Stock Analysis

- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

High Growth Tech Stocks in Hong Kong to Watch This September 2024

Reviewed by Simply Wall St

As global markets experience mixed performance and Hong Kong's Hang Seng Index shows a notable gain, investors are increasingly looking towards high-growth tech stocks in the region. In this context, identifying companies with strong fundamentals, innovative products, and robust market positions becomes crucial for navigating the current economic landscape.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.23% | ★★★★★★ |

| Akeso | 32.46% | 55.03% | ★★★★★★ |

| Innovent Biologics | 21.31% | 59.83% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 9.08% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

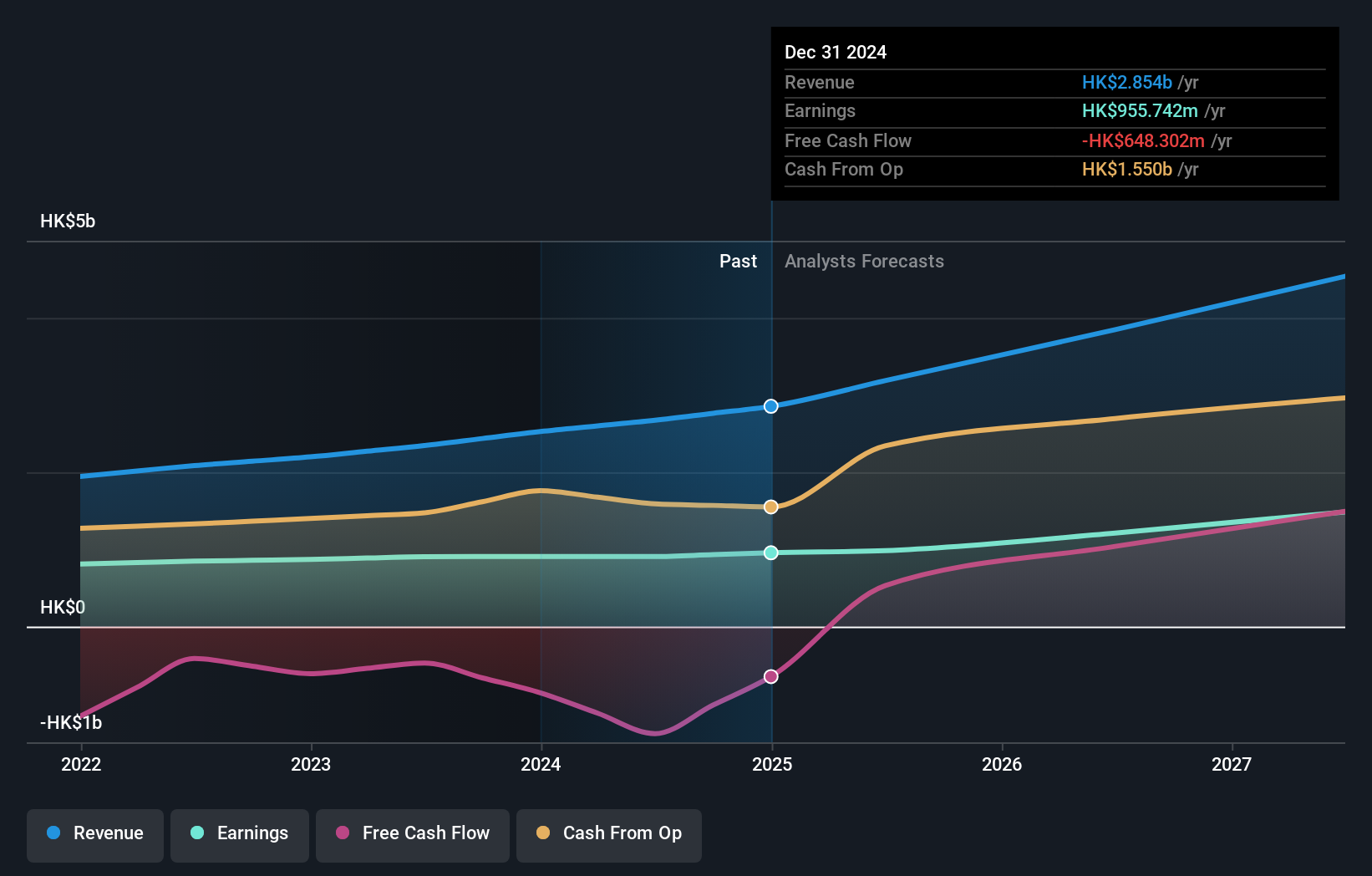

Overview: SUNeVision Holdings Ltd., an investment holding company, provides data centre and information technology (IT) facility services in Hong Kong, with a market cap of HK$13.68 billion.

Operations: The company's primary revenue streams are derived from its data centre and IT facilities, which generated HK$2.46 billion, and its extra-low voltage (ELV) and IT systems segment, contributing HK$213.03 million.

SUNeVision Holdings has shown steady growth, with earnings increasing by 0.2% over the past year and revenue reaching HKD 2.67 billion, up from HKD 2.35 billion previously. The company's R&D expenses are integral to its strategy, contributing to a forecasted annual earnings growth of 13.6%, outpacing the Hong Kong market average of 10.9%. Recent board changes and dividend affirmations indicate a focus on shareholder value and corporate governance improvements, aligning with industry trends towards digital transformation and data center expansion in Asia.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

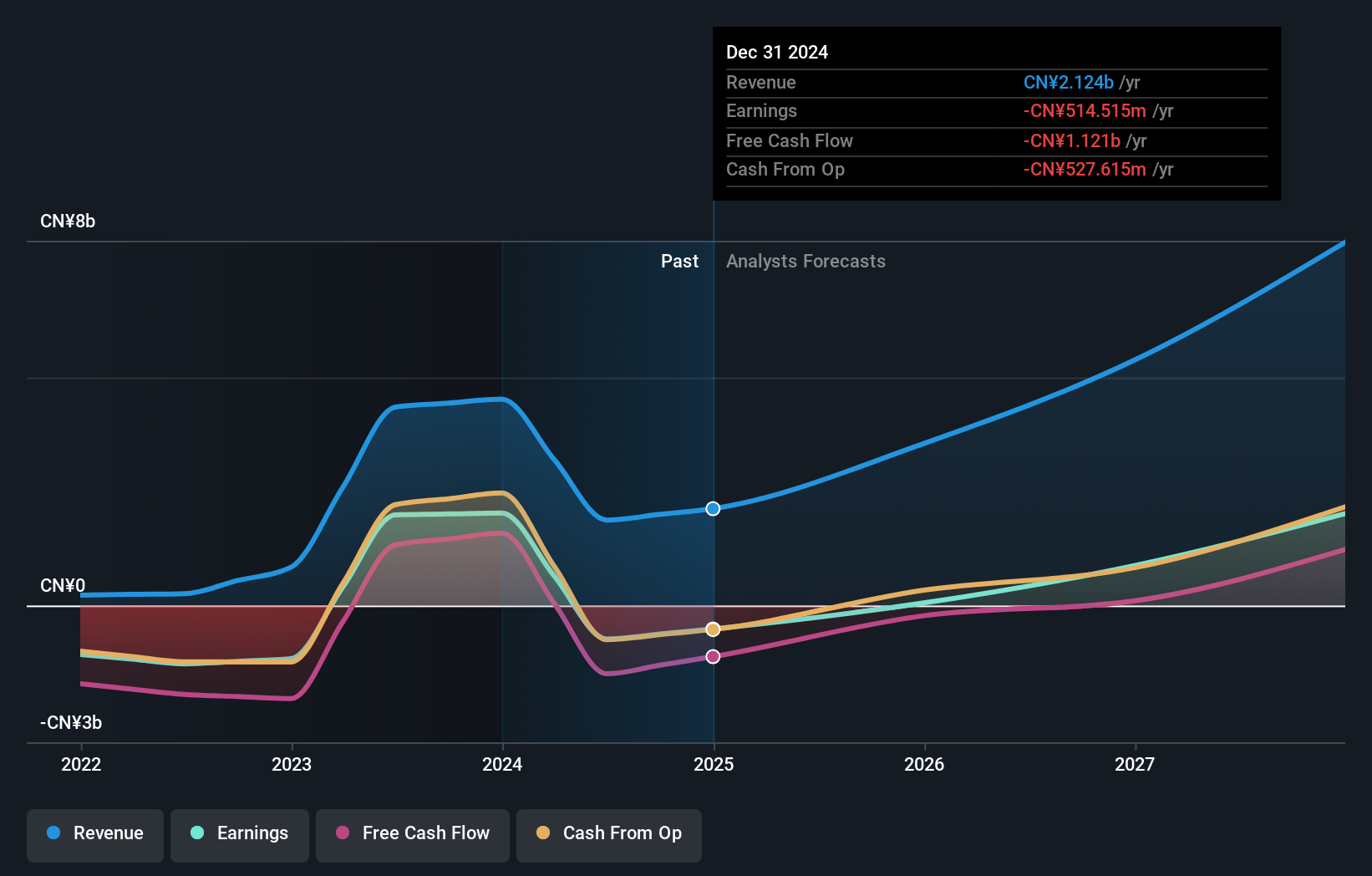

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company involved in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments, with a market cap of HK$52.76 billion.

Operations: Sunny Optical Technology (Group) Company Limited generates revenue primarily from three segments: Optical Components (CN¥12.32 billion), Optoelectronic Products (CN¥25.10 billion), and Optical Instruments (CN¥0.59 billion).

Sunny Optical Technology (Group) has demonstrated robust growth, with half-year sales reaching CNY 18.86 billion, up from CNY 14.28 billion a year ago. Net income surged to CNY 1.08 billion from CNY 436.71 million, reflecting a significant recovery in the smartphone market and an improved product mix. The company's R&D expenses play a crucial role in its competitive edge, contributing to forecasted annual earnings growth of 20.9%, surpassing the Hong Kong market's average of 10.9%. With revenue expected to grow at an annual rate of 10.2%, Sunny Optical is well-positioned within the high-growth tech landscape in Hong Kong.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$42.47 billion.

Operations: The company generates revenue primarily from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1874.14 million. The focus is on antibody drugs within the biopharmaceutical sector.

Akeso's recent earnings report shows a significant shift, with revenue dropping to CNY 1.02 billion from CNY 3.68 billion last year and a net loss of CNY 238.59 million compared to a net income of CNY 2.53 billion previously. Despite these figures, the company is heavily investing in R&D, with expenses contributing to its innovative pipeline, including ivonescimab's promising Phase III trials for lung cancer treatment. Revenue is forecasted to grow at an impressive annual rate of 32.5%, while earnings are expected to increase by 55% per year over the next three years, indicating robust potential despite current challenges.

- Get an in-depth perspective on Akeso's performance by reading our health report here.

Examine Akeso's past performance report to understand how it has performed in the past.

Taking Advantage

- Embark on your investment journey to our 47 SEHK High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.