- Hong Kong

- /

- Specialty Stores

- /

- SEHK:393

Undiscovered Opportunities: Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

Global markets have experienced a mixed week, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating, while small-cap stocks showed resilience. For investors interested in smaller or newer companies, penny stocks—despite their old-fashioned name—remain a compelling area to explore. These stocks can offer significant value when backed by strong financials and growth potential, presenting opportunities for those seeking to invest in promising yet under-the-radar companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$514.18M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.73 | MYR126.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.01 | MYR2.07B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

Click here to see the full list of 5,813 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Glorious Sun Enterprises (SEHK:393)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Glorious Sun Enterprises Limited is an investment holding company involved in interior decoration and renovation across Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and other international markets with a market cap of HK$1.69 billion.

Operations: The company's revenue is primarily derived from its interior decoration and renovation segment at HK$390.31 million, followed by export operations generating HK$303.86 million, financial investments contributing HK$143.19 million, and retail, franchise and others adding HK$59.61 million.

Market Cap: HK$1.69B

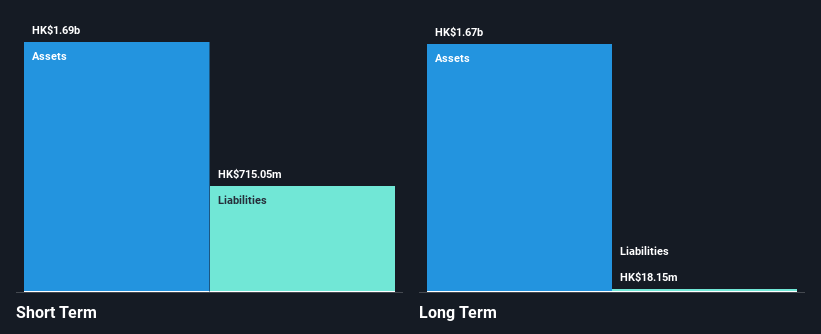

Glorious Sun Enterprises has demonstrated resilience in the volatile penny stock segment, with a market cap of HK$1.69 billion and diversified revenue streams from interior decoration and export operations. Despite a 20.5% annual decline in earnings over five years, recent performance shows improvement with a 23.8% earnings growth over the past year, surpassing industry trends. The company's financial health is robust; it maintains more cash than debt and has improved its debt-to-equity ratio significantly over five years. However, its dividend yield of 7.86% isn't well-covered by earnings or free cash flows, posing potential sustainability concerns amidst fluctuating profits influenced by one-off items.

- Jump into the full analysis health report here for a deeper understanding of Glorious Sun Enterprises.

- Evaluate Glorious Sun Enterprises' historical performance by accessing our past performance report.

Beisen Holding (SEHK:9669)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beisen Holding Limited is an investment holding company offering cloud-based human capital management solutions for enterprises in China, with a market cap of HK$2.53 billion.

Operations: The company generated CN¥854.74 million from its cloud-based HCM solutions and related professional services segment.

Market Cap: HK$2.53B

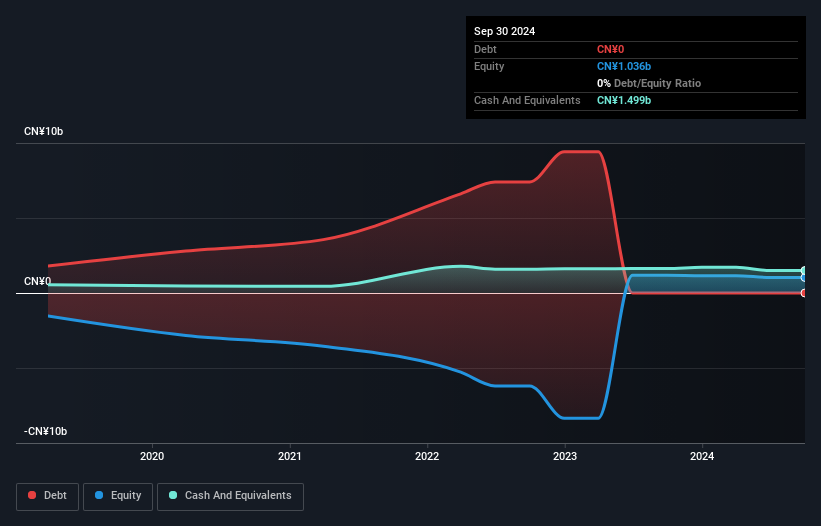

Beisen Holding, with a market cap of HK$2.53 billion, is an investment holding company providing cloud-based human capital management solutions in China. Despite being unprofitable and having a negative return on equity, the company boasts seasoned management with an average tenure of five years and no debt burden. Its short-term assets significantly exceed both short- and long-term liabilities, indicating strong liquidity. Beisen's cash runway extends beyond three years based on current free cash flow levels, offering financial stability amidst its volatile weekly stock performance. Earnings are projected to grow substantially at 98.68% annually according to analyst estimates.

- Click here and access our complete financial health analysis report to understand the dynamics of Beisen Holding.

- Learn about Beisen Holding's future growth trajectory here.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited is a real estate services provider operating in Singapore and internationally, with a market capitalization of SGD603.10 million.

Operations: The company's revenue is primarily derived from Agency Services at SGD793.97 million, Project Marketing Services contributing SGD220.11 million, Training Services at SGD2.69 million, and Administrative Support Services generating SGD4.41 million.

Market Cap: SGD603.1M

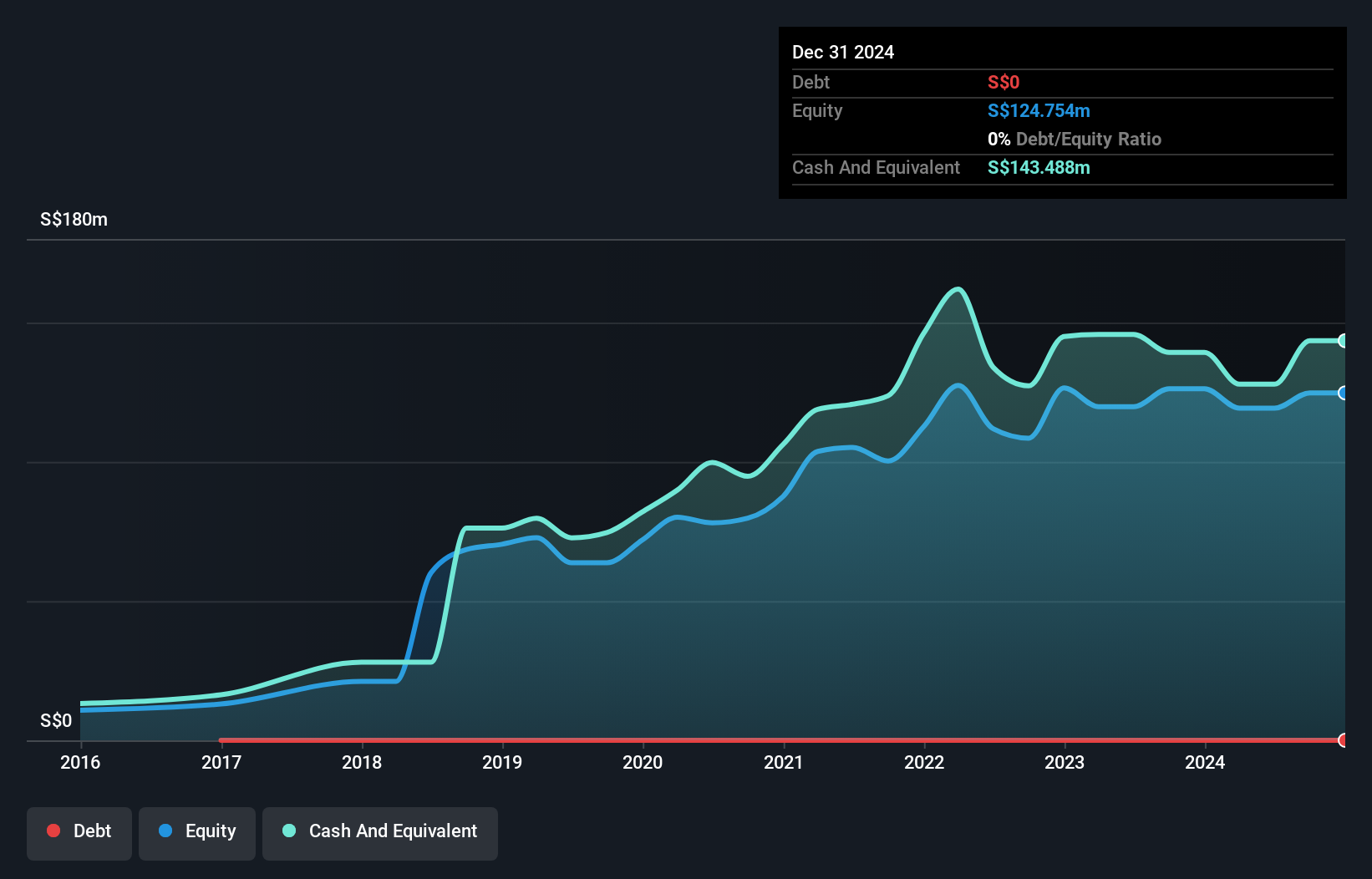

PropNex Limited, with a market cap of SGD603.10 million, operates debt-free and has high-quality earnings despite recent declines in revenue and net income. The company's short-term assets of SGD269.4 million comfortably cover both its short- and long-term liabilities, indicating robust financial health. However, its dividend yield of 7.06% is not well supported by current earnings or cash flows, raising sustainability concerns. PropNex's return on equity is strong at 38.7%, but the company faces challenges with negative earnings growth over the past year and recent exclusion from the S&P Global BMI Index could affect investor sentiment.

- Take a closer look at PropNex's potential here in our financial health report.

- Gain insights into PropNex's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Gain an insight into the universe of 5,813 Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:393

Glorious Sun Enterprises

An investment holding company, engages in interior decoration and renovation business in Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and internationally.

Flawless balance sheet with acceptable track record.