- Hong Kong

- /

- Real Estate

- /

- SEHK:800

Optimism around A8 New Media Group (HKG:800) delivering new earnings growth may be shrinking as stock declines 19% this past week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in A8 New Media Group Limited (HKG:800) have tasted that bitter downside in the last year, as the share price dropped 48%. That falls noticeably short of the market decline of around 8.7%. On the bright side, the stock is actually up 7.0% in the last three years. The last week also saw the share price slip down another 19%.

With the stock having lost 19% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for A8 New Media Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

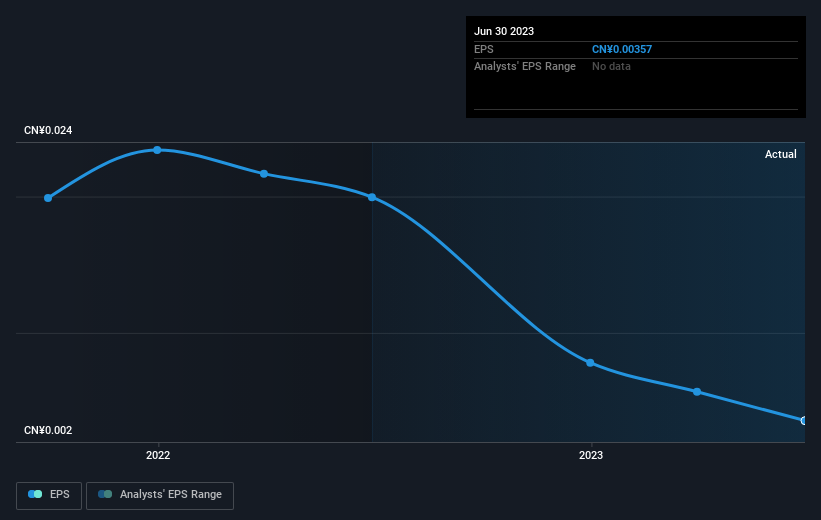

Unhappily, A8 New Media Group had to report a 82% decline in EPS over the last year. The share price fall of 48% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into A8 New Media Group's key metrics by checking this interactive graph of A8 New Media Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 8.7% in the twelve months, A8 New Media Group shareholders did even worse, losing 48%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - A8 New Media Group has 3 warning signs we think you should be aware of.

But note: A8 New Media Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:800

A8 New Media Group

An investment holding company, engages in the property investment and cultural businesses primarily in the People’s Republic of China.

Flawless balance sheet with acceptable track record.