Stock Analysis

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Sihuan Pharmaceutical Holdings Group Ltd. (HKG:460) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 75% drop in the share price over that period. And more recent buyers are having a tough time too, with a drop of 34% in the last year. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

With the stock having lost 8.6% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Sihuan Pharmaceutical Holdings Group

Given that Sihuan Pharmaceutical Holdings Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, Sihuan Pharmaceutical Holdings Group's revenue dropped 8.1% per year. That is not a good result. The share price fall of 21% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

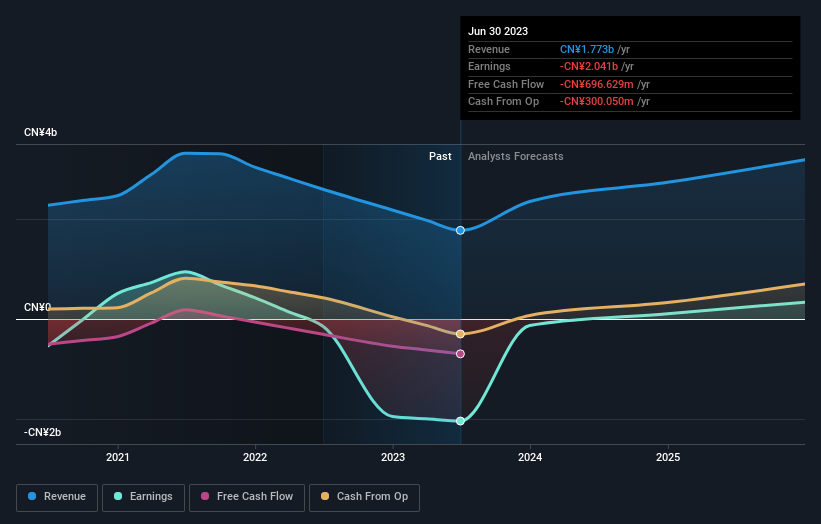

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Sihuan Pharmaceutical Holdings Group stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Sihuan Pharmaceutical Holdings Group's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Sihuan Pharmaceutical Holdings Group's TSR of was a loss of 69% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Sihuan Pharmaceutical Holdings Group shareholders are down 30% for the year. Unfortunately, that's worse than the broader market decline of 9.9%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Sihuan Pharmaceutical Holdings Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Sihuan Pharmaceutical Holdings Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sihuan Pharmaceutical Holdings Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:460

Sihuan Pharmaceutical Holdings Group

Sihuan Pharmaceutical Holdings Group Ltd., an investment holding company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical and medical aesthetic products in the People’s Republic of China.

High growth potential and fair value.