- China

- /

- Metals and Mining

- /

- SHSE:600725

3 Asian Penny Stocks With Market Caps Over US$2B

Reviewed by Simply Wall St

As global markets face a mix of challenges, including concerns over AI spending and economic uncertainties, investors are increasingly looking towards diverse opportunities across regions like Asia. Despite their historical connotations, penny stocks remain an intriguing area for those interested in smaller or newer companies with potential for growth. This article explores three Asian penny stocks that combine robust financials with the possibility of significant returns, offering a chance to uncover hidden value in quality investments.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.84 | HK$2.31B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.54 | HK$952.52M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.12 | SGD453.92M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.98 | THB2.99B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.099 | SGD51.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.38 | SGD13.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.03 | HK$2.77B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.40 | THB8.89B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 945 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

K. Wah International Holdings (SEHK:173)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: K. Wah International Holdings Limited is an investment holding company involved in property development and investment in Hong Kong and Mainland China, with a market cap of approximately HK$7.41 billion.

Operations: The company's revenue primarily comes from property development in Mainland China, which generated HK$5.91 billion, followed by property investment at HK$623.61 million and property development in Hong Kong at HK$410.53 million.

Market Cap: HK$7.41B

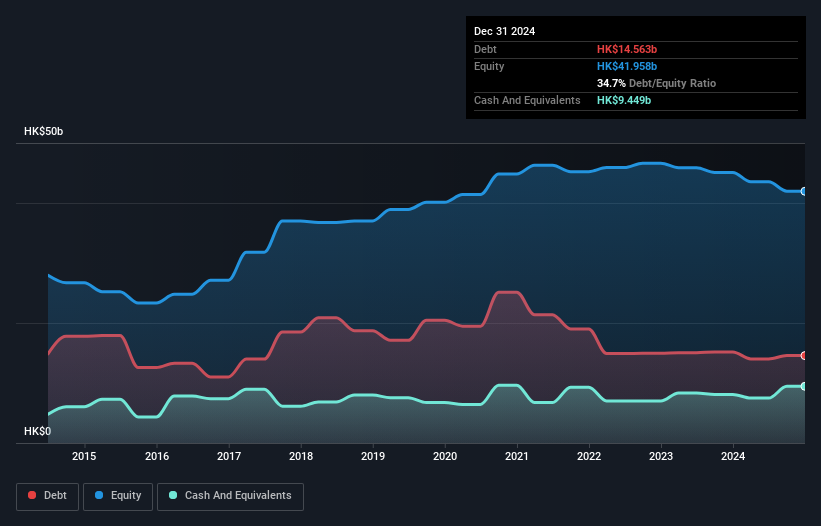

K. Wah International Holdings, with a market cap of HK$7.41 billion, faces challenges typical of penny stocks, such as declining earnings and profit margins. Recent half-year results show sales at HK$1.05 billion and net income at HK$113.9 million, both down from the previous year. Despite a satisfactory net debt to equity ratio of 11.1% and well-covered debt by operating cash flow, the company struggles with low return on equity (0.7%) and an unstable dividend history, recently decreasing its interim dividend to HKD 0.02 per share for 2025's first half-year period while being added to the S&P Global BMI Index in September 2025.

- Click here to discover the nuances of K. Wah International Holdings with our detailed analytical financial health report.

- Evaluate K. Wah International Holdings' prospects by accessing our earnings growth report.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.88 billion.

Operations: The company generates revenue of SGD1.53 billion from its supermarket operations selling consumer goods.

Market Cap: SGD3.88B

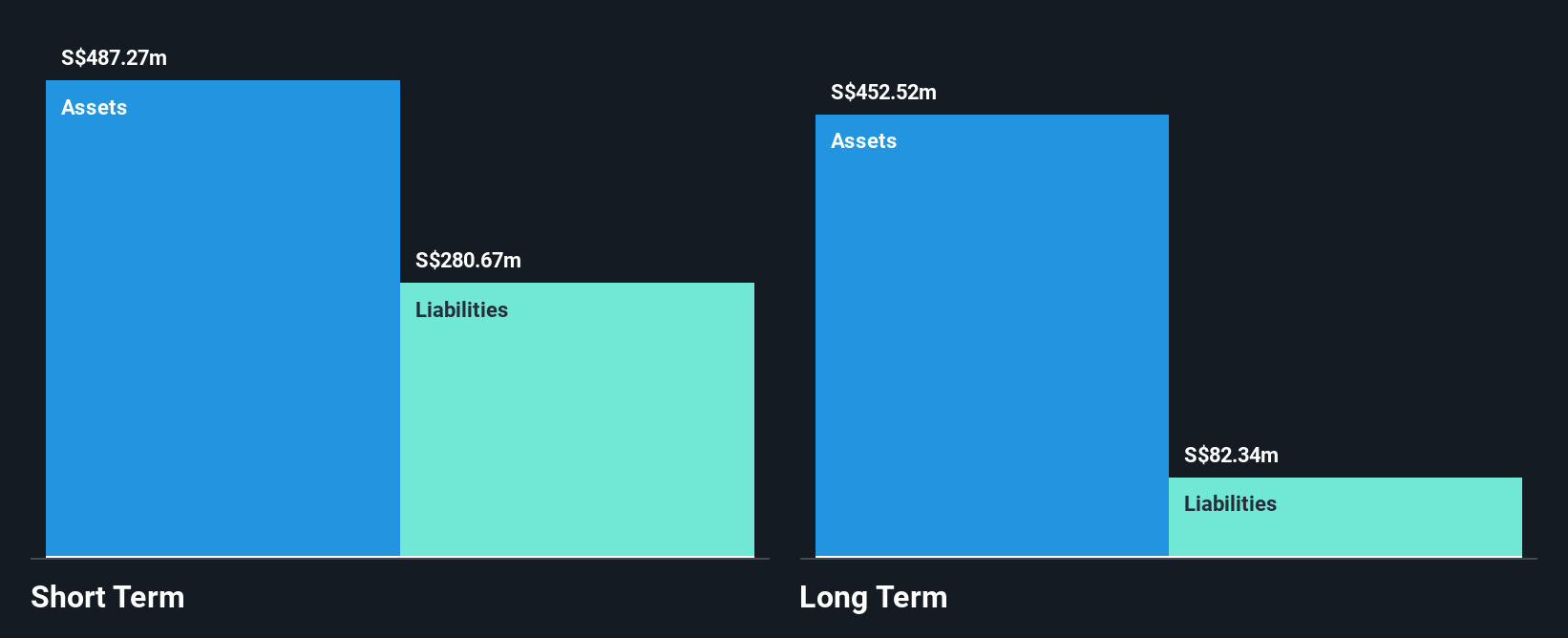

Sheng Siong Group Ltd, with a market cap of SGD3.88 billion, reported robust financial performance for the third quarter of 2025, achieving sales of SGD415.51 million and net income of SGD43.75 million, both up from the previous year. The company maintains a strong balance sheet with no debt and high-quality earnings. Its experienced management team supports stable operations, while short-term assets comfortably cover liabilities. However, profit margins have slightly declined to 9.4% from 10.1% last year, and its earnings growth rate has not outpaced the broader Consumer Retailing industry over the past year despite stable shareholding without dilution.

- Jump into the full analysis health report here for a deeper understanding of Sheng Siong Group.

- Assess Sheng Siong Group's future earnings estimates with our detailed growth reports.

Yunnan Yunwei (SHSE:600725)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yunnan Yunwei Company Limited operates in China, focusing on the production and operation of coal coke and chemical products, with a market cap of CN¥4.89 billion.

Operations: Yunnan Yunwei Company Limited has not reported any specific revenue segments.

Market Cap: CN¥4.89B

Yunnan Yunwei Company Limited, with a market cap of CN¥4.89 billion, faces challenges typical for penny stocks, including unprofitability and increasing losses over the past five years at a rate of 71.1% annually. Despite this, the company has managed to maintain a stable cash runway exceeding three years due to its free cash flow position and more cash than debt. Recent earnings reports show declining sales from CN¥550.82 million to CN¥442.74 million year-on-year and an increased net loss from CN¥9.11 million to CN¥17.32 million, highlighting ongoing financial difficulties amid management changes with short tenures impacting strategic direction stability.

- Click to explore a detailed breakdown of our findings in Yunnan Yunwei's financial health report.

- Understand Yunnan Yunwei's track record by examining our performance history report.

Turning Ideas Into Actions

- Embark on your investment journey to our 945 Asian Penny Stocks selection here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600725

Yunnan Yunwei

Engages in the production and operation of coal coke and chemical products in China.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives