- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1094

Health Check: How Prudently Does China Public Procurement (HKG:1094) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies China Public Procurement Limited (HKG:1094) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for China Public Procurement

What Is China Public Procurement's Debt?

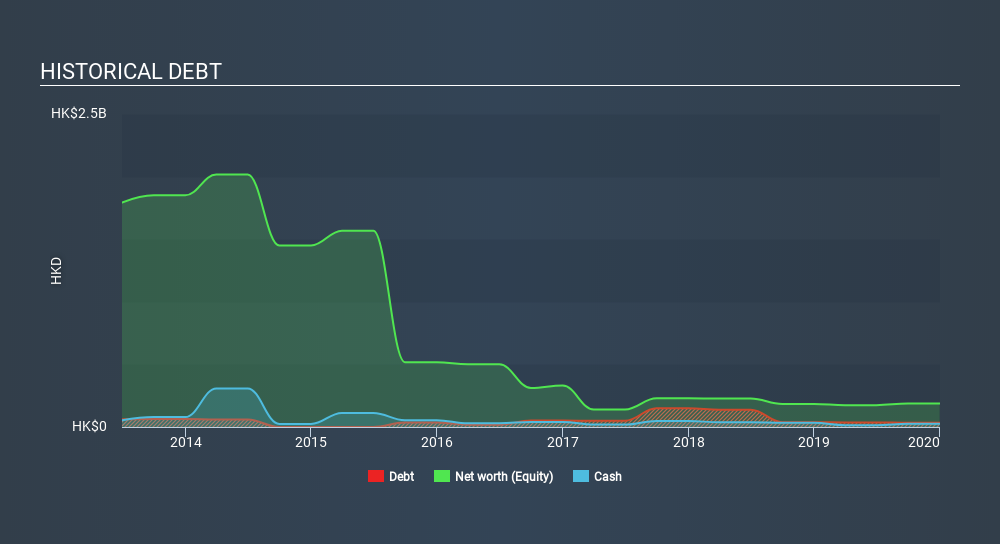

The image below, which you can click on for greater detail, shows that China Public Procurement had debt of HK$33.5m at the end of December 2019, a reduction from HK$38.9m over a year. However, it also had HK$26.0m in cash, and so its net debt is HK$7.55m.

How Strong Is China Public Procurement's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China Public Procurement had liabilities of HK$67.9m due within 12 months and liabilities of HK$78.1m due beyond that. On the other hand, it had cash of HK$26.0m and HK$6.86m worth of receivables due within a year. So it has liabilities totalling HK$113.1m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the HK$47.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, China Public Procurement would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Public Procurement will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year China Public Procurement wasn't profitable at an EBIT level, but managed to grow its revenue by 7.4%, to HK$73m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, China Public Procurement had negative earnings before interest and tax (EBIT), over the last year. Its EBIT loss was a whopping HK$23m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of HK$13m. And until that time we think this is a risky stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for China Public Procurement (1 is significant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1094

Cherish Sunshine International

An investment holding company, trades in various products in the People’s Republic of China.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives