- Hong Kong

- /

- Semiconductors

- /

- SEHK:3800

GCL Tech (SEHK:3800): Valuation Insights Following Major Share Issuance to Infini Global

Reviewed by Simply Wall St

GCL Technology Holdings (SEHK:3800) has completed a sizable share issuance to Infini Global Master Fund, raising substantial new capital. This move likely signals that management is focusing on strengthening the company's market position and supporting future expansion plans.

See our latest analysis for GCL Technology Holdings.

After raising capital through the latest share issuance, GCL Technology Holdings has seen momentum pick up; its share price is up nearly 39% year-to-date and 29% over the last 90 days. While long-term investors are still looking at a negative total shareholder return over one and three years, the recent upward price trend hints at renewed investor confidence and possible early signs of a turnaround.

If GCL’s capital raise has you watching for other opportunities, it’s a good moment to broaden your search and discover fast growing stocks with high insider ownership

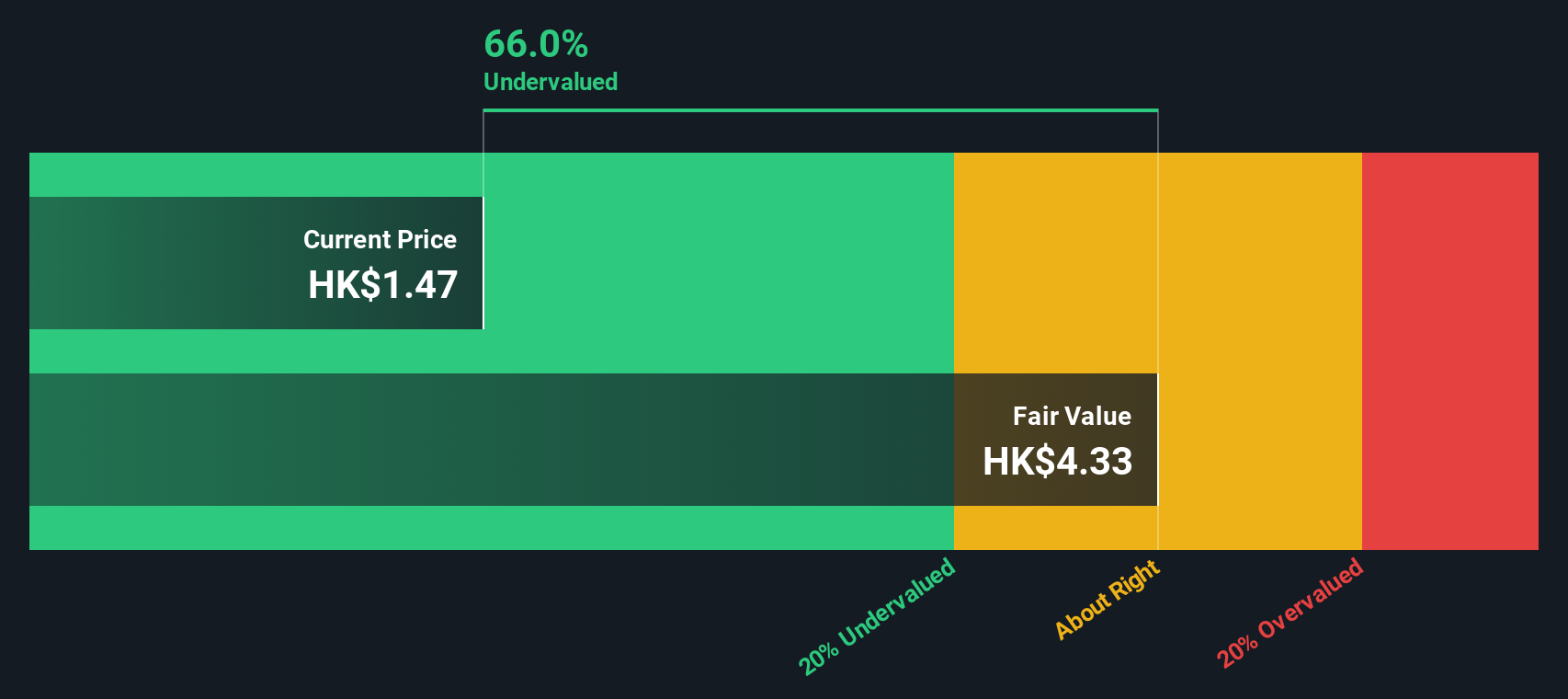

With the recent surge in share price and a fresh injection of capital, investors may be wondering whether GCL Technology Holdings is trading at a bargain or if expectations for growth are already fully reflected in its valuation.

Price-to-Sales of 3.4x: Is it justified?

GCL Technology Holdings trades at a price-to-sales ratio of 3.4x, notably higher than the Hong Kong Semiconductor industry average of 1.8x. With the last close at HK$1.47, this suggests the stock is currently priced at a premium relative to peers.

The price-to-sales ratio compares a company’s market capitalization to its annual revenue. In the semiconductor sector, this metric is often used for companies with volatile or negative earnings, providing investors a way to benchmark relative value based on topline sales.

GCL Technology Holdings’ premium valuation implies that the market is expecting stronger revenue growth or future profitability improvements than its peers. However, compared to the estimated fair price-to-sales ratio of 1.6x, its current valuation appears stretched and may not be justified unless significant growth materializes.

Compared to both industry peers and its own fair value benchmark, GCL Technology Holdings stands out as expensive. If the market were to move towards the fair ratio, a significant revaluation could follow.

Explore the SWS fair ratio for GCL Technology Holdings

Result: Price-to-Sales of 3.4x (OVERVALUED)

However, continued operating losses and an overvalued share price could limit future gains if anticipated growth does not occur.

Find out about the key risks to this GCL Technology Holdings narrative.

Another View: Discounted Cash Flow Perspective

While the current price-to-sales ratio suggests GCL Technology Holdings is expensive, our DCF model provides a different perspective. According to this method, the shares are trading more than 65% below their estimated fair value, which may indicate a potential undervalued opportunity. Can the fundamentals support both sides of the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GCL Technology Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GCL Technology Holdings Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can quickly craft your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GCL Technology Holdings.

Looking for more investment ideas?

Stay ahead of the curve by tapping into unique opportunities. Don’t let them pass you by when smarter investing options are just a click away.

- Boost your income potential by targeting reliable companies with strong payouts using these 17 dividend stocks with yields > 3%, offering yields above 3%.

- Join the AI evolution and seize fast-growing opportunities in automation, big data, and intelligent platforms through these 25 AI penny stocks, making headlines in the sector.

- Capitalize on value by finding quality businesses trading well below their intrinsic worth among these 861 undervalued stocks based on cash flows, based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3800

GCL Technology Holdings

Manufactures and sells polysilicon and wafers products in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives