Stock Analysis

- Hong Kong

- /

- Real Estate

- /

- SEHK:160

Optimism around Hon Kwok Land Investment Company (HKG:160) delivering new earnings growth may be shrinking as stock declines 10% this past week

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the Hon Kwok Land Investment Company, Limited (HKG:160) share price dropped 65% in the last half decade. That is extremely sub-optimal, to say the least. And some of the more recent buyers are probably worried, too, with the stock falling 30% in the last year. More recently, the share price has dropped a further 20% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Hon Kwok Land Investment Company

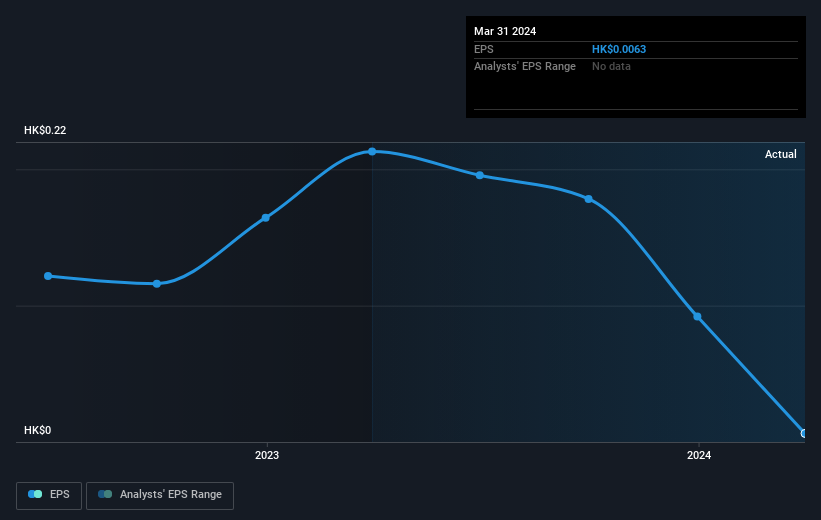

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Hon Kwok Land Investment Company's earnings per share (EPS) dropped by 67% each year. The impact of extraordinary items helps explain this. The share price decline of 19% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. The high P/E ratio of 218.98 suggests that shareholders believe earnings will grow in the years ahead.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Hon Kwok Land Investment Company's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Hon Kwok Land Investment Company's TSR for the last 5 years was -57%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Hon Kwok Land Investment Company shareholders are down 25% for the year (even including dividends), but the market itself is up 5.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Hon Kwok Land Investment Company better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Hon Kwok Land Investment Company (at least 2 which are significant) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Hon Kwok Land Investment Company is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Hon Kwok Land Investment Company is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:160

Hon Kwok Land Investment Company

An investment holding company, engages in the property development, investment, and related activities in Hong Kong and Mainland China.

Medium and fair value.