Stock Analysis

- Hong Kong

- /

- Life Sciences

- /

- SEHK:1548

Strong week for Genscript Biotech (HKG:1548) shareholders doesn't alleviate pain of one-year loss

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Genscript Biotech Corporation (HKG:1548) share price slid 33% over twelve months. That contrasts poorly with the market decline of 8.6%. On the bright side, the stock is actually up 11% in the last three years. It's down 34% in about a quarter.

While the stock has risen 6.6% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Genscript Biotech

Genscript Biotech isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Genscript Biotech saw its revenue grow by 24%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 33%. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

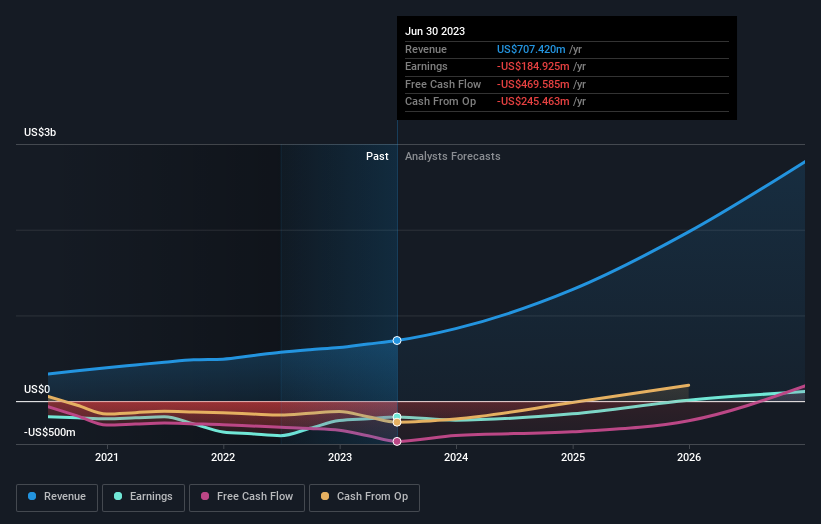

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Genscript Biotech is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Genscript Biotech in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 8.6% in the twelve months, Genscript Biotech shareholders did even worse, losing 33%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before spending more time on Genscript Biotech it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Genscript Biotech is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1548

Genscript Biotech

Genscript Biotech Corporation, an investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, the People’s Republic of China, Japan, the other Asia Pacific regions, and internationally.

Very undervalued with high growth potential.