- Hong Kong

- /

- Diversified Financial

- /

- SEHK:9923

Analyst Forecasts Just Became More Bearish On Yeahka Limited (HKG:9923)

The latest analyst coverage could presage a bad day for Yeahka Limited (HKG:9923), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

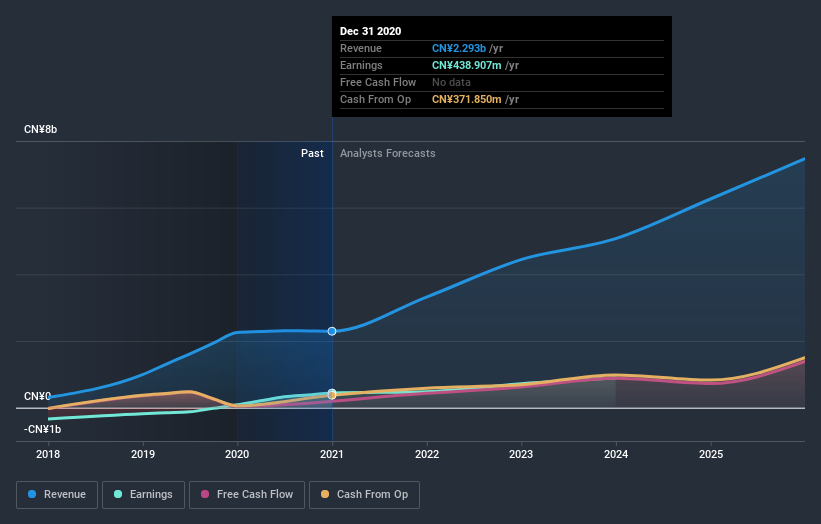

Following the downgrade, the current consensus from Yeahka's six analysts is for revenues of CN¥3.3b in 2021 which - if met - would reflect a substantial 45% increase on its sales over the past 12 months. Statutory earnings per share are supposed to crater 22% to CN¥1.13 in the same period. Prior to this update, the analysts had been forecasting revenues of CN¥3.7b and earnings per share (EPS) of CN¥1.25 in 2021. Indeed, we can see that analyst sentiment has declined measurably after the new consensus came out, with a substantial drop in revenue estimates and a minor downgrade to EPS estimates to boot.

Check out our latest analysis for Yeahka

The average price target climbed 5.7% to HK$75.70 despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Yeahka at HK$94.70 per share, while the most bearish prices it at HK$45.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Yeahka'shistorical trends, as the 45% annualised revenue growth to the end of 2021 is roughly in line with the 42% annual revenue growth over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 20% per year. So it's pretty clear that Yeahka is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Yeahka after today.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Yeahka going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Yeahka or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:9923

Yeahka

An investment holding company, provides payment and business services to merchants and consumers in the People’s Republic of China.

Good value with reasonable growth potential.