Stock Analysis

Exploring Kinetic Development Group And Two More Hidden Small Caps With Robust Fundamentals

Reviewed by Simply Wall St

In recent market activities, the Hong Kong stock market has shown a notable divergence in performance, particularly with small-cap stocks gaining attention as investors shift their focus towards value shares amidst broader economic shifts. This trend underscores the potential of exploring lesser-known companies like Kinetic Development Group, which may offer robust fundamentals in a transforming global landscape. Identifying strong candidates within these emerging sectors requires a keen understanding of how current economic conditions, such as trade tensions and policy adjustments, might influence growth opportunities for small-cap entities.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, an investment holding company, focuses on the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$8.94 billion.

Operations: The company generates revenue primarily from sales of its products, evidenced by consistent growth in gross profit, which increased from CN¥9.31 million in September 2013 to CN¥2.80 billion by December 2023. Despite fluctuations in net income margins over the years, it has shown improvement, with recent figures reaching as high as 43.79% in December 2023.

Kinetic Development Group, a lesser-highlighted player in Hong Kong's market, recently saw a dividend cut to HKD 0.05 per share as of May 2024, reflecting cautious financial adjustments. Despite a challenging environment with a 22% earnings contraction last year, the company trades at 19.3% below its estimated fair value, suggesting potential undervaluation. With an impressive interest coverage ratio of 55.7x and reduced debt-to-equity from 26.6% to 17.6%, Kinetic showcases robust financial health and resilience amidst industry pressures.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. is a company that specializes in the research, development, production, and marketing of edible bird’s nest products within the People’s Republic of China, boasting a market capitalization of HK$6.53 billion.

Operations: Xiamen Yan Palace Bird's Nest Industry generates revenue primarily through direct sales to online and offline customers, alongside sales to e-commerce platforms and distributors. The company has seen a steady increase in revenue, reaching CN¥1.96 billion by 2023, with a significant portion of its costs attributed to the cost of goods sold (COGS), which was CN¥969.32 million in the same year.

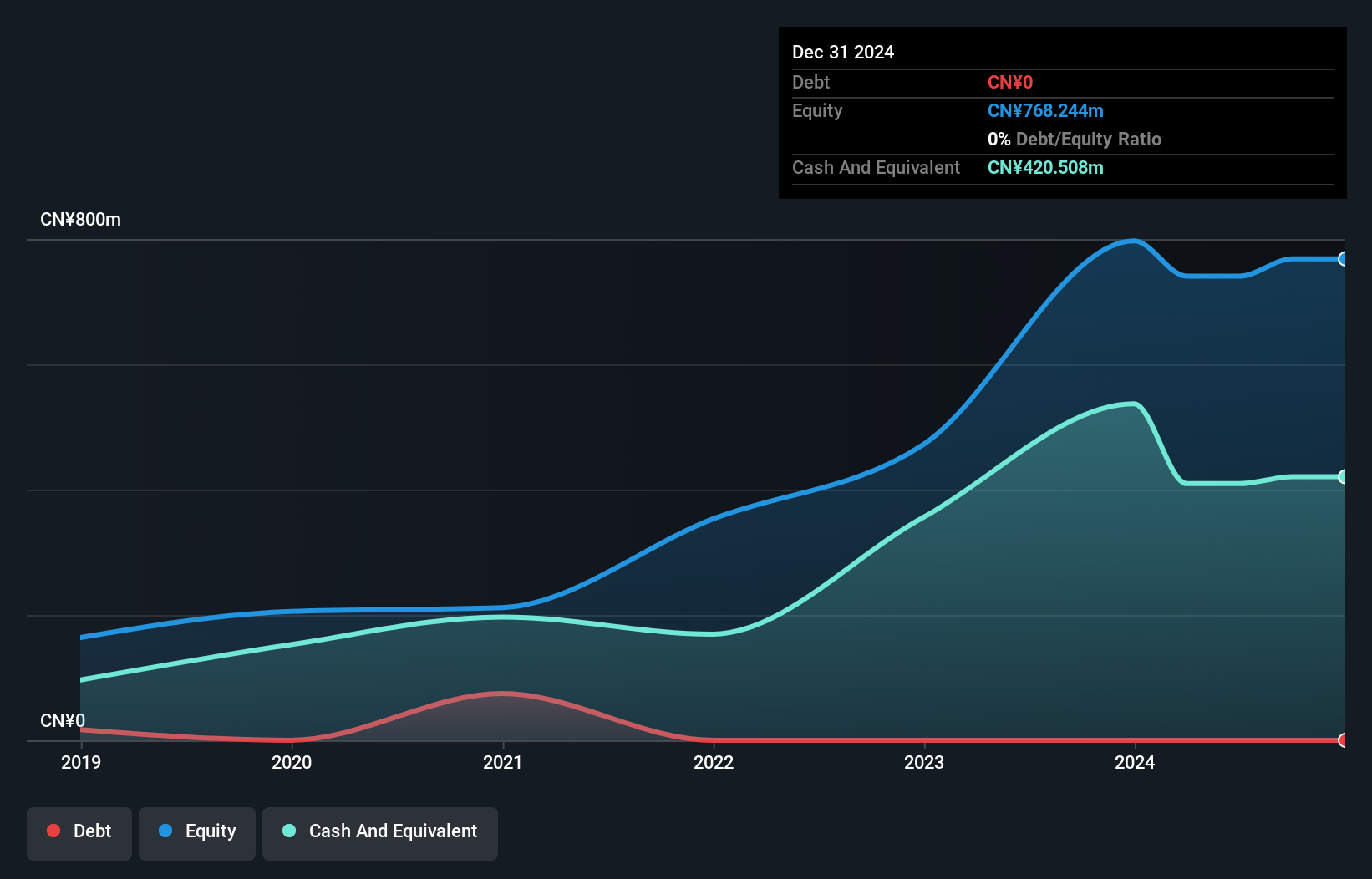

Xiamen Yan Palace Bird's Nest Industry Co., Ltd., a notable player in the niche market of bird's nest products, has shown resilience with a steady revenue increase of 10% to 15% year-over-year for the first half of 2024, totaling RMB 1,045 million to RMB 1,090 million. Despite a challenging environment, the company leveraged online sales growth but anticipates a net profit drop between 40% to 50%, forecasting RMB 50 million to RMB 60 million. The firm remains debt-free and declared an annual dividend of RMB 2.15 per ten shares for FY2023.

YiChang HEC ChangJiang Pharmaceutical (SEHK:1558)

Simply Wall St Value Rating: ★★★★★☆

Overview: YiChang HEC ChangJiang Pharmaceutical Co., Ltd. is a pharmaceutical company focused on the research, development, manufacturing, and sale of various medicines in China, with a market capitalization of HK$8.14 billion.

Operations: The company generates its revenue primarily through the sale of pharmaceutical products, which totaled CN¥6.29 billion in the most recent period. Its operations involve significant costs related to goods sold and operational expenses, leading to a net income of CN¥1.99 billion and a gross profit margin of 79.21% at the end of the last reported period.

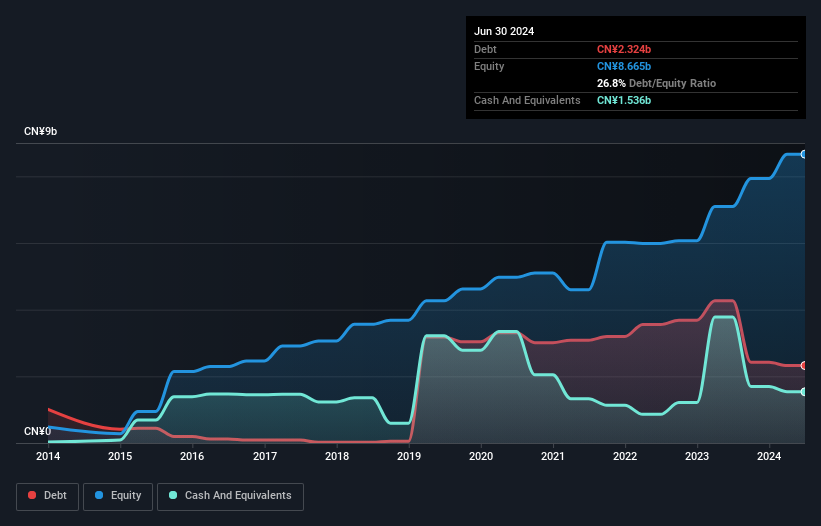

YiChang HEC ChangJiang Pharmaceutical, a lesser-known yet promising entity in Hong Kong's market, has demonstrated remarkable financial performance. The company outpaced the pharmaceutical industry with a 2501.2% earnings growth over the past year compared to the industry average of 0.1%. Despite an increase in its debt-to-equity ratio from 1.5% to 30.5%, its net debt-to-equity remains satisfactory at 9.2%. Recently, YiChang proposed a special dividend of HKD 1.5 per share and is undergoing a significant acquisition by Sunshine Lake Pharma valued at HKD 8.3 billion, expected to complete by June 2025, underscoring its strategic expansion efforts and shareholder value enhancement.

Next Steps

- Investigate our full lineup of 179 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether YiChang HEC ChangJiang Pharmaceutical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1558

YiChang HEC ChangJiang Pharmaceutical

YiChang HEC ChangJiang Pharmaceutical Co., Ltd.

Solid track record with excellent balance sheet.