- Hong Kong

- /

- Real Estate

- /

- SEHK:9968

Risks Still Elevated At These Prices As Huijing Holdings Company Limited (HKG:9968) Shares Dive 31%

Huijing Holdings Company Limited (HKG:9968) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

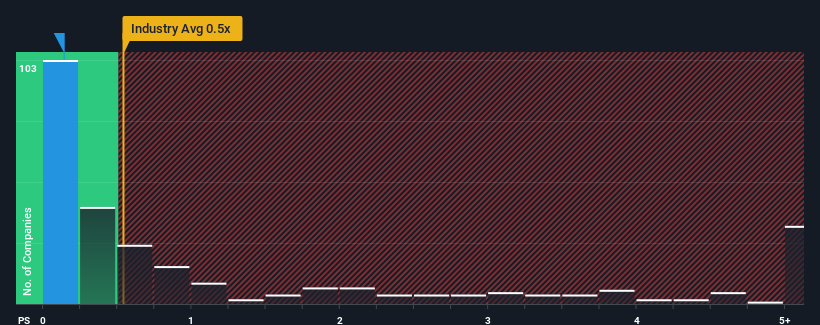

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Huijing Holdings' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Huijing Holdings

What Does Huijing Holdings' Recent Performance Look Like?

Huijing Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Huijing Holdings will help you shine a light on its historical performance.How Is Huijing Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Huijing Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 82% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 4.7% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Huijing Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Huijing Holdings' P/S

Huijing Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Huijing Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 3 warning signs for Huijing Holdings you should be aware of, and 2 of them are significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Huijing Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9968

Huijing Holdings

An investment holding company, engages in the property development and investment activities in the People’s Republic of China.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives