Abbisko Cayman Limited's (HKG:2256) 28% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Abbisko Cayman Limited (HKG:2256) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 188%.

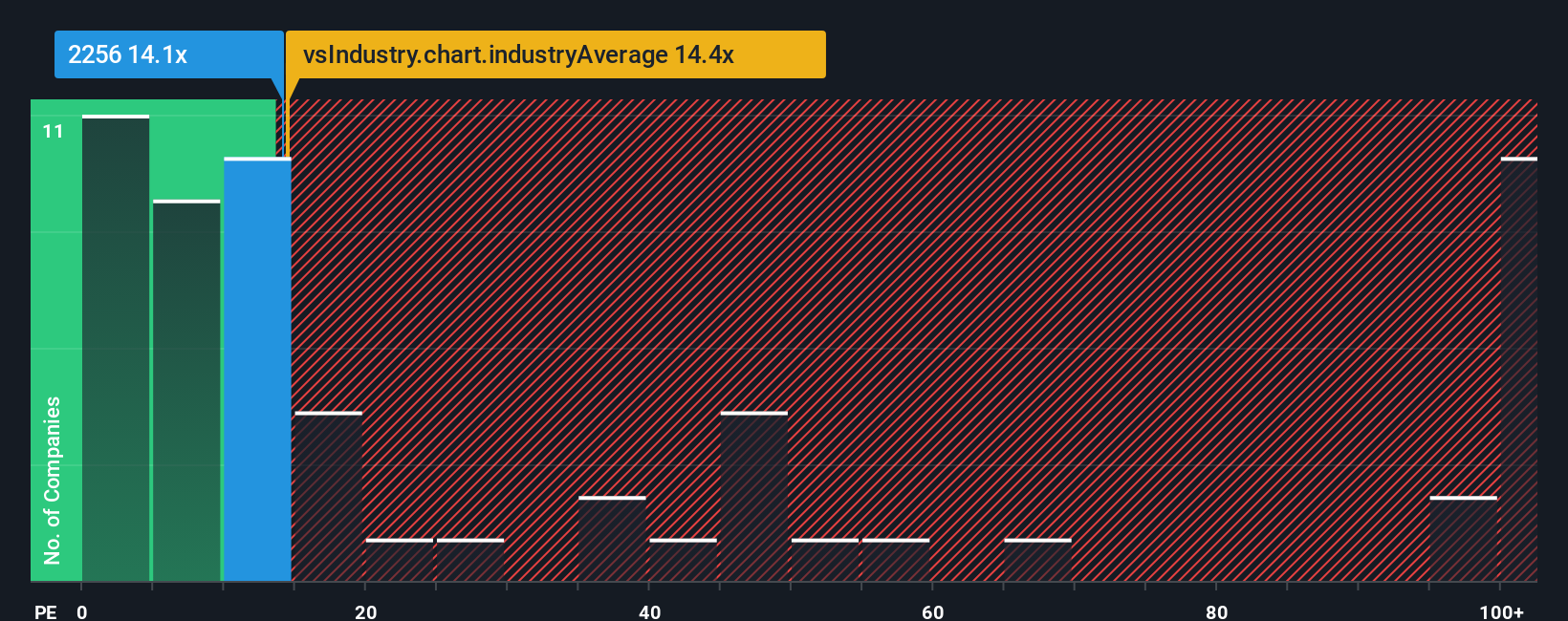

Although its price has dipped substantially, it's still not a stretch to say that Abbisko Cayman's price-to-sales (or "P/S") ratio of 14.1x right now seems quite "middle-of-the-road" compared to the Biotechs industry in Hong Kong, where the median P/S ratio is around 14.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Abbisko Cayman

How Has Abbisko Cayman Performed Recently?

Recent times haven't been great for Abbisko Cayman as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Abbisko Cayman's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Abbisko Cayman's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 0.7% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 92% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Abbisko Cayman's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Abbisko Cayman's P/S

With its share price dropping off a cliff, the P/S for Abbisko Cayman looks to be in line with the rest of the Biotechs industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Abbisko Cayman's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 1 warning sign for Abbisko Cayman you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2256

Abbisko Cayman

Engages in the research and development of pharmaceutical products in the People’s Republic of China and the European Union.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives