A Look at HBM Holdings (SEHK:2142) Valuation After Latest CAR-T Therapy and AI Collaboration Advances

Reviewed by Simply Wall St

HBM Holdings (SEHK:2142) has unveiled a new evaluation and license agreement with Umoja Biopharma, combining its in-house platforms with Umoja’s technology to pursue in vivo CAR-T therapies. This collaboration could expand HBM’s reach in advanced cell therapy.

See our latest analysis for HBM Holdings.

HBM Holdings has certainly been making waves beyond its latest tie-up with Umoja, rolling out a new generative AI antibody platform and forging strategic alliances in AI-driven biologics discovery. Despite a turbulent month for the share price, which saw a 1-month return of -23.73%, momentum has shifted sharply upward over the longer term. The company has reported a year-to-date price gain of over 534% and an astonishing 956% total shareholder return over the past year. These recent collaborations and outlier returns suggest that the market is recognizing HBM’s bold push into next-generation therapies, even as short-term volatility persists.

If all the biotech moves have you inspired, it could be worth checking what other companies are innovating in the space. See the full healthcare stocks list here: See the full list for free.

With shares surging nearly tenfold in a year, the question now is whether HBM Holdings’ rapid ascent leaves room for further upside, or if the market has already priced in its ambitious growth trajectory. Could this still be a buying opportunity?

Price-to-Earnings of 19.3x: Is it justified?

At the last close of HK$12.57, HBM Holdings trades on a price-to-earnings (P/E) ratio of 19.3x, which is significantly lower than the Asian Biotechs industry average.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of company earnings. This makes it a key reference for profit-generating biotechs. For HBM Holdings, this relatively modest multiple implies the market is skeptical of the company’s future growth or sees risks not present in peers.

However, compared to the Asian Biotechs industry average P/E of 42x and the peer average of 76.4x, HBM is trading at a substantial discount. According to the fair price-to-earnings ratio calculated for HBM, the stock is a bit expensive (19.3x versus a fair value of 16.6x), suggesting the market could still adjust as expectations evolve.

Explore the SWS fair ratio for HBM Holdings

Result: Price-to-Earnings of 19.3x (ABOUT RIGHT)

However, weak revenue and net income growth could dampen optimism if HBM fails to deliver on its ambitious biotech expansion plans.

Find out about the key risks to this HBM Holdings narrative.

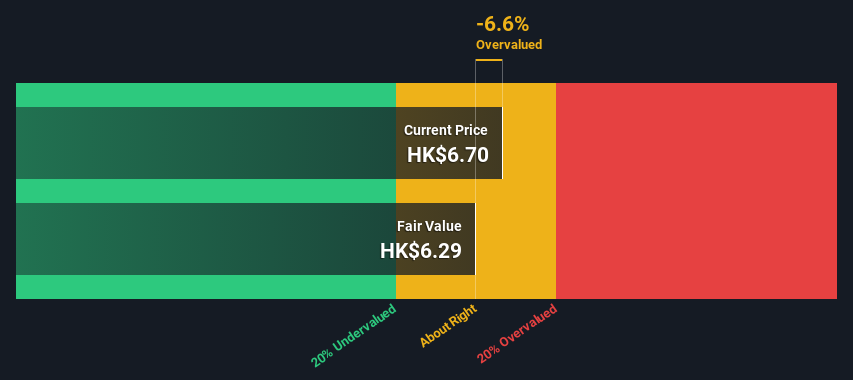

Another View: Our SWS DCF Model Weighs In

While the price-to-earnings ratio suggests HBM Holdings is priced a little above its fair ratio, our SWS DCF model comes to a more critical conclusion. It estimates the shares are trading well above intrinsic value, implying the market might be overly optimistic about the company’s future cash flows. Does this divergence signal caution for investors, or is the market right to look past near-term growth hurdles?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HBM Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HBM Holdings Narrative

If you see things differently, or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your HBM Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let standout opportunities slip through your fingers. Broaden your horizons and get fresh perspectives with these powerful investing tools from Simply Wall Street:

- Start building wealth with stocks offering strong yields and financial resilience by checking out these 17 dividend stocks with yields > 3% for unique dividend plays above 3%.

- Tap into a universe of innovation by scanning these 25 AI penny stocks to uncover companies leading game-changing developments in artificial intelligence.

- Find your edge with undervalued gems by using these 861 undervalued stocks based on cash flows, pinpointing stocks trading below what their cash flows suggest they’re truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HBM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2142

HBM Holdings

A biopharmaceutical company, engages in the discovery, development, and commercialization of antibody therapeutics focusing on immunology and oncology in Mainland China, the United States, Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives