Akeso (SEHK:9926): Assessing Valuation Following Latest Share Price Movement

Reviewed by Simply Wall St

See our latest analysis for Akeso.

Akeso’s share price has surged impressively year to date, reflecting renewed optimism among investors despite a recent dip over the past month. With a 63% total shareholder return over the past year and an even stronger long-term record, it is clear momentum is building for the company as it continues to attract attention after today’s move.

Curious what other fast movers are capturing investor interest right now? Broaden your research and discover See the full list for free.

Given Akeso’s remarkable run and strong long-term returns, the key question now is whether the stock’s price still offers value, or if the market has already accounted for the company’s future growth prospects. Is there still a buying opportunity here?

Most Popular Narrative: 33.1% Undervalued

With the narrative fair value set at HK$172.00 and Akeso’s last close price at HK$115.10, the price remains well below the most widely followed valuation. Investors are taking notice of the strong upside potential reflected in this narrative, even after today’s significant share price move.

The collaboration with SUMMIT Therapeutics and the strategic partnership with Pfizer to combine ivonescimab with Pfizer's ADCs suggests expansion into new therapeutic areas and geographic markets, promising to impact earnings positively. The company's strong R&D pipeline, including advanced bispecific antibodies and ADC candidates, provides a foundation for long-term growth and sets the stage for potential increases in net margins as products move from development to commercialization.

Wondering why Akeso’s story commands such a high premium? The narrative hinges on bold pipeline bets and ambitious projections for rapid profit growth, not just steady gains. Want to unravel which blockbuster forecasts truly drive this target? The answer will surprise you.

Result: Fair Value of $172.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Akeso’s reliance on a few key drugs and ongoing operating losses could quickly shift its outlook if clinical or commercialization hurdles emerge.

Find out about the key risks to this Akeso narrative.

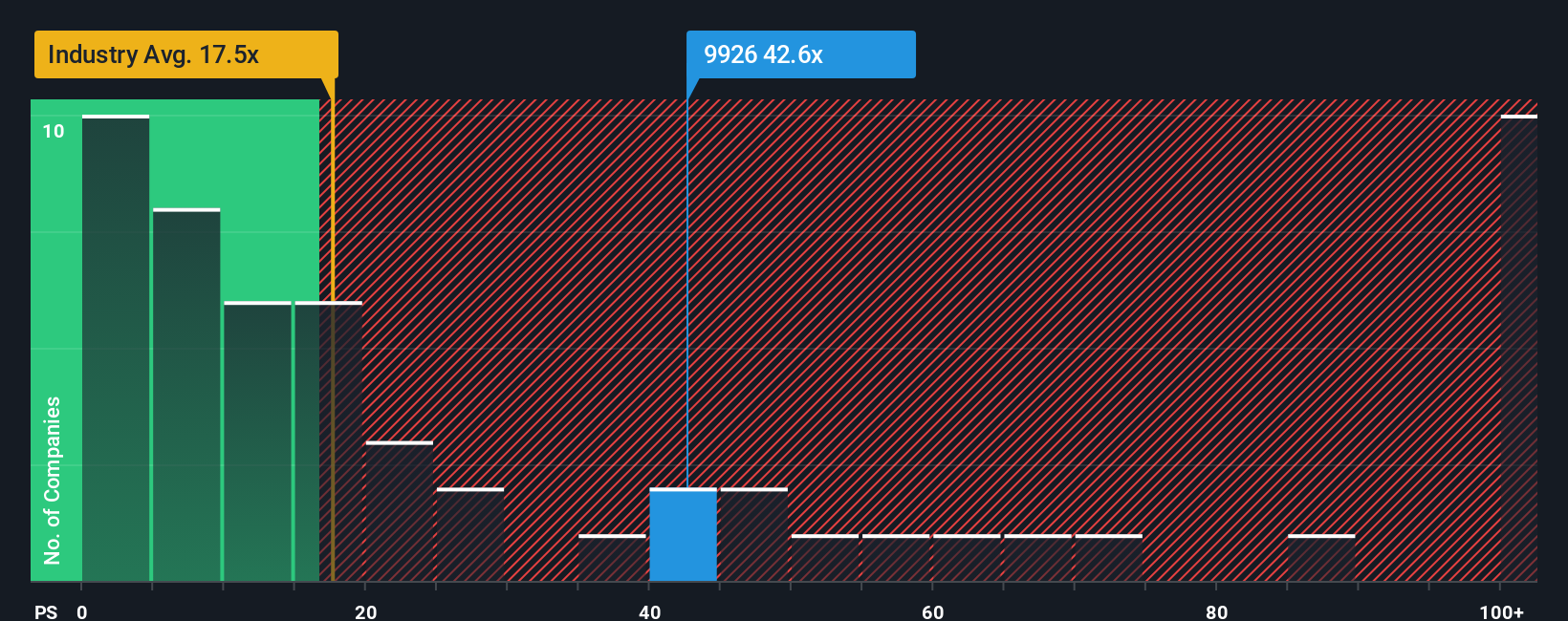

Another View: Market Ratio Signals a Premium

Looking at Akeso through the lens of its price-to-sales ratio paints a more cautious picture. The company's ratio stands at 38.7x, well above both the Hong Kong Biotechs industry average of 13.1x and its peer average of 24.2x. Even compared to the fair ratio of 19.4x, Akeso trades at a hefty premium. This elevated level might signal greater valuation risk to investors if expectations shift. Are the company’s future prospects truly strong enough to justify such a high bar?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Akeso Narrative

If you see the numbers differently or want to follow your own reasoning, you can quickly craft a personalized outlook using the data provided. Do it your way.

A great starting point for your Akeso research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investing Ideas?

Don't stop at one great opportunity. Smart investors always keep their options open, and the next big winner could be just a click away.

- Tap into technology's unstoppable momentum and seize potential by checking out these 25 AI penny stocks poised for breakthroughs in artificial intelligence.

- Get ahead of the curve on tomorrow's finance by selecting these 82 cryptocurrency and blockchain stocks leading innovation in digital assets and blockchain infrastructure.

- Unlock serious value possibilities now by finding these 870 undervalued stocks based on cash flows that the market may be overlooking for future gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives