Stock Analysis

- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

High Growth Tech Stocks in Hong Kong to Watch

Reviewed by Simply Wall St

As global markets grapple with rising U.S. Treasury yields and mixed economic signals, Hong Kong's tech sector presents intriguing opportunities amidst broader market fluctuations, highlighted by the Hang Seng Index's recent decline of 1.03%. In this environment, high-growth tech stocks in Hong Kong are drawing attention for their potential to navigate these challenges through innovation and strategic positioning within the evolving economic landscape.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 23.28% | 38.76% | ★★★★★☆ |

| Innovent Biologics | 21.96% | 59.01% | ★★★★★☆ |

| RemeGen | 26.23% | 52.03% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Akeso | 33.50% | 53.28% | ★★★★★★ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Qingci Games | 54.54% | 168.74% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.61% | 7.62% | ★★★★★☆ |

Click here to see the full list of 42 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China with a market capitalization of approximately HK$203.92 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations, contributing CN¥117.32 billion, with a smaller portion from overseas activities at CN¥3.57 billion. The company focuses on live streaming and online marketing services within China.

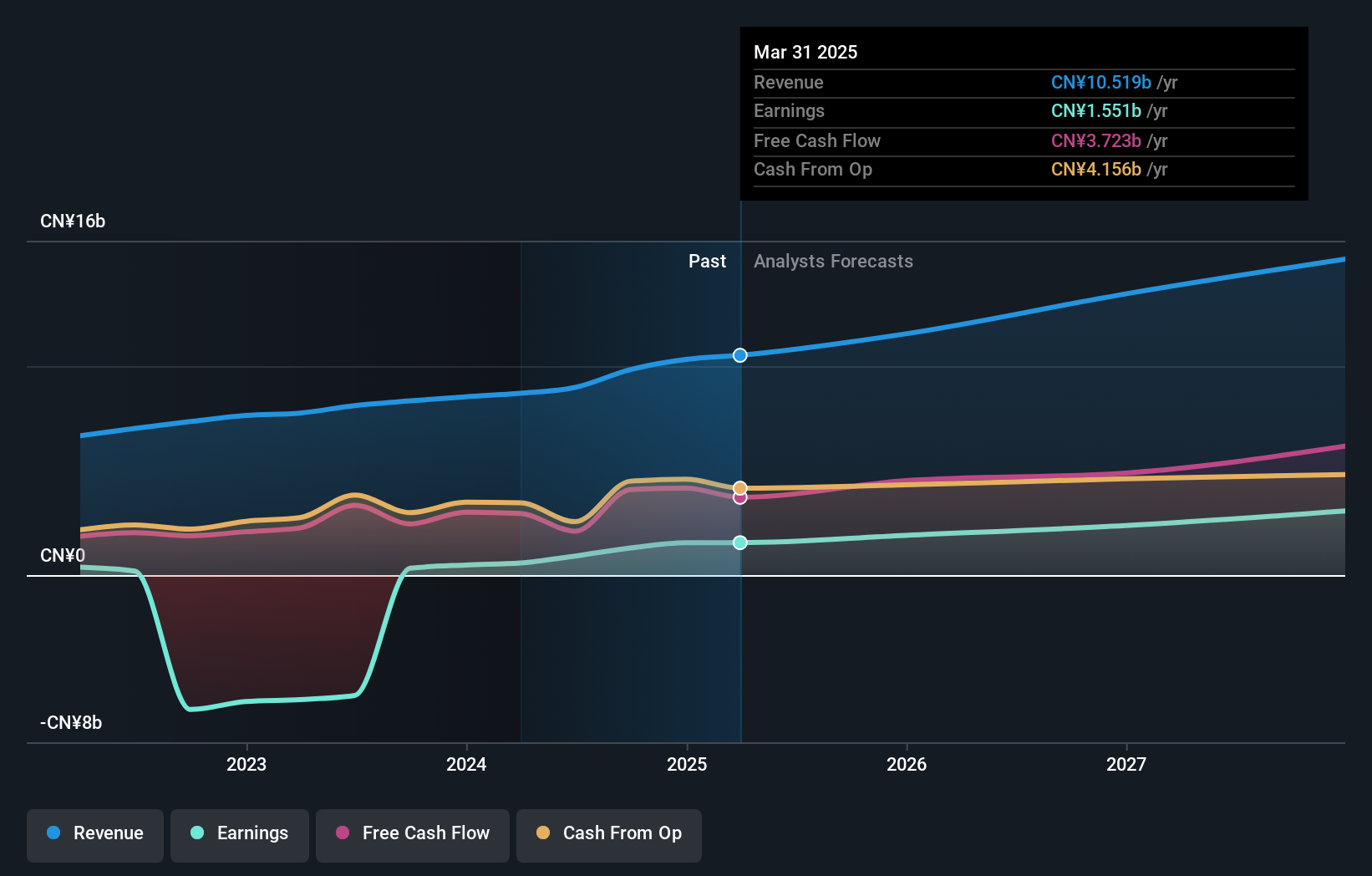

Kuaishou Technology, amidst a vibrant tech scene in Hong Kong, has demonstrated robust financial growth with its Q2 earnings soaring to CNY 3.98 billion from CNY 1.48 billion year-over-year, reflecting a substantial increase in profitability. This performance is underpinned by an impressive 18.7% forecasted annual earnings growth, outpacing the local market's 12.2%. Moreover, the company's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term competitiveness in the fast-evolving tech landscape. Despite facing slower revenue growth projections at 9% annually compared to more aggressive market averages, Kuaishou's strategic focus on high-quality earnings and positive free cash flow positions it as a noteworthy contender in the region’s tech industry.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$36.75 billion.

Operations: Kingsoft Corporation Limited generates revenue primarily from its office software and services segment, which accounts for CN¥4.80 billion, and its entertainment software segment with CN¥4.18 billion in revenue. The company operates across Mainland China, Hong Kong, and internationally.

Kingsoft's recent financial performance showcases a significant uptick, with Q2 revenue climbing to CNY 2.47 billion from CNY 2.19 billion year-over-year and net income surging to CNY 393.35 million from CNY 57.19 million, reflecting a robust growth trajectory in the tech sector. The company's dedication to innovation is mirrored in its R&D spending, crucial for maintaining competitive edge in rapidly evolving markets like AI and software development. Despite some challenges, Kingsoft has repurchased shares worth HKD 37.19 million recently, underscoring confidence in its financial health and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Kingsoft.

Assess Kingsoft's past performance with our detailed historical performance reports.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market capitalization of approximately HK$61.89 billion.

Operations: The company's primary revenue stream comes from the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion.

Akeso's trajectory in the high-growth tech landscape of Hong Kong is marked by its aggressive pursuit of innovation, particularly in biopharmaceuticals. The company's recent completion of a HKD 1.94 billion equity offering underscores its robust financial strategies and commitment to growth. Notably, Akeso has made significant strides in R&D, with a focus on groundbreaking therapies like cadonilimab for cervical cancer, demonstrating promising clinical outcomes with a 53.3% annual earnings growth forecast. These efforts are pivotal as Akeso not only addresses critical healthcare needs but also positions itself as a leader in biotech innovations, enhancing its competitive edge in the global market.

- Unlock comprehensive insights into our analysis of Akeso stock in this health report.

Gain insights into Akeso's historical performance by reviewing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 39 SEHK High Growth Tech and AI Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.