Shanghai Junshi Biosciences (HKG:1877 investor three-year losses grow to 77% as the stock sheds HK$1.2b this past week

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) investors who have held the stock for three years as it declined a whopping 77%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 53%, so we doubt many shareholders are delighted. On top of that, the share price is down 9.1% in the last week.

With the stock having lost 9.1% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Shanghai Junshi Biosciences

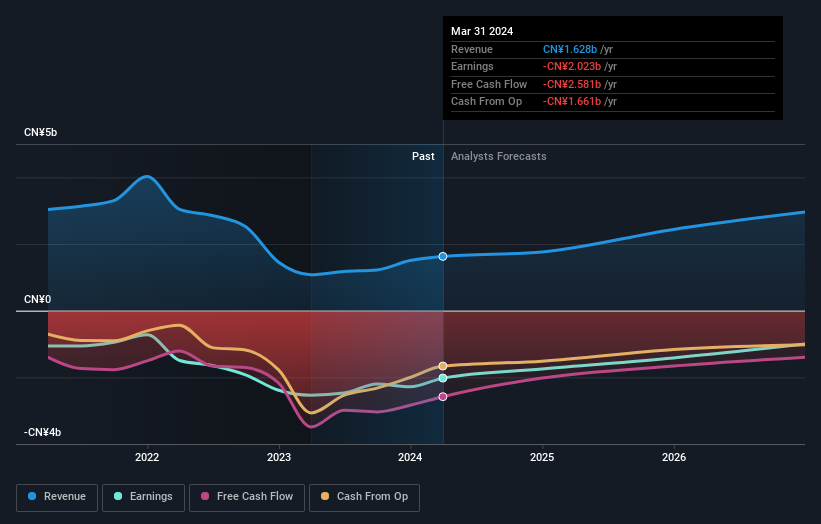

Shanghai Junshi Biosciences wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Shanghai Junshi Biosciences saw its revenue shrink by 37% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 21%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Shanghai Junshi Biosciences stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Shanghai Junshi Biosciences shareholders are down 53% for the year. Unfortunately, that's worse than the broader market decline of 2.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Shanghai Junshi Biosciences better, we need to consider many other factors. Even so, be aware that Shanghai Junshi Biosciences is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of oncology, metabolic, autoimmune, neurologic, nervous system, and infectious diseases in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.