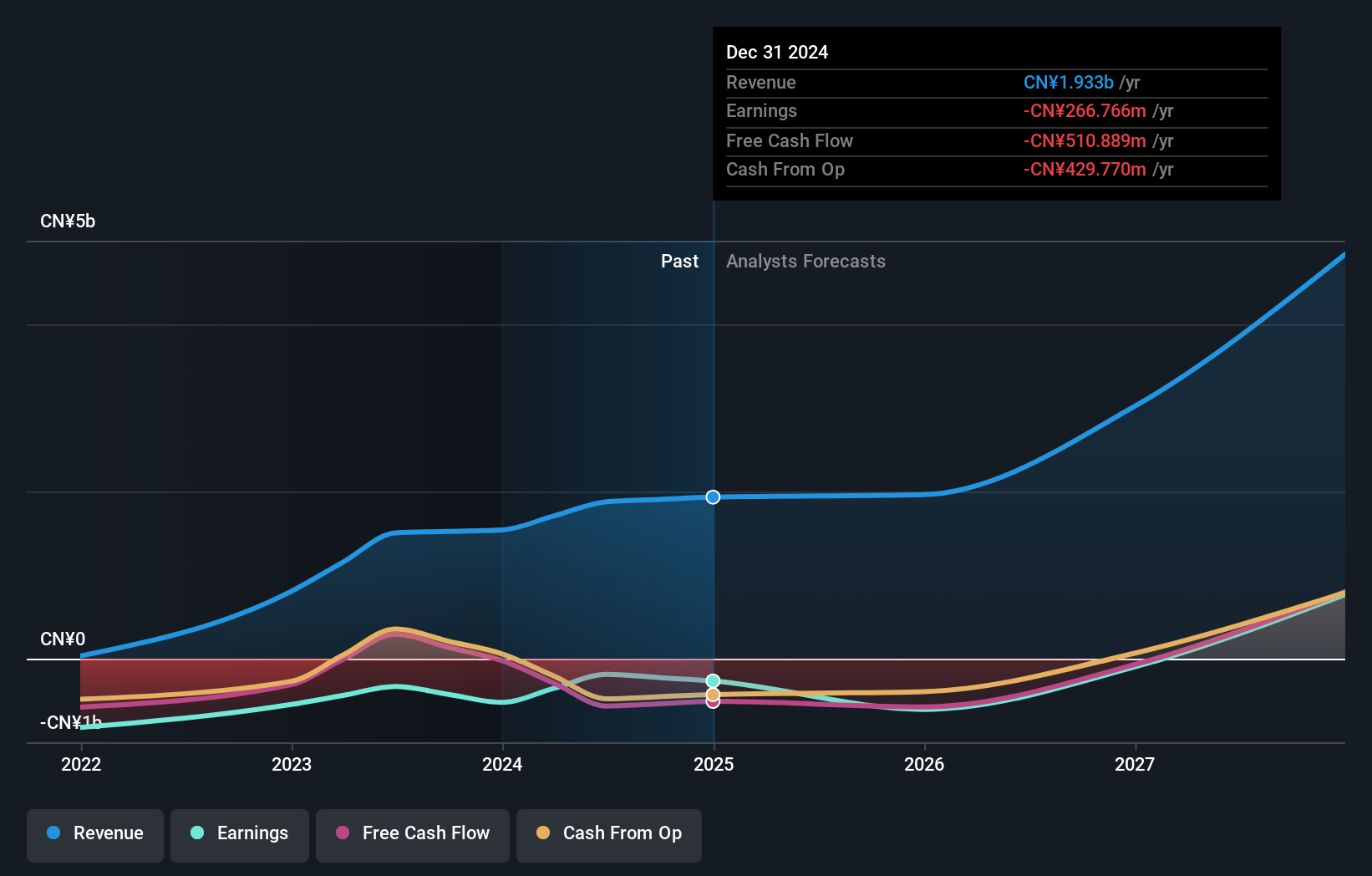

Operations: Kelun-Biotech focuses on the research, development, and commercialization of innovative pharmaceuticals, generating revenue primarily from its pharmaceutical segment amounting to CN¥1.88 billion.

Sichuan Kelun-Biotech Biopharmaceutical has been making significant strides in high-growth biotech, particularly with its innovative drug sacituzumab tirumotecan (sac-TMT). The company recently reported a robust 24.7% revenue growth year-over-year, reflecting strong market demand and successful clinical advancements. Notably, their R&D commitment is highlighted by an 8.5% annual increase in earnings forecasted due to ongoing investments in research trials which have shown promising results against tough-to-treat cancers like TNBC and NSCLC. These developments not only enhance Sichuan Kelun-Biotech's competitive edge but also position it favorably for future profitability and industry leadership in targeted cancer therapies.

Make It Happen

- Embark on your investment journey to our 43 SEHK High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs to address unmet medical needs in the People’s Republic of China and internationally.