- China

- /

- Specialty Stores

- /

- SZSE:002024

Kingsoft And 2 Additional Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape of shifting economic conditions, including rate cuts from the European Central Bank and fluctuations in U.S. indices, investors are increasingly focused on companies with strong growth potential and significant insider ownership. Such stocks often attract attention due to the alignment of interests between shareholders and company insiders, which can be particularly appealing in volatile market environments where confidence in management's commitment is crucial.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Let's uncover some gems from our specialized screener.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of HK$35.23 billion.

Operations: The company's revenue is derived from two main segments: Office Software and Services, contributing CN¥4.80 billion, and Entertainment Software and Others, generating CN¥4.18 billion.

Insider Ownership: 20.4%

Revenue Growth Forecast: 12.9% p.a.

Kingsoft's earnings are projected to grow significantly at 24.4% annually, outpacing the Hong Kong market. Despite a low forecasted return on equity of 7.4%, its revenue is expected to grow faster than the market at 12.9% per year. The company has executed share buybacks totaling HK$592.96 million, enhancing shareholder value while trading at a substantial discount of 73.8% below estimated fair value, indicating potential for appreciation amidst high insider ownership dynamics.

- Take a closer look at Kingsoft's potential here in our earnings growth report.

- Our valuation report here indicates Kingsoft may be undervalued.

Suning.com (SZSE:002024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suning.com Co., Ltd. operates in the retail sector in China with a market capitalization of approximately CN¥14.84 billion.

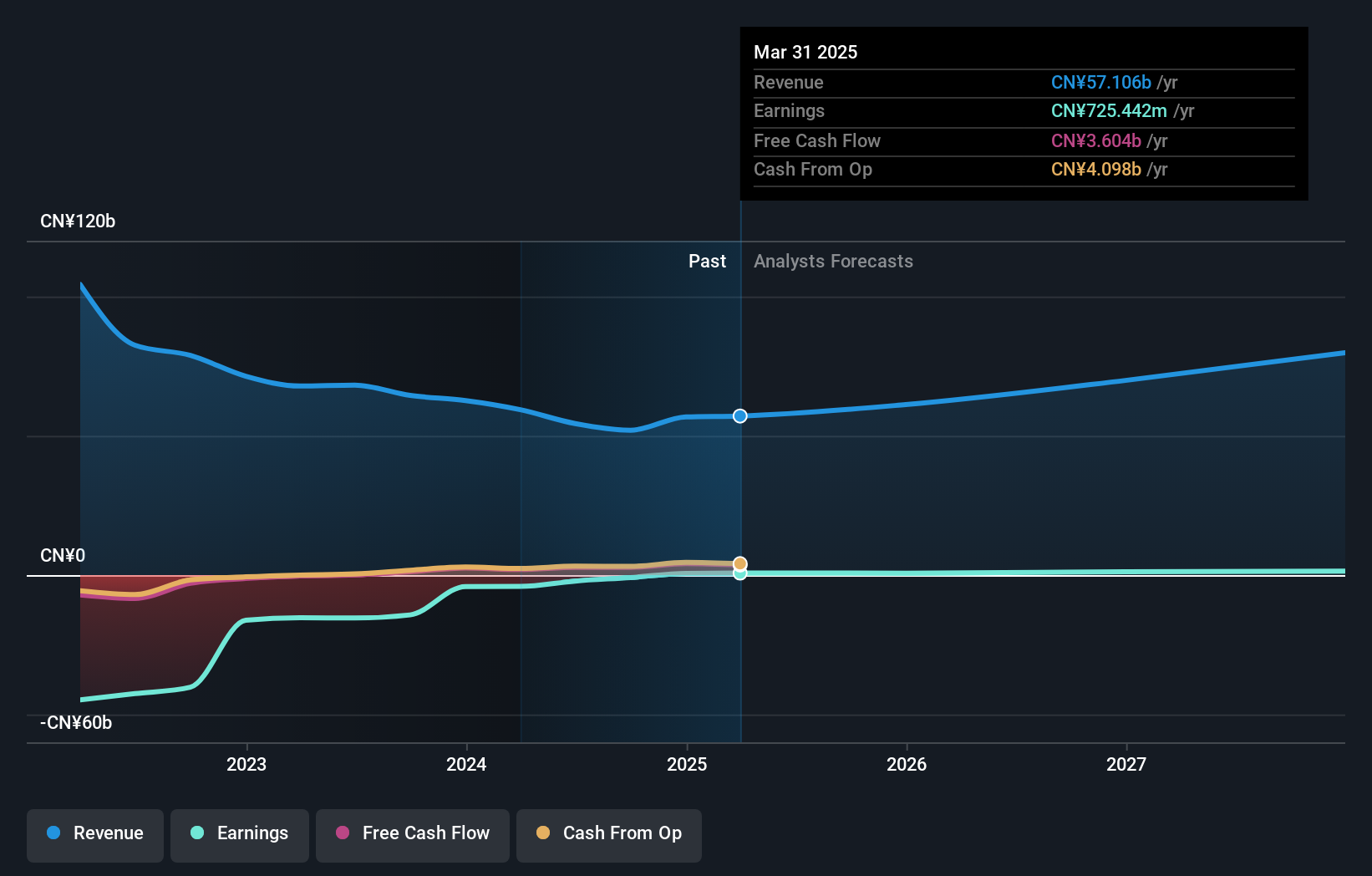

Operations: The company's revenue is primarily derived from its Mainland Retail Division at CN¥53.28 billion, followed by the Mainland Logistics Division at CN¥3.43 billion, and the Hong Kong and Other Regions Division at CN¥1.26 billion.

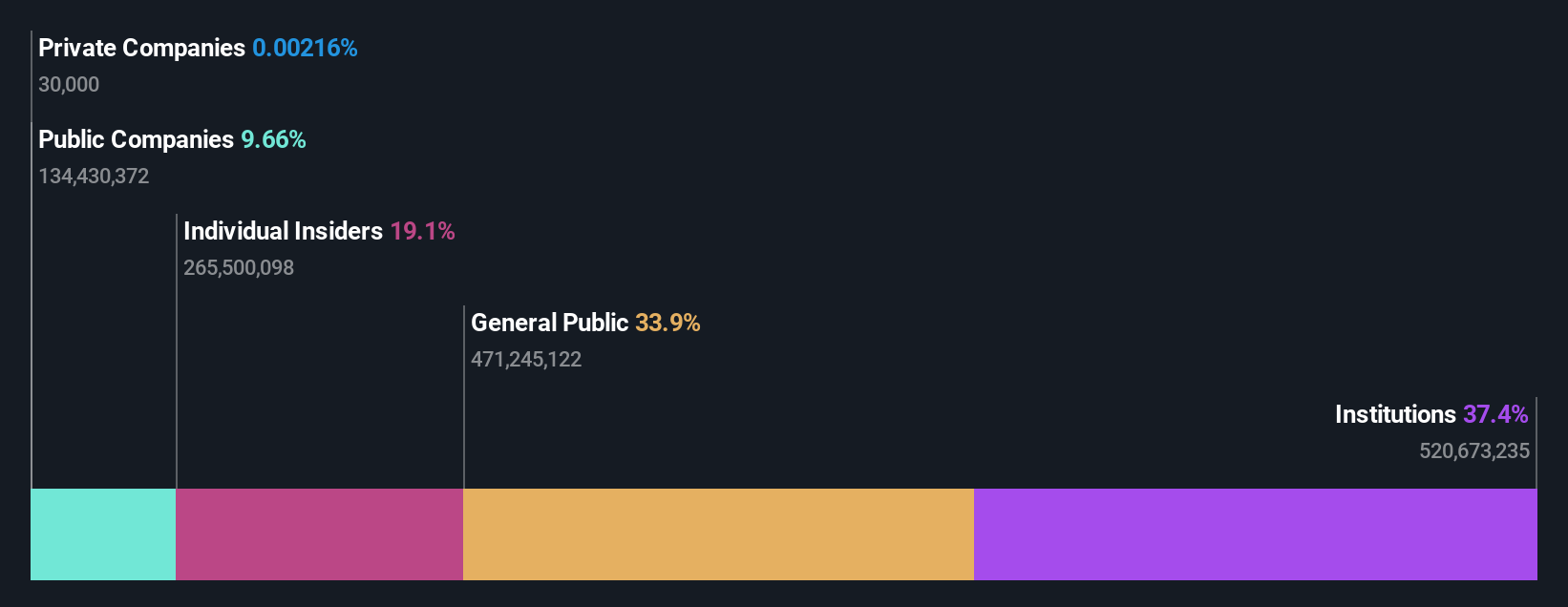

Insider Ownership: 20.2%

Revenue Growth Forecast: 18.4% p.a.

Suning.com is trading at a significant discount, 94.1% below estimated fair value, suggesting potential for appreciation. Despite recent challenges with declining sales to CNY 23.43 billion, the company reported a positive net income of CNY 14.75 million for the first half of 2024, reversing prior losses. Forecasts indicate revenue growth of 18.4% annually and profitability within three years, surpassing market averages while maintaining robust insider ownership dynamics through strategic share buybacks totaling CNY 80.34 million recently completed.

- Navigate through the intricacies of Suning.com with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Suning.com is priced lower than what may be justified by its financials.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. focuses on the research, development, production, and sale of intelligent equipment and its control components in China with a market cap of CN¥13.05 billion.

Operations: The company's revenue is primarily derived from its Instrument and Meter Manufacturing segment, which generates CN¥4.58 billion.

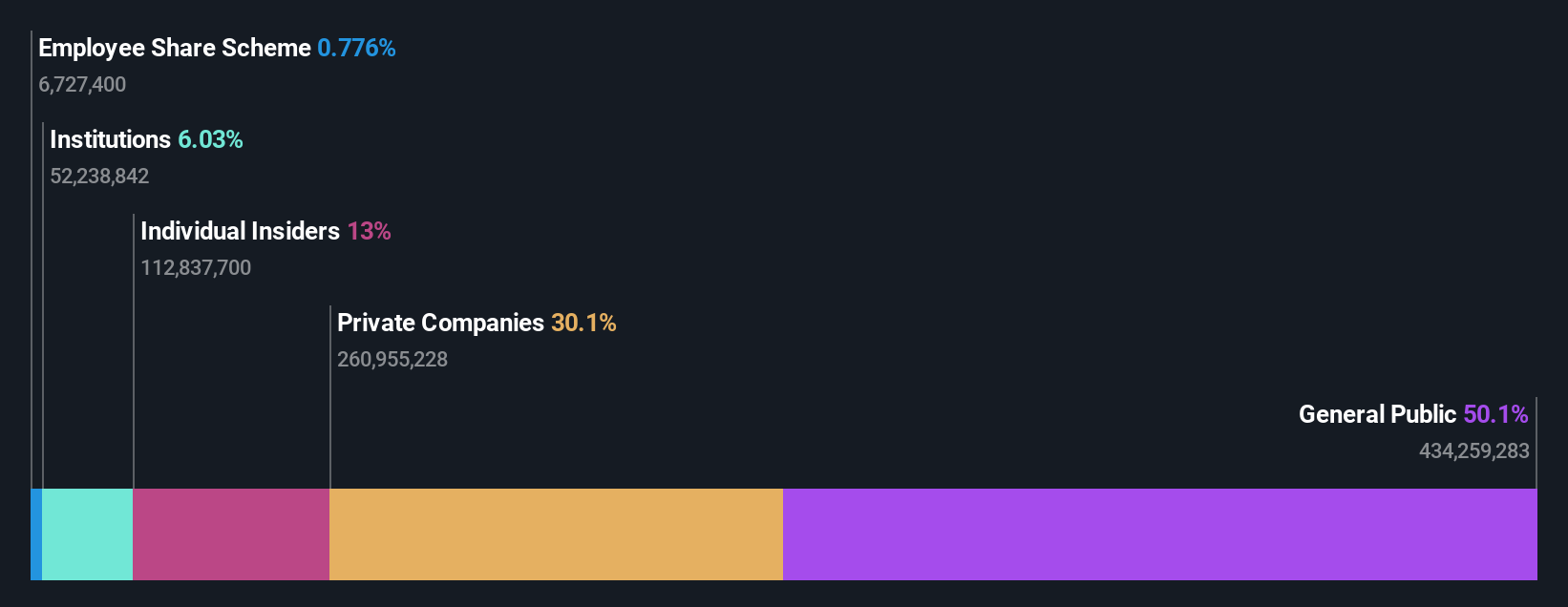

Insider Ownership: 13%

Revenue Growth Forecast: 14.3% p.a.

Estun Automation's revenue is forecast to grow at 14.3% annually, outpacing the Chinese market average of 13.5%, yet below the 20% threshold often associated with high-growth companies. Despite a challenging first half in 2024, with sales declining to CNY 2.17 billion and a net loss of CNY 73.42 million, earnings are expected to increase by over 50% per year, achieving profitability within three years—an above-market growth trajectory without recent insider trading activity noted.

- Click here to discover the nuances of Estun Automation with our detailed analytical future growth report.

- The analysis detailed in our Estun Automation valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Get an in-depth perspective on all 1486 Fast Growing Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002024

Undervalued with reasonable growth potential.