- Hong Kong

- /

- Real Estate

- /

- SEHK:75

Y. T. Realty Group (HKG:75) shareholders are up 71% this past week, but still in the red over the last five years

Y. T. Realty Group Limited (HKG:75) shareholders are doubtless heartened to see the share price bounce 71% in just one week. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 76%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

While the stock has risen 71% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Y. T. Realty Group

Y. T. Realty Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Y. T. Realty Group grew its revenue at 71% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 12% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

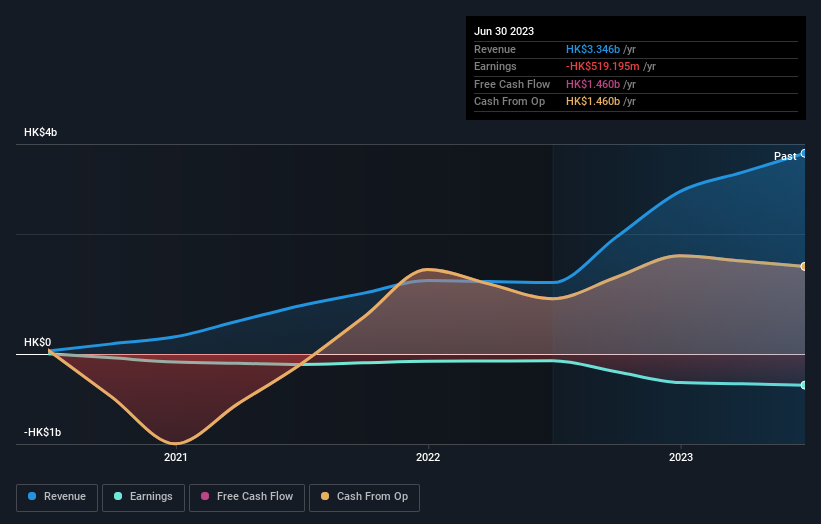

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Y. T. Realty Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that Y. T. Realty Group shares lost 3.2% throughout the year, that wasn't as bad as the market loss of 9.7%. What is more upsetting is the 12% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand Y. T. Realty Group better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Y. T. Realty Group (including 3 which make us uncomfortable) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:75

Y. T. Realty Group

An investment holding company, engages in the property investment, development, and trading activities in Hong Kong, the United Kingdom, and Mainland China.

Good value with mediocre balance sheet.