- Hong Kong

- /

- Real Estate

- /

- SEHK:16

We Discuss Why Sun Hung Kai Properties Limited's (HKG:16) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

The disappointing performance at Sun Hung Kai Properties Limited (HKG:16) will make some shareholders rather disheartened. At the upcoming AGM on 03 November 2022, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

Check out the opportunities and risks within the HK Real Estate industry.

Comparing Sun Hung Kai Properties Limited's CEO Compensation With The Industry

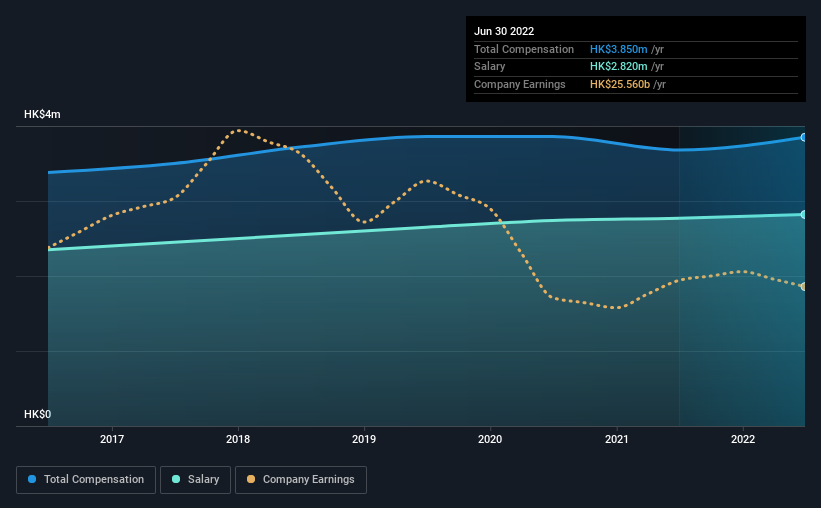

According to our data, Sun Hung Kai Properties Limited has a market capitalization of HK$250b, and paid its CEO total annual compensation worth HK$3.9m over the year to June 2022. That's a modest increase of 4.6% on the prior year. We note that the salary portion, which stands at HK$2.82m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations over HK$63b, the reported median total CEO compensation was HK$23m. Accordingly, Sun Hung Kai Properties pays its CEO under the industry median. What's more, Raymond Kwok holds HK$5.9b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | HK$2.8m | HK$2.8m | 73% |

| Other | HK$1.0m | HK$910k | 27% |

| Total Compensation | HK$3.9m | HK$3.7m | 100% |

Talking in terms of the industry, salary represented approximately 72% of total compensation out of all the companies we analyzed, while other remuneration made up 28% of the pie. There isn't a significant difference between Sun Hung Kai Properties and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Sun Hung Kai Properties Limited's Growth Numbers

Sun Hung Kai Properties Limited has reduced its earnings per share by 17% a year over the last three years. It saw its revenue drop 8.8% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sun Hung Kai Properties Limited Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Sun Hung Kai Properties Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Sun Hung Kai Properties that you should be aware of before investing.

Important note: Sun Hung Kai Properties is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:16

Sun Hung Kai Properties

Develops and invests in properties for sale and rent in Hong Kong, Mainland China, and internationally.

Good value with adequate balance sheet and pays a dividend.