- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

Assessing Hua Hong Semiconductor (SEHK:1347) Valuation After a Strong Year of Share Price Gains

Reviewed by Simply Wall St

Hua Hong Semiconductor (SEHK:1347) has caught the market’s attention lately, with its share price reflecting an interesting mix of recent trading pressure and longer-term momentum. Investors are weighing current declines in light of its strong performance over the past few months.

See our latest analysis for Hua Hong Semiconductor.

Hua Hong Semiconductor may have eased back lately, with a 1-day share price return of -0.81% and a 1-week slide of -0.38%. However, the stock’s powerful rally this year tells a compelling story. With a 293.32% year-to-date share price return and a stellar 246.94% total shareholder return over the past twelve months, momentum remains firmly on the company’s side despite recent pullbacks.

If you’re intrigued by Hua Hong’s momentum and want to catch other big movers, it’s a perfect time to broaden your search and discover See the full list for free.

The key question for investors is whether Hua Hong’s explosive gains have outpaced its fundamentals or if current prices still offer upside. Is this a genuine bargain, or has the market already priced in the company’s growth prospects?

Most Popular Narrative: 47% Overvalued

Compared to Hua Hong Semiconductor’s last close at HK$79.45, the most widely followed narrative suggests a fair value near HK$53.96. This sharp difference puts a spotlight on bold expectations for the company’s future and hints at mixed market sentiment. Here is a key catalyst from the popular narrative driving this viewpoint:

The company’s aggressive capacity expansion, particularly the ramp and near-term completion of Fab9, anticipates sustained demand growth from areas like AI, EVs, and industrial automation. However, this build-out could outpace end-market absorption, risking future overcapacity, underutilization, and margin compression if global digitalization and electrification trends decelerate. This would negatively impact both revenue growth and future net margins.

What are the high-stakes financial bets behind this valuation call? One set of assumptions, if proven right, could mean explosive upside or a rude awakening for bulls. Only by reading the full narrative can you see which growth forecasts and profit margins power this forecast.

Result: Fair Value of $53.96 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust AI-fueled demand or successful capacity expansion could quickly shift sentiment. This could spark a re-evaluation of Hua Hong’s earnings and growth outlook.

Find out about the key risks to this Hua Hong Semiconductor narrative.

Another View: Looking Beyond Narratives

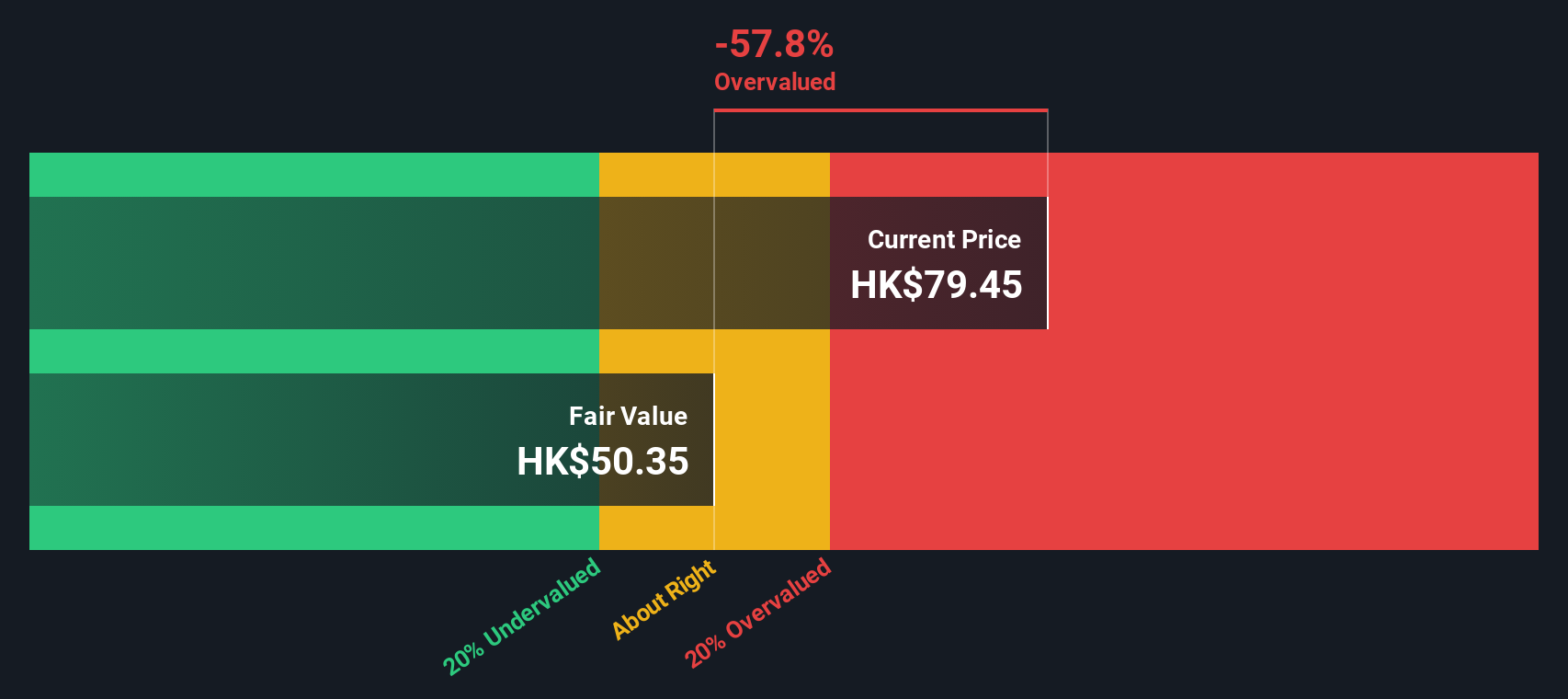

While the market consensus values Hua Hong Semiconductor much lower than its current share price, our SWS DCF model also points to overvaluation, with shares trading well above the estimated fair value of HK$50.35. Two different approaches raise one challenging question: which verdict will prove more accurate in the long run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hua Hong Semiconductor Narrative

If you want a different perspective or enjoy digging into the numbers yourself, it only takes a few minutes to shape your own story. Do it your way

A great starting point for your Hua Hong Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more share price movers and smart investment ideas?

Don’t let the next winning opportunity pass you by. Called-out stocks can show up anywhere, and the best ideas are one click away when you know where to look.

- Capture the upside from tomorrow’s emerging innovators and financial outliers by tracking these 3587 penny stocks with strong financials that are poised for breakout growth.

- Benefit from secular growth by tapping into AI technology trends through these 24 AI penny stocks. These stocks are powering breakthroughs in automation and predictive analytics.

- Start building your income stream and spot cash-generating market leaders among these 16 dividend stocks with yields > 3% currently offering attractive payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives