Wing On Company International's (HKG:289) Dividend Will Be HK$0.43

Wing On Company International Limited (HKG:289) will pay a dividend of HK$0.43 on the 24th of October. This takes the annual payment to 6.7% of the current stock price, which is about average for the industry.

Wing On Company International's Distributions May Be Difficult To Sustain

We aren't too impressed by dividend yields unless they can be sustained over time. Wing On Company International isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This is quite a strong warning sign that the dividend may not be sustainable.

Over the next year, EPS might fall by 43.4% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

View our latest analysis for Wing On Company International

Dividend Volatility

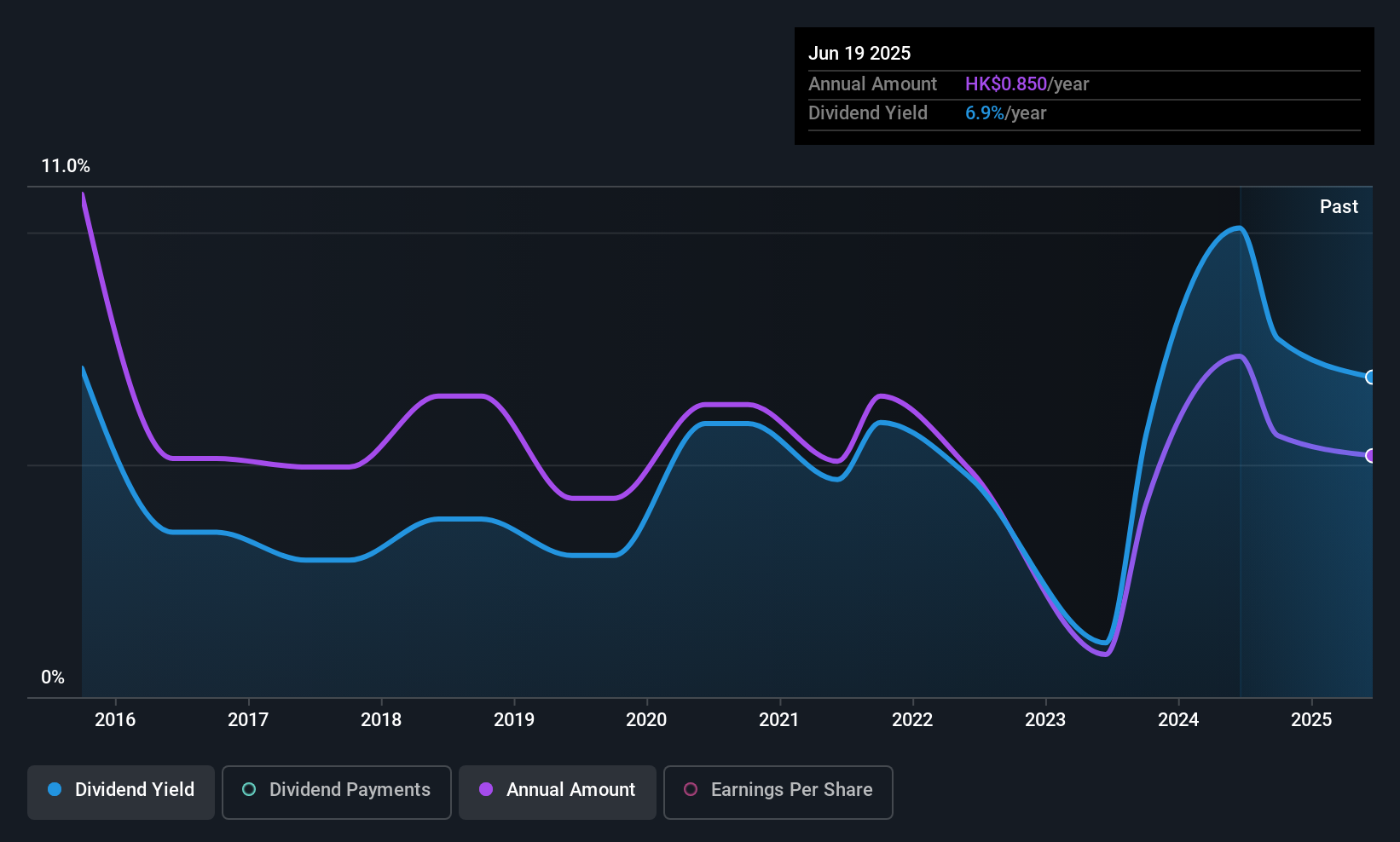

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the dividend has gone from HK$1.77 total annually to HK$0.85. This works out to be a decline of approximately 7.1% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Potential Is Shaky

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Wing On Company International's EPS has fallen by approximately 43% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

We're Not Big Fans Of Wing On Company International's Dividend

In conclusion, we have some concerns about this dividend, even though it being raised is good. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, the dividend is not reliable enough to make this a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Wing On Company International that investors need to be conscious of moving forward. Is Wing On Company International not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Wing On Company International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:289

Wing On Company International

Operates department stores in the People’s Republic of China, Australia, and the United States.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives