As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, the Hong Kong market has shown resilience with the Hang Seng Index advancing. In this environment, identifying high-growth tech stocks becomes crucial, as these companies often benefit from favorable monetary policies and investor optimism.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 9.08% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.24% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China with a market cap of HK$70.87 billion.

Operations: Innovent Biologics generates revenue primarily through its biotechnology segment, amounting to CN¥6.21 billion. The company focuses on developing and commercializing monoclonal antibodies and other drug assets across various therapeutic areas in China.

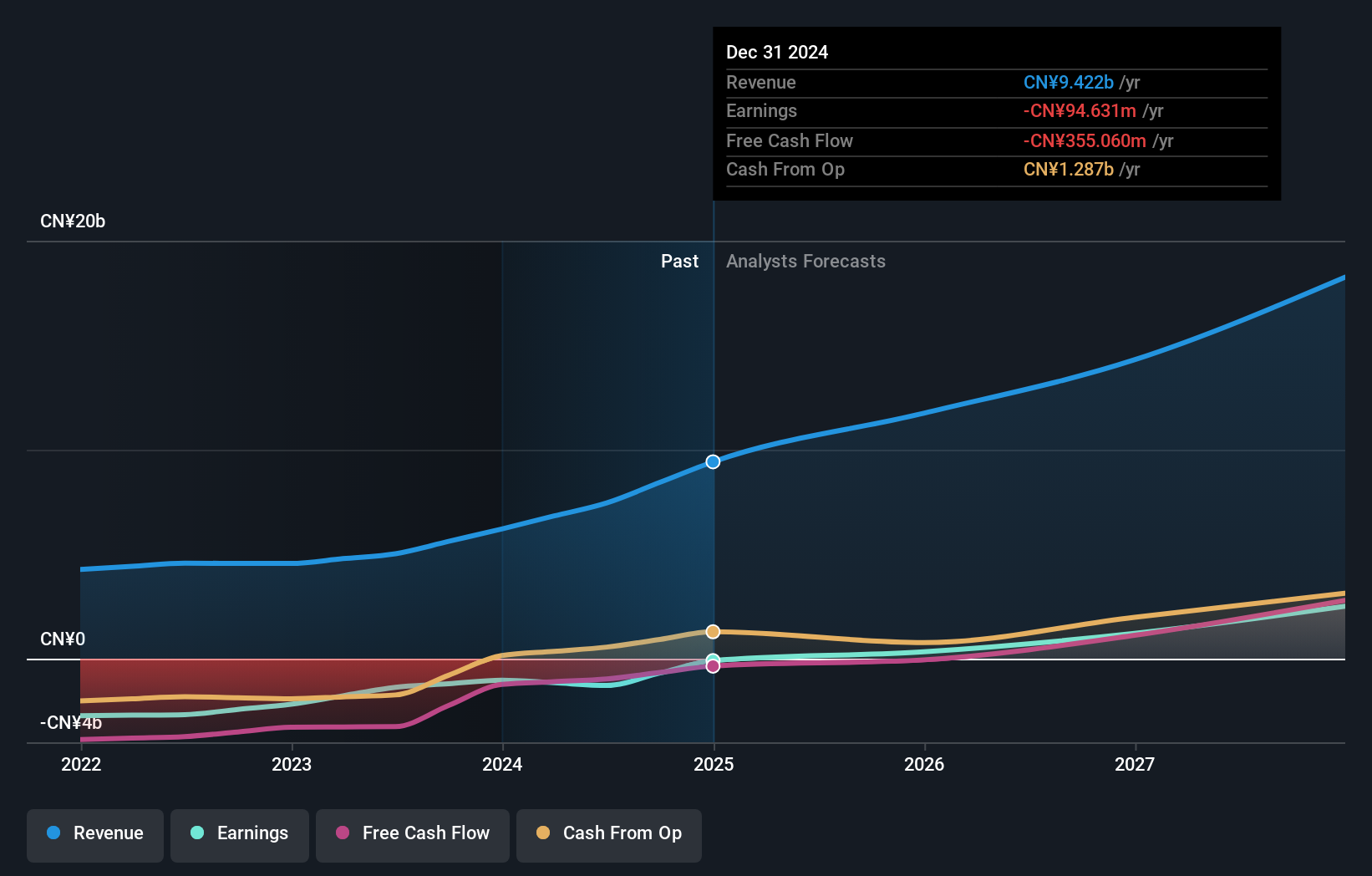

Innovent Biologics has demonstrated significant strides in its R&D efforts, with expenses accounting for 21.2% of revenue, highlighting a strong commitment to innovation. The recent approval of Dupert® (fulzerasib) by China's NMPA for advanced NSCLC patients with KRAS G12C mutation marks a critical milestone, potentially benefiting a large patient population. With earnings forecasted to grow at an impressive 50.78% annually and robust product revenue growth exceeding ¥2 billion in Q2 2024, Innovent is well-positioned within the high-growth tech landscape in Hong Kong.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc., an investment holding company, provides solutions for smart devices across various regions including Mainland China, Hong Kong SAR, Taiwan, other Asian countries, the United States, and Europe with a market cap of HK$38.59 billion.

Operations: AAC Technologies Holdings Inc. generates revenue primarily from five segments: Optics Products (CN¥4.07 billion), Acoustics Products (CN¥7.64 billion), Sensor and Semiconductor Products (CN¥0.92 billion), and Electromagnetic Drives and Precision Mechanics (CN¥8.28 billion). The company operates in various regions including Mainland China, Hong Kong SAR, Taiwan, other Asian countries, the United States, and Europe.

AAC Technologies Holdings has demonstrated robust growth, with H1 2024 sales reaching ¥11.25 billion, a notable increase from ¥9.22 billion the previous year. The company's net income surged to ¥537 million from ¥150 million, reflecting an 81.3% earnings growth over the past year and forecasted annual revenue growth of 12%. With R&D expenses constituting approximately 20.7% of revenue, AAC's commitment to innovation is evident in its focus on advanced acoustic components and precision manufacturing for major clients like Apple and Samsung.

- Unlock comprehensive insights into our analysis of AAC Technologies Holdings stock in this health report.

Learn about AAC Technologies Holdings' historical performance.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, provides a range of services including value-added services (VAS), online advertising, fintech, and business services in China and globally, with a market cap of HK$3.51 trillion.

Operations: Tencent generates revenue primarily from value-added services (VAS), online advertising, and fintech and business services, with VAS contributing CN¥302.28 billion and fintech and business services adding CN¥209.17 billion. The company's market cap stands at HK$3.51 trillion.

Tencent Holdings continues to be a formidable player in the tech sector, with its revenue projected to grow at 8.2% annually, outpacing the Hong Kong market's 7.3% growth rate. The company's earnings are forecasted to increase by 12.8% per year, reflecting strong performance relative to the broader market's 10.8%. Tencent’s commitment to innovation is underscored by substantial R&D expenses, which account for approximately ¥30 billion or about 15% of its revenue, driving advancements in AI and software solutions that cater to diverse segments from gaming to cloud services.

- Click here to discover the nuances of Tencent Holdings with our detailed analytical health report.

Explore historical data to track Tencent Holdings' performance over time in our Past section.

Where To Now?

- Dive into all 48 of the SEHK High Growth Tech and AI Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, develops and commercializes monoclonal antibodies and other drug assets in the fields of oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in the People’s Republic of China.

High growth potential with adequate balance sheet.