- Hong Kong

- /

- Entertainment

- /

- SEHK:6633

High Growth Tech Stocks To Watch In Hong Kong August 2024

Reviewed by Simply Wall St

The Hong Kong market has seen a notable uptick, with the Hang Seng Index rising by 1.99% amid a backdrop of mixed economic signals from China. As global markets show signs of recovery and investor sentiment improves, it's crucial to identify high-growth tech stocks that can capitalize on these trends and offer potential for substantial returns.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Everest Medicines (SEHK:1952)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Everest Medicines Limited is a biopharmaceutical company focused on the discovery, license-in, development, and commercialization of therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of HK$6.22 billion.

Operations: Everest Medicines Limited generates revenue primarily from the sale of pharmaceuticals, amounting to CN¥125.93 million. The company's focus is on addressing critical unmet medical needs in Greater China and other Asia Pacific markets through its biopharmaceutical products.

Everest Medicines is making significant strides in biotech, particularly with its recent advancements in autoimmune disease treatments. The company reported a 37.8% annual revenue growth forecast and expects earnings to grow at an impressive 76.3% per year, highlighting robust future prospects. Everest's substantial investment in R&D, accounting for $50M annually, underscores its commitment to innovation. With the successful dosing of zetomipzomib in Phase 2b trials for lupus nephritis and positive data from NEFECON® studies, Everest is poised to impact the biotech landscape significantly.

- Click here to discover the nuances of Everest Medicines with our detailed analytical health report.

Examine Everest Medicines' past performance report to understand how it has performed in the past.

Qingci Games (SEHK:6633)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingci Games Inc., an investment holding company with a market cap of HK$2.01 billion, develops, publishes, and operates mobile games across various international markets including China, Japan, the United States, Canada, Australia, New Zealand, Hong Kong, Macau, and Taiwan.

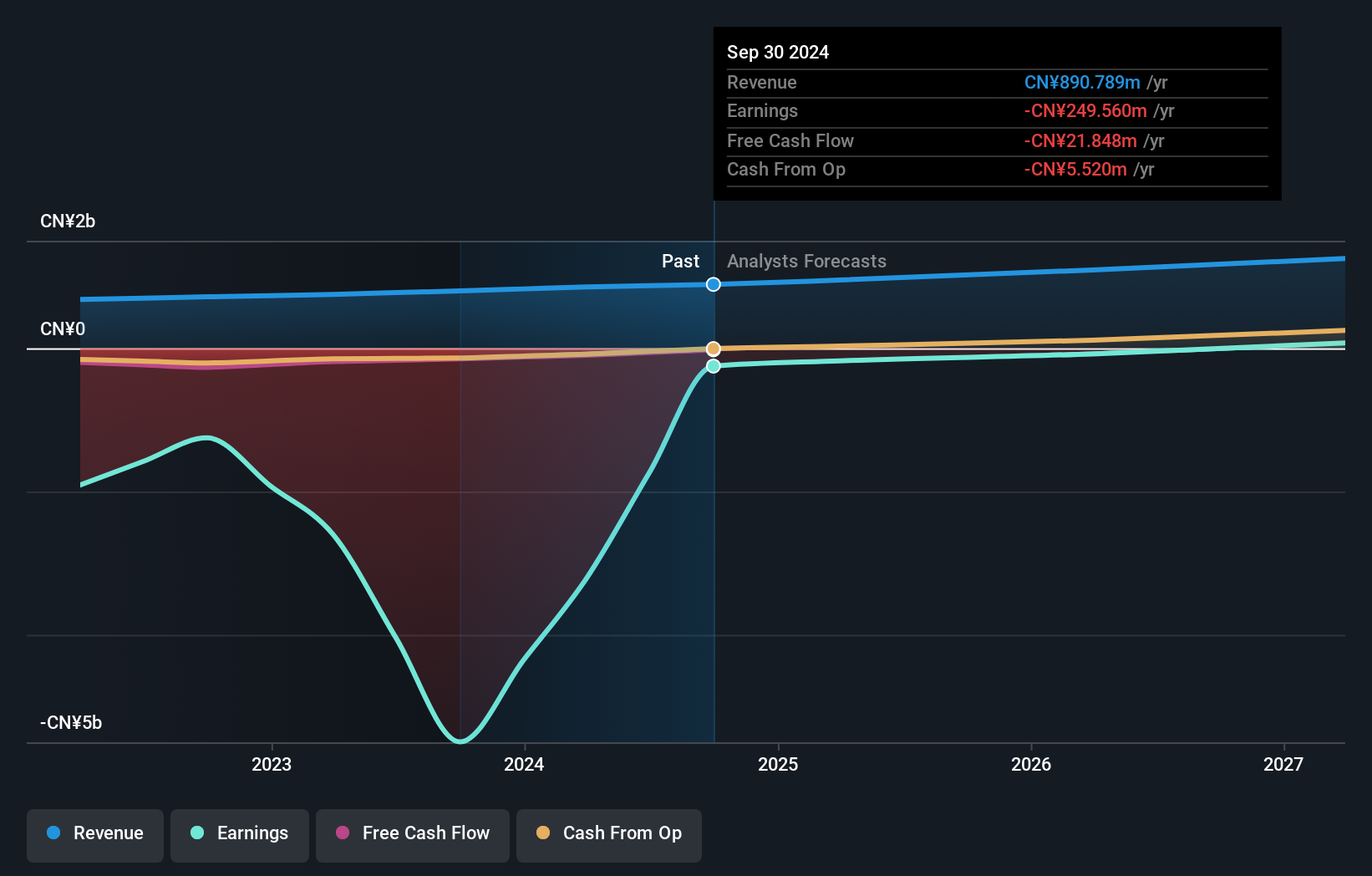

Operations: Qingci Games generates revenue primarily from developing, publishing, and operating mobile games. For the latest period, the company reported revenue of CN¥905.74 million from its Computer Graphics segment.

Qingci Games is experiencing rapid growth, with revenue projected to increase by 40.1% annually, significantly outpacing the Hong Kong market's 7.4%. The company's earnings are expected to grow at an impressive rate of 111.7% per year over the next three years, highlighting its potential for profitability despite current unprofitability. Notably, Qingci Games has invested heavily in R&D, which accounted for $30M last year, underscoring its commitment to innovation and long-term growth in the competitive gaming industry.

- Click to explore a detailed breakdown of our findings in Qingci Games' health report.

Assess Qingci Games' past performance with our detailed historical performance reports.

Beisen Holding (SEHK:9669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beisen Holding Limited, an investment holding company with a market cap of HK$2.61 billion, provides cloud-based human capital management solutions for enterprises to recruit, evaluate, manage, develop, and retain talents in the People's Republic of China.

Operations: Beisen Holding generates revenue primarily from providing cloud-based human capital management (HCM) solutions and related professional services, totaling CN¥854.74 million. The company's operations focus on offering enterprises tools to manage their talent lifecycle in the People’s Republic of China.

Beisen Holding has demonstrated significant growth, with revenue rising from ¥750.91M to ¥854.74M in the past year, a notable 13.8% increase. Despite a net loss of ¥3,208.59M due to higher share-based payments and changes in fair value of redeemable convertible preferred shares, the company’s annual recurring revenue surged by 15-18%, reaching up to ¥766.9M, reflecting strong subscription retention rates between 105% and 107%. Additionally, Beisen invested heavily in R&D with expenses accounting for approximately 15% of its total revenue last year, underscoring its commitment to innovation within the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Beisen Holding.

Understand Beisen Holding's track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our SEHK High Growth Tech and AI Stocks list of 47 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingci Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6633

Qingci Games

An investment holding company, develops, publishes, and operates mobile games in the People’s Republic of China, Japan, the United States, Canada, Australia, New Zealand, Hong Kong, Macau, Taiwan, and internationally.

Flawless balance sheet with high growth potential.