Top SEHK Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, the Hong Kong market has not been immune to the broader volatility, experiencing its share of declines amid weak corporate earnings and mixed economic data. In this environment, investors often seek out growth companies with high insider ownership as these stocks can offer potential stability and confidence due to significant insider stakes. Identifying such companies can be particularly appealing in uncertain times, as high insider ownership often indicates that those who know the business best have substantial skin in the game.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.9% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Fenbi (SEHK:2469) | 31.2% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 69.8% |

| Adicon Holdings (SEHK:9860) | 22.4% | 31.2% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 93.4% |

Here we highlight a subset of our preferred stocks from the screener.

Pacific Textiles Holdings (SEHK:1382)

Simply Wall St Growth Rating: ★★★★★☆

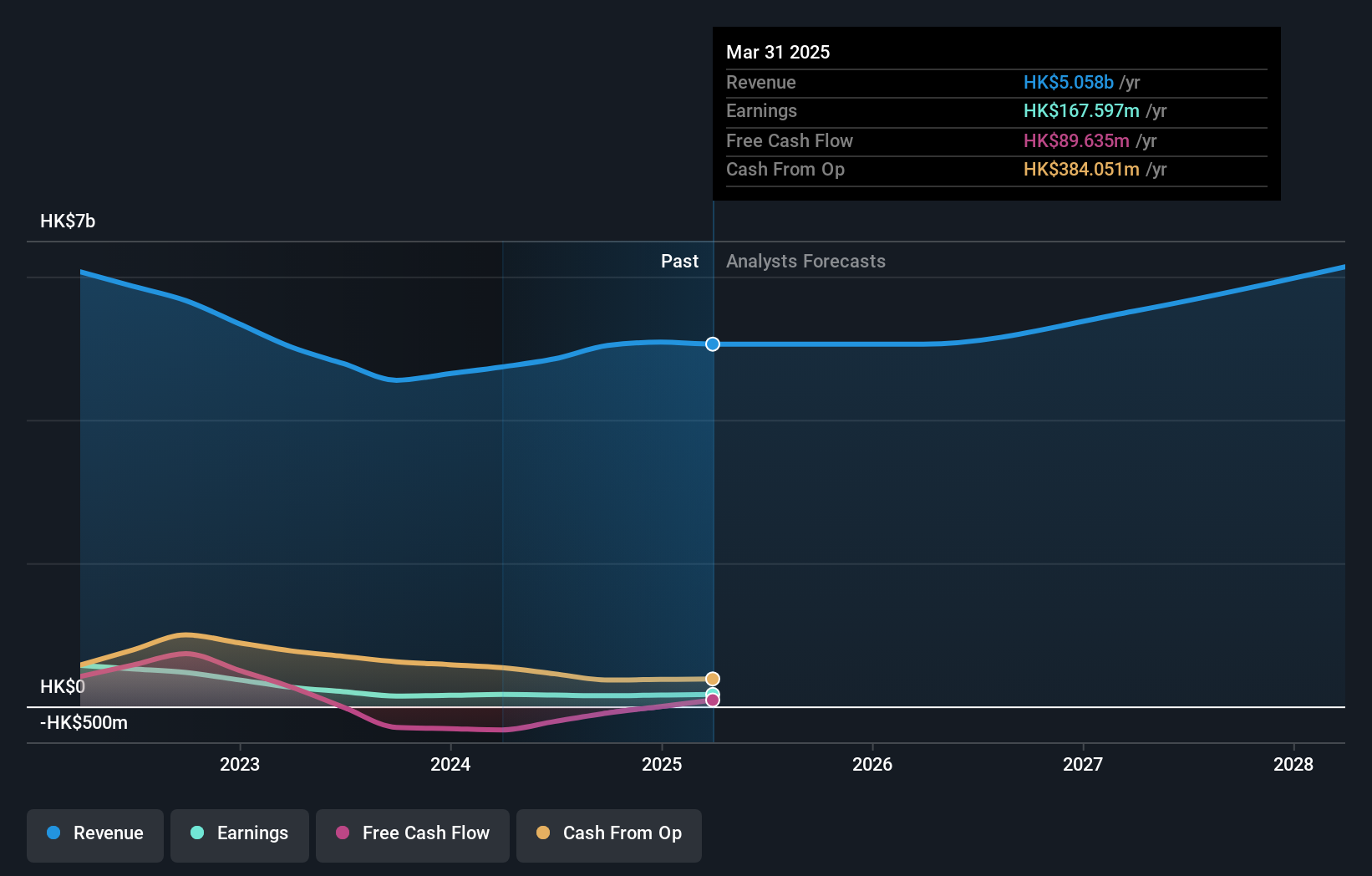

Overview: Pacific Textiles Holdings Limited manufactures and trades textile products across various regions including China, Vietnam, Bangladesh, Hong Kong, and internationally with a market cap of HK$2.09 billion.

Operations: The company's revenue segment comprises HK$4.67 billion from the manufacturing and trading of textile products.

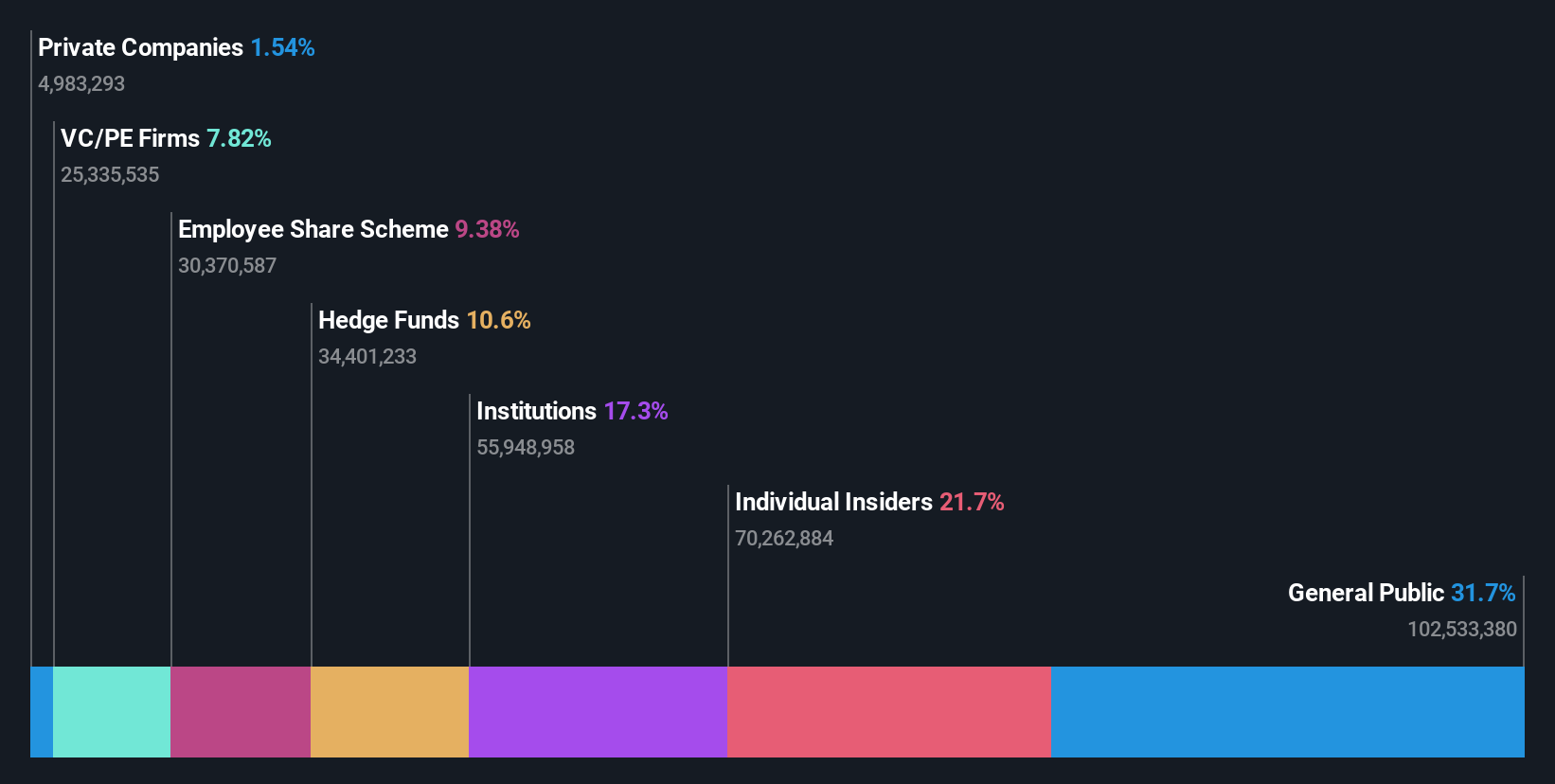

Insider Ownership: 11.2%

Revenue Growth Forecast: 12% p.a.

Pacific Textiles Holdings is forecast to achieve significant earnings growth of 37.7% annually, outpacing the broader Hong Kong market. Despite a recent decline in profit margins from 5.4% to 3.6%, the company’s revenue is expected to grow at 12% per year, faster than the market's average of 7.4%. Trading at nearly half its estimated fair value, it has substantial insider ownership and recently updated its corporate bylaws for regulatory compliance and efficiency improvements.

- Get an in-depth perspective on Pacific Textiles Holdings' performance by reading our analyst estimates report here.

- The analysis detailed in our Pacific Textiles Holdings valuation report hints at an deflated share price compared to its estimated value.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Simply Wall St Growth Rating: ★★★★★☆

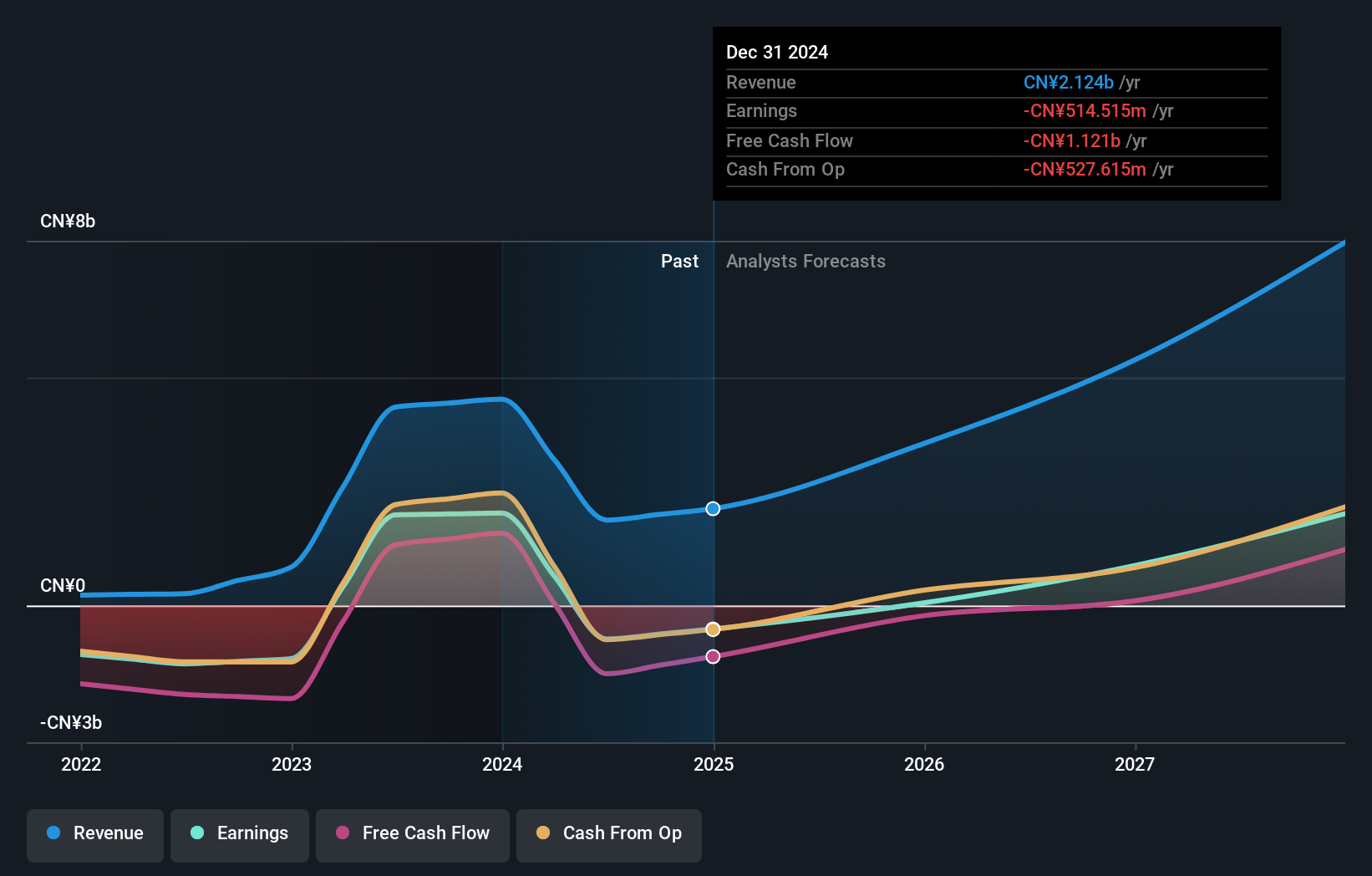

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company that supplies neuro- and peripheral-vascular interventional devices in China and internationally, with a market cap of HK$3.61 billion.

Operations: Revenue from sales of neurovascular and peripheral-vascular interventional surgical devices was CN¥663.61 million.

Insider Ownership: 18.7%

Revenue Growth Forecast: 23.8% p.a.

Zylox-Tonbridge Medical Technology is forecast to achieve impressive annual earnings growth of 69.8%, significantly outpacing the Hong Kong market. With revenue expected to grow at 23.8% per year, the company recently became profitable, reporting CNY 68.87 million in net income for H1 2024. Trading at a substantial discount to its estimated fair value, Zylox-Tonbridge has initiated a share repurchase program aimed at enhancing net assets and earnings per share.

- Dive into the specifics of Zylox-Tonbridge Medical Technology here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Zylox-Tonbridge Medical Technology's current price could be quite moderate.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc., a biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$48.23 billion.

Operations: The company's revenue segment primarily focuses on the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion.

Insider Ownership: 20.5%

Revenue Growth Forecast: 32.8% p.a.

Akeso is forecast to achieve robust revenue growth of 32.8% per year, outpacing the Hong Kong market. Despite a recent net loss of CNY 238.59 million for H1 2024, the company is expected to become profitable within three years. Insider ownership remains strong, and Akeso's innovative PD-1/VEGF bispecific antibody ivonescimab has shown significant clinical value with multiple priority review approvals in China, positioning it well for future growth in oncology treatments.

- Take a closer look at Akeso's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Akeso is trading beyond its estimated value.

Seize The Opportunity

- Explore the 47 names from our Fast Growing SEHK Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1382

Pacific Textiles Holdings

Manufactures and trades in textile products in the People’s Republic of China, Vietnam, Bangladesh, Hong Kong, Indonesia, Sri Lanka, Cambodia, the United States, Jordan, Africa, Haiti, India, rest of Asia, and internationally.

High growth potential with excellent balance sheet.