Despite recent volatility in global markets, the Hong Kong market has shown resilience, with the Hang Seng Index gaining 0.85% amidst broader economic uncertainties. This environment presents a unique opportunity to explore lesser-known stocks that may offer significant potential for growth. When considering stocks in such a dynamic market, it's essential to look for companies with strong fundamentals and innovative strategies that can thrive despite external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, with a market cap of HK$9.86 billion, is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company's net profit margin is currently at 15.23%.

Kinetic Development Group, a smaller player in Hong Kong's market, has shown mixed performance recently. The company repurchased shares in 2024 and announced a special dividend of HK$0.04 per share with payment on September 9, 2024. Its debt to equity ratio improved from 26.6% to 17.6% over five years, and interest payments are well covered by EBIT at 55.7x coverage. Despite high-quality earnings, it faced -22% earnings growth last year compared to the industry average of -6.8%.

YiChang HEC ChangJiang Pharmaceutical (SEHK:1558)

Simply Wall St Value Rating: ★★★★★☆

Overview: YiChang HEC ChangJiang Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sales of pharmaceutical products with a market cap of HK$8.39 billion.

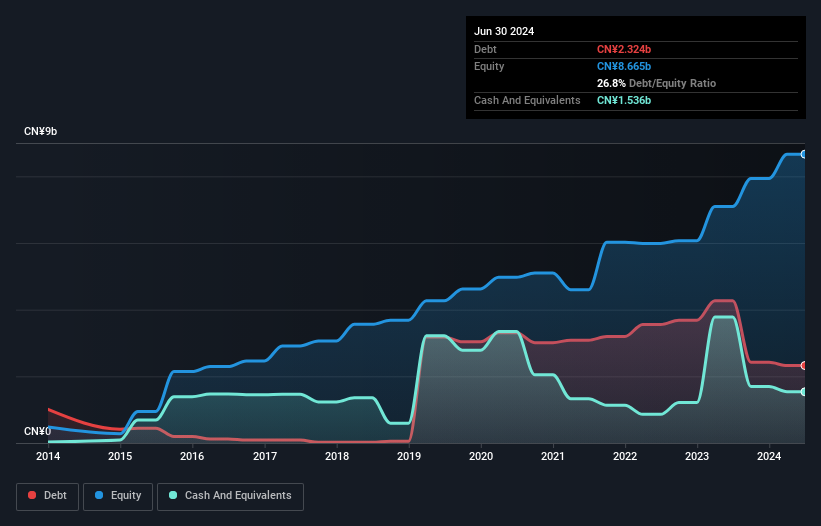

Operations: YiChang HEC ChangJiang Pharmaceutical generates revenue primarily from the sales of pharmaceutical products, amounting to CN¥6.29 billion. The company's net profit margin for the latest period is %.

YiChang HEC ChangJiang Pharmaceutical has shown remarkable earnings growth of 2501.2% over the past year, outpacing the industry average. Its net debt to equity ratio stands at a satisfactory 9.2%, and interest payments are well covered by EBIT with a coverage ratio of 16.9x. The company announced a special dividend of HKD 1.5 per share in May 2024, reflecting strong financial health and commitment to shareholder returns despite earnings declining by an average of 15.7% annually over five years.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

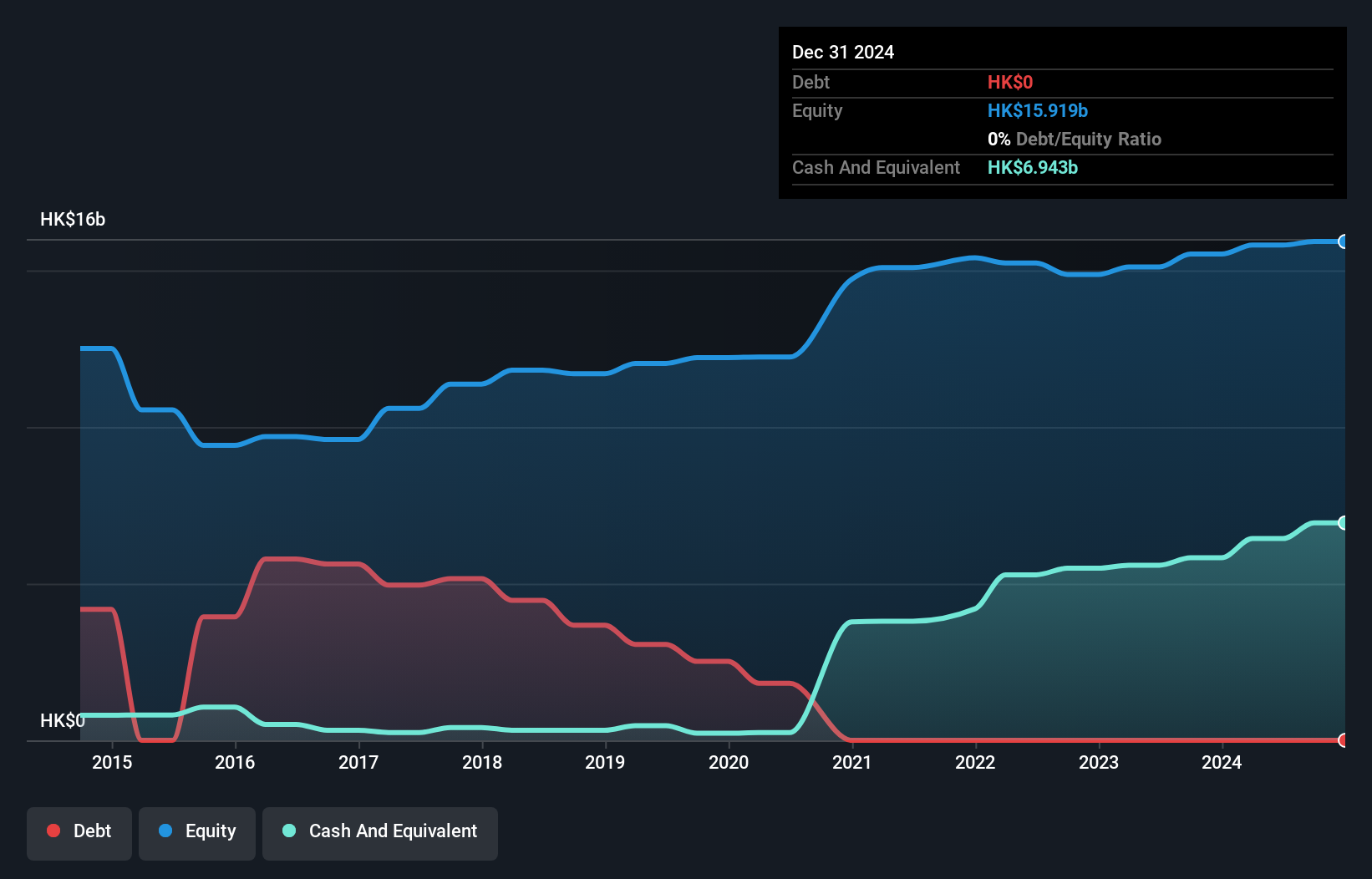

Overview: Sinopec Kantons Holdings Limited, an investment holding company, provides crude oil jetty services and has a market cap of HK$11.34 billion.

Operations: The company generates revenue primarily from crude oil jetty and storage services, amounting to HK$609.87 million.

Sinopec Kantons Holdings, a niche player in the oil and gas sector, has seen its earnings surge by 198.6% over the past year, outpacing the industry average of -6.8%. The company repurchased shares recently and is trading at 77.3% below its estimated fair value. With no debt on its balance sheet compared to a 31.4% debt-to-equity ratio five years ago, Sinopec Kantons appears financially robust and poised for steady growth with earnings forecasted to increase by 4% annually.

- Unlock comprehensive insights into our analysis of Sinopec Kantons Holdings stock in this health report.

Gain insights into Sinopec Kantons Holdings' past trends and performance with our Past report.

Where To Now?

- Access the full spectrum of 173 SEHK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1558

YiChang HEC ChangJiang Pharmaceutical

YiChang HEC ChangJiang Pharmaceutical Co., Ltd.

Flawless balance sheet and good value.