- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

High Growth Tech Stocks To Watch In Hong Kong This September 2024

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14% recently. Against this backdrop, identifying high growth tech stocks becomes crucial for investors looking to capitalize on innovation and market momentum in a dynamic environment like Hong Kong's.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Joy Spreader Group | 35.36% | 107.63% | ★★★★★☆ |

| Akeso | 32.52% | 55.14% | ★★★★★★ |

| Cowell e Holdings | 31.40% | 35.53% | ★★★★★★ |

| Innovent Biologics | 21.24% | 59.84% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 9.08% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SUNeVision Holdings Ltd., with a market cap of HK$13.48 billion, is an investment holding company that provides data centre and IT facility services in Hong Kong.

Operations: The company generates revenue primarily from its data centre and IT facility services, amounting to HK$2.46 billion, and from its Extra-Low Voltage (ELV) and IT systems segment, which contributes HK$213.03 million.

SUNeVision Holdings is poised for notable growth, with its revenue forecasted to increase by 15.6% annually, outpacing the Hong Kong market's 7.5% rate. The company's earnings are expected to grow at 13.6% per year, suggesting a robust upward trajectory compared to the market's 10.9%. Despite a modest earnings growth of just 0.2% last year, SUNeVision has committed significant resources towards innovation and development, reflected in their R&D expenses which have seen an uptick recently. This strategic focus on R&D positions them well within the competitive tech landscape in Hong Kong. Recent updates include proposed amendments to their memorandum and articles of association aimed at enhancing corporate governance and shareholder communication through electronic means and treasury share management. Additionally, the company has recommended a final dividend of HKD 0.112 per share for FY2024, signaling confidence in its financial health despite minor board changes with two directors not seeking re-election to pursue other commitments.

- Click here to discover the nuances of SUNeVision Holdings with our detailed analytical health report.

Explore historical data to track SUNeVision Holdings' performance over time in our Past section.

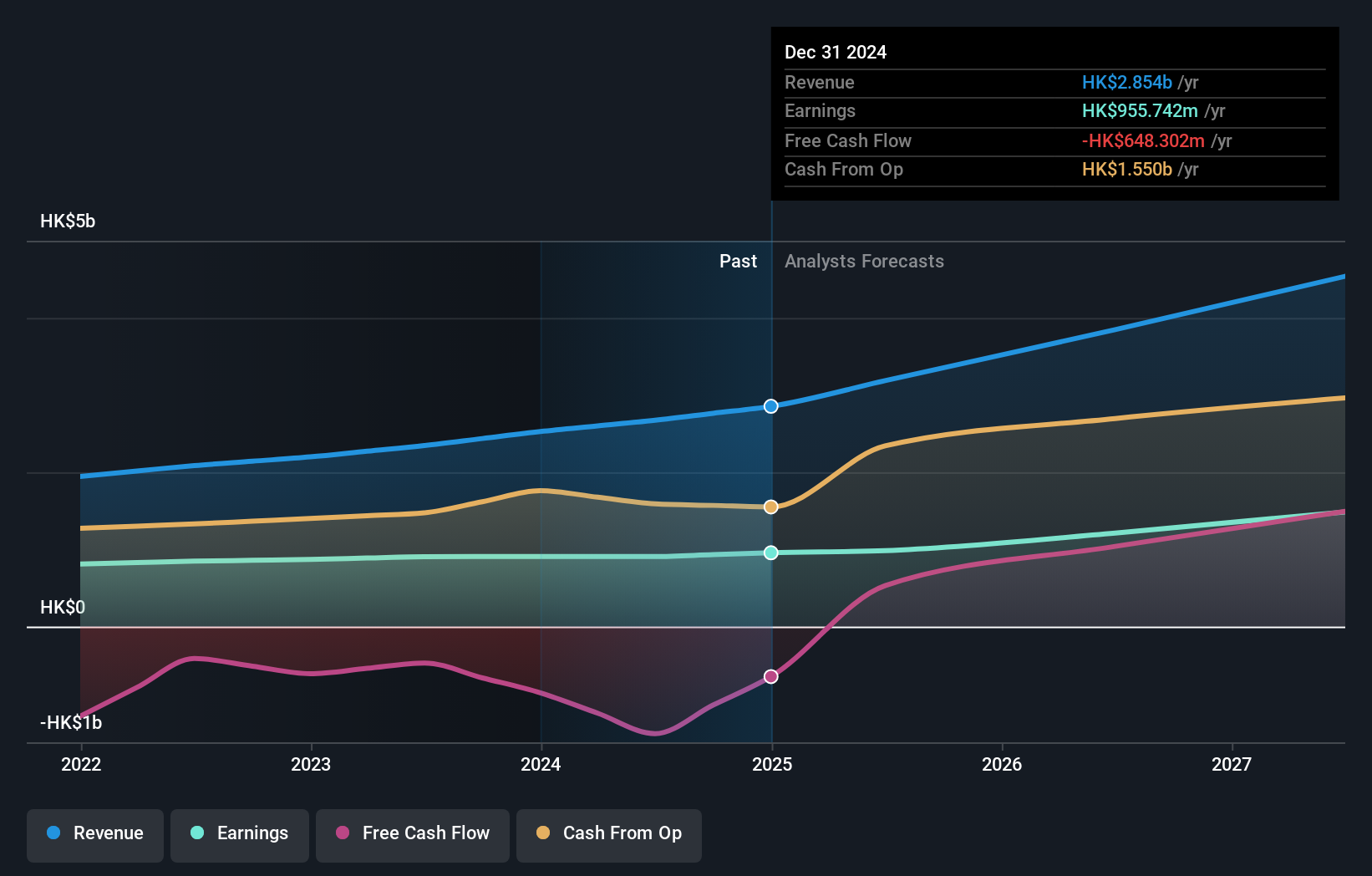

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company that designs, researches, develops, manufactures, and sells optical and optical-related products as well as scientific instruments, with a market cap of HK$52.87 billion.

Operations: Sunny Optical Technology (Group) generates revenue primarily from three segments: Optical Components (CN¥12.32 billion), Optoelectronic Products (CN¥25.10 billion), and Optical Instruments (CN¥0.59 billion). The company focuses on designing, developing, manufacturing, and selling these products.

Sunny Optical Technology (Group) has demonstrated impressive growth, with earnings surging by 17.2% over the past year, outpacing the Electronic industry’s 11.7%. The company's revenue is forecast to grow at a rate of 10.2% annually, surpassing Hong Kong's market average of 7.5%. Their R&D expenses have seen a significant uptick, reflecting their commitment to innovation and maintaining competitive advantage; this strategic focus positions them well for future growth as they continue to enhance their product offerings in smartphone optics and camera modules.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$43.55 billion.

Operations: The company focuses on the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion in revenue from these activities. The primary revenue stream is derived from antibody drugs.

Akeso's revenue growth is projected at 32.5% annually, significantly outpacing the Hong Kong market's 7.5%. The company has invested heavily in R&D, with expenses reaching CNY 1.02 billion last year, underscoring their commitment to innovation in biopharmaceuticals. Despite a net loss of CNY 238.59 million for H1 2024, Akeso's ivonescimab has shown promising results in clinical trials for non-small cell lung cancer, potentially setting new standards in cancer treatment and driving future profitability.

- Click to explore a detailed breakdown of our findings in Akeso's health report.

Understand Akeso's track record by examining our Past report.

Taking Advantage

- Dive into all 47 of the SEHK High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

Flawless balance sheet with reasonable growth potential.