- Hong Kong

- /

- Semiconductors

- /

- SEHK:2203

Brainhole Technology Limited's (HKG:2203) Shares Bounce 64% But Its Business Still Trails The Industry

Brainhole Technology Limited (HKG:2203) shareholders would be excited to see that the share price has had a great month, posting a 64% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

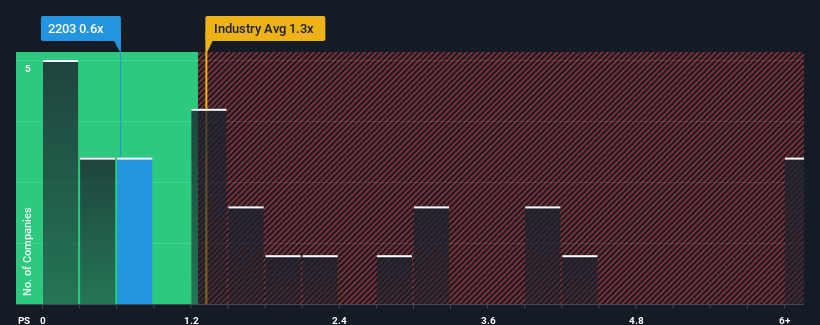

In spite of the firm bounce in price, when close to half the companies operating in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Brainhole Technology as an enticing stock to check out with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Brainhole Technology

How Has Brainhole Technology Performed Recently?

As an illustration, revenue has deteriorated at Brainhole Technology over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Brainhole Technology will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Brainhole Technology will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Brainhole Technology?

In order to justify its P/S ratio, Brainhole Technology would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. This means it has also seen a slide in revenue over the longer-term as revenue is down 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 19% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Brainhole Technology's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Brainhole Technology's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Brainhole Technology revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Brainhole Technology (of which 1 is significant!) you should know about.

If these risks are making you reconsider your opinion on Brainhole Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Brainhole Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2203

Brainhole Technology

An investment holding company, engages in the assembly, packaging, and sale of discrete semiconductors primarily for smart consumer electronic devices in the People’s Republic of China, Hong Kong, Korea, rest of Asia, Europe, and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026