- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1478

Q Technology (SEHK:1478) Valuation: Assessing New Growth Momentum After Latest Sales Jump and India Exit

Reviewed by Simply Wall St

Q Technology (Group) (SEHK:1478) reported a year-on-year rise in October 2025 sales volumes for its camera and fingerprint modules, reflecting gains in mobile phone, IoT, and smart vehicle markets. The company also exited its Q Tech India stake.

See our latest analysis for Q Technology (Group).

Q Technology’s latest operational gains have added a shot of energy to its momentum story this year. Despite recent volatility, with a 1-day share price climb of 4.34% offsetting some of last week’s losses, the real headline is its strong year-to-date share price return of 84.51%. Even more eye-catching, shareholders have seen a 137.08% total return over the past year. This highlights both fresh growth potential and a renewed appetite for risk as the company pivots further into high-growth markets.

If you’re looking beyond single stories to spot tomorrow’s winners, now’s an ideal time to explore fast growing stocks with high insider ownership.

With the stock’s recent surge and operational momentum in focus, is Q Technology’s valuation still attractive, or are investors already factoring in all future growth? Is there another leg up left for buyers, or is the market ahead of itself?

Price-to-Earnings of 27.2x: Is it justified?

Q Technology (Group) currently trades on a price-to-earnings (P/E) ratio of 27.2x, which is notably higher than both its peers and industry benchmarks. With the last close at HK$11.79, investors are paying a premium compared to similar stocks in the electronic sector.

The P/E ratio reflects how much investors are willing to pay for a dollar of earnings, helping assess whether a company’s profitability justifies its price tag. For tech manufacturers like Q Technology, a higher P/E can sometimes signal strong growth expectations. In this case, the company's rapid earnings rebound stands out, but the premium leaves little margin for disappointment if targets are not met.

Compared to the Hong Kong Electronic industry average of 14.2x and the peer average of 11.6x, Q Technology’s multiple looks even more demanding. Even against its own estimated fair P/E of 18x, the current level suggests the market is pricing in aggressive future gains, far above what fundamentals may support if momentum slows.

Explore the SWS fair ratio for Q Technology (Group)

Result: Price-to-Earnings of 27.2x (OVERVALUED)

However, if revenue growth slows or profit targets are missed, the high valuation could quickly be challenged and investor enthusiasm for Q Technology’s shares could be dampened.

Find out about the key risks to this Q Technology (Group) narrative.

Another View: What Does the SWS DCF Model Say?

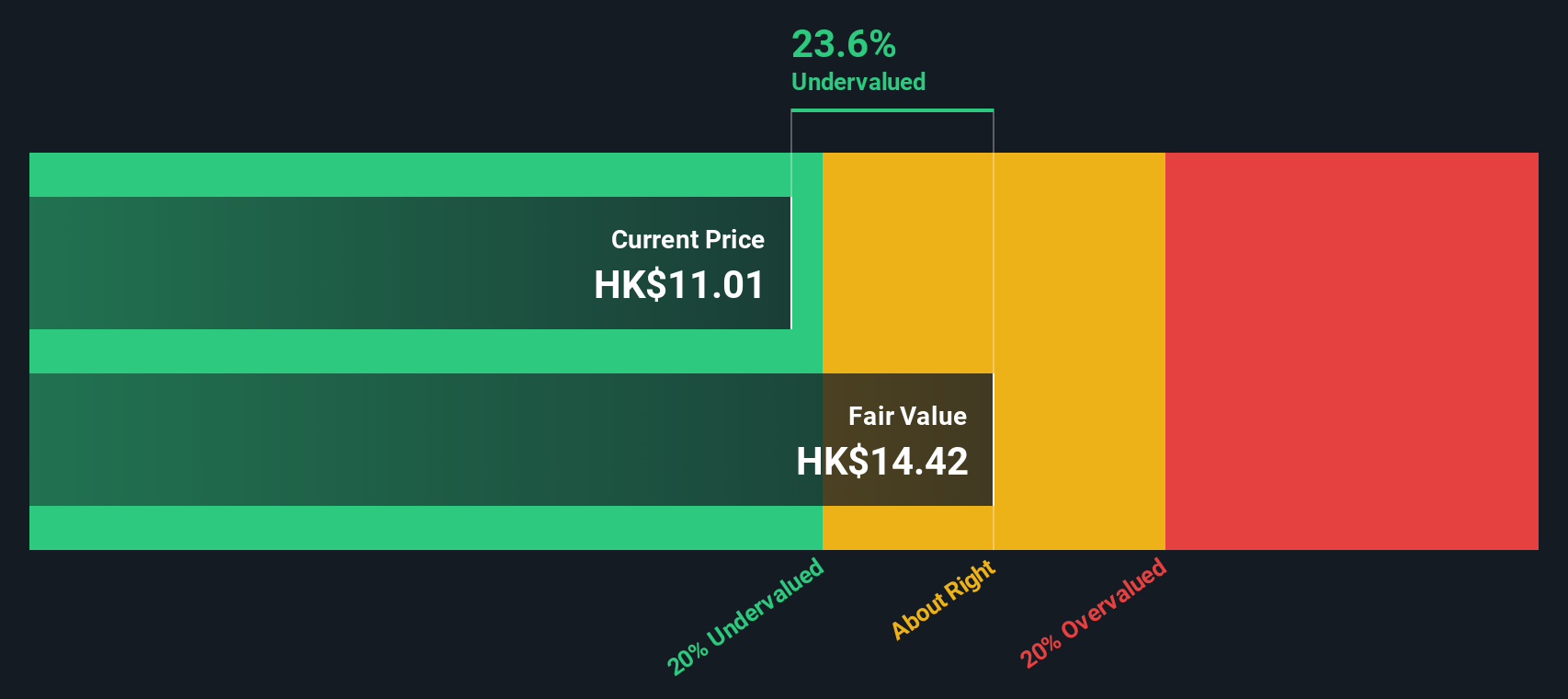

While the price-to-earnings multiple presents Q Technology as expensive compared to peers, our SWS DCF model presents a different perspective. According to this approach, shares are currently priced about 18% below their estimated fair value. This raises the question of whether the market is underestimating Q Technology’s longer-term cash flow prospects.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Q Technology (Group) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Q Technology (Group) Narrative

If you want to dive deeper or have your own perspective, you can build your personal view on Q Technology in just a few minutes. Do it your way.

A great starting point for your Q Technology (Group) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investing Ideas?

Smart investors always keep their watchlists fresh. Don’t limit yourself—expand your horizons and get ahead of the curve with these proven strategies from the Simply Wall Street Screener:

- Target reliability and consistency by tapping into opportunities offering robust income with these 15 dividend stocks with yields > 3%. This tool is designed to help you find strong yields in today’s market.

- Position yourself at the forefront of healthcare’s digital transformation and take advantage of future-defining trends through these 32 healthcare AI stocks.

- Accelerate your search for undervalued gems and maximize your growth potential by leveraging these 872 undervalued stocks based on cash flows. This resource is perfect for spotting powerful opportunities before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1478

Q Technology (Group)

An investment holding company, engages in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules in the Mainland of China, Hong Kong, India, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives