- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

Hua Hong Semiconductor (SEHK:1347) Is Down 7.0% After Profit Drop and Leadership Change - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Hua Hong Semiconductor reported its financial results for the nine months ended September 30, 2025, with sales rising to CNY 12.58 billion but net income decreasing sharply to CNY 251.27 million compared to the previous year.

- The company also experienced significant leadership changes, as President Peng Bai was appointed chairman, consolidating both roles amid financial pressures.

- We'll examine how Hua Hong's simultaneous profit decline and leadership shift could affect its investment narrative and operational outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Hua Hong Semiconductor Investment Narrative Recap

To be a shareholder in Hua Hong Semiconductor, one has to believe in the company's ability to capitalize on long-term demand for specialty chips and benefit from China's push for self-sufficiency, despite recent profit softness. The latest earnings report, showing robust sales growth but sharply lower net income, does not materially alter the company’s short-term catalyst: the ramp-up of Fab9 and capacity expansion. However, the biggest risk, margin compression if demand weakens, gains relevance given the profit decline.

Among recent announcements, the leadership transition stands out: Mr. Peng Bai’s appointment as both president and chairman consolidates authority during a period of heightened financial pressure. This move arrives just as Hua Hong faces increased competition and must balance capital investment with operational efficiency, a crucial backdrop for monitoring the near-term impact of new capacity coming online.

Yet, amid the optimism about long-term demand, investors should remain alert to signs that rapid expansion may bring unexpected risks if...

Read the full narrative on Hua Hong Semiconductor (it's free!)

Hua Hong Semiconductor is forecast to reach CN¥25.4 billion in revenue and CN¥2.6 billion in earnings by 2028. This outlook is underpinned by expected annual revenue growth of 17.5% and an earnings increase of CN¥2.37 billion from current earnings of CN¥225.7 million.

Uncover how Hua Hong Semiconductor's forecasts yield a HK$53.96 fair value, a 33% downside to its current price.

Exploring Other Perspectives

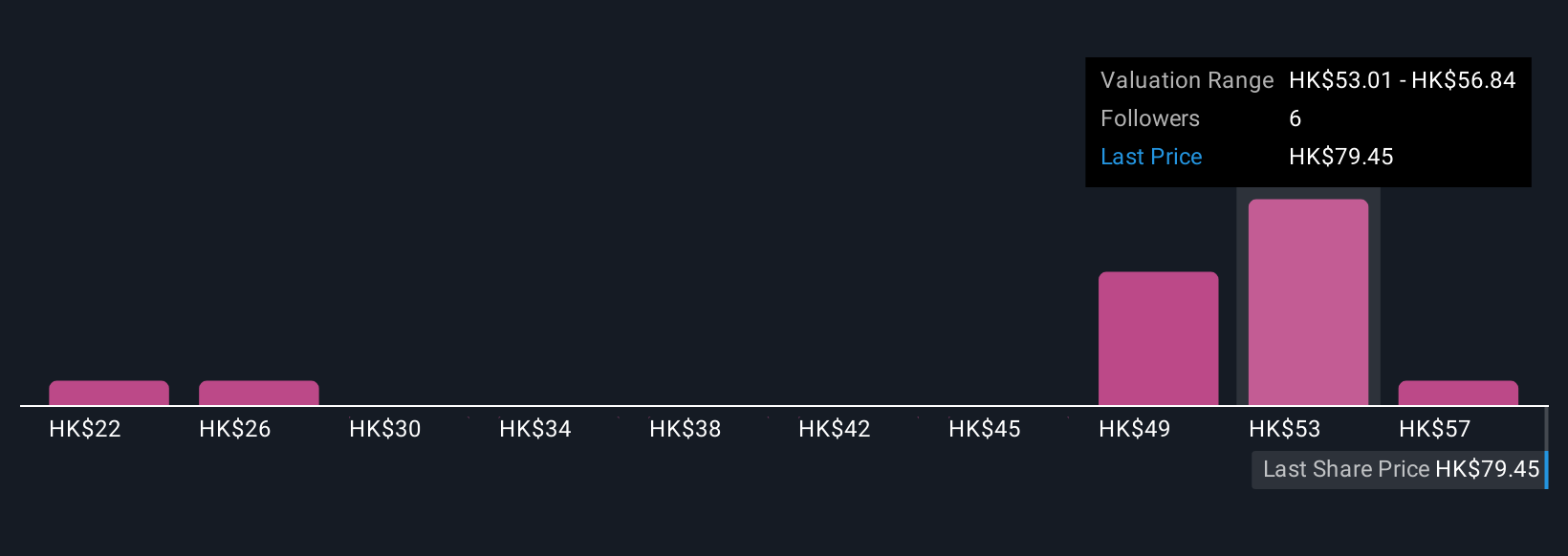

Six fair value estimates from the Simply Wall St Community range widely from HK$22.38 to HK$55.96 per share. With earnings pressured and margins in focus, opinions differ sharply, explore several perspectives before you decide.

Explore 6 other fair value estimates on Hua Hong Semiconductor - why the stock might be worth less than half the current price!

Build Your Own Hua Hong Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hua Hong Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hua Hong Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hua Hong Semiconductor's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives