From what we can see, insiders were net sellers in Kingsoft Corporation Limited's (HKG:3888 ) during the past 12 months. That is, insiders sold the stock in greater numbers than they purchased it.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Kingsoft

The Last 12 Months Of Insider Transactions At Kingsoft

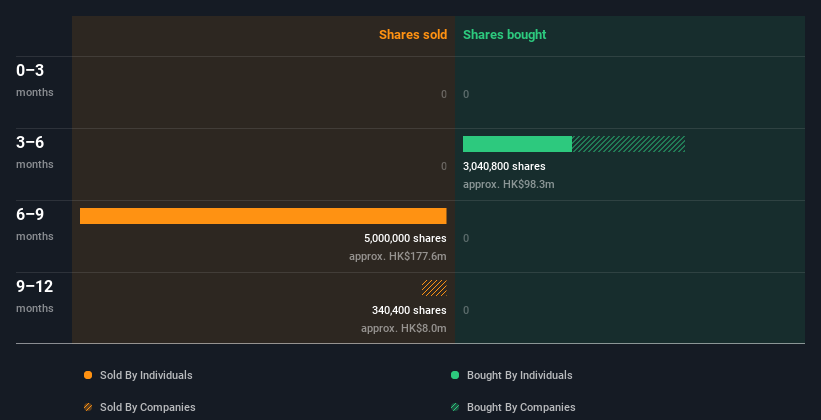

Over the last year, we can see that the biggest insider sale was by the Non-Executive Director, Pak Kwan Kau, for HK$103m worth of shares, at about HK$34.28 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (HK$28.40). So it is hard to draw any strong conclusion from it. Pak Kwan Kau was the only individual insider to sell shares in the last twelve months.

Pak Kwan Kau ditched 5.00m shares over the year. The average price per share was CN¥35.27. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Kingsoft Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Kingsoft insiders own about HK$7.7b worth of shares (which is 20% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Kingsoft Insiders?

The fact that there have been no Kingsoft insider transactions recently certainly doesn't bother us. While we feel good about high insider ownership of Kingsoft, we can't say the same about the selling of shares. Therefore, you should definitely take a look at this FREE report showing analyst forecasts for Kingsoft.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Flawless balance sheet with reasonable growth potential.