Stock Analysis

- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3993

CMOC Group (HKG:3993) Has Announced That It Will Be Increasing Its Dividend To CN¥0.0938

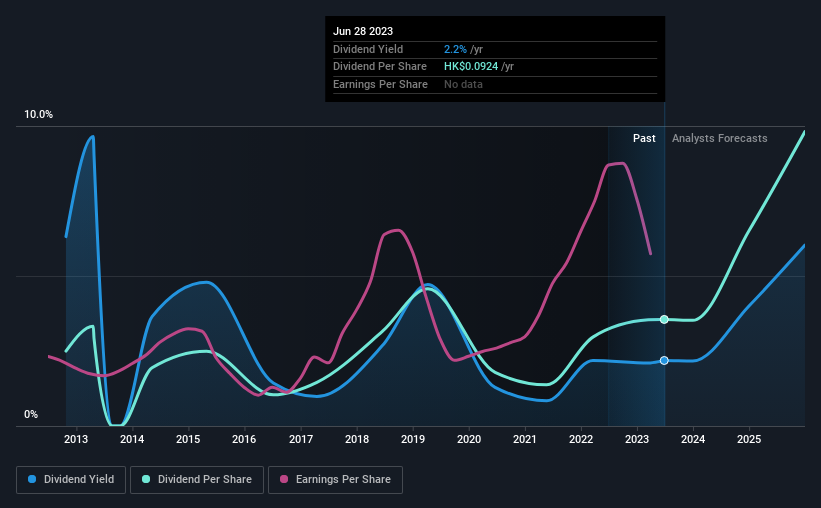

CMOC Group Limited (HKG:3993) will increase its dividend from last year's comparable payment on the 27th of July to CN¥0.0938. Despite this raise, the dividend yield of 2.2% is only a modest boost to shareholder returns.

See our latest analysis for CMOC Group

CMOC Group's Earnings Easily Cover The Distributions

If it is predictable over a long period, even low dividend yields can be attractive. The last dividend was quite easily covered by CMOC Group's earnings. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 198.8%. If the dividend continues along recent trends, we estimate the payout ratio will be 15%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of CN¥0.06 in 2013 to the most recent total annual payment of CN¥0.0854. This works out to be a compound annual growth rate (CAGR) of approximately 3.6% a year over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. However, CMOC Group has only grown its earnings per share at 3.8% per annum over the past five years. Growth of 3.8% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This could mean the dividend doesn't have the growth potential we look for going into the future.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Earnings growth generally bodes well for the future value of company dividend payments. See if the 15 CMOC Group analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether CMOC Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3993

CMOC Group

CMOC Group Limited, together with its subsidiaries, engages in the mining, beneficiation, smelting, refining, and trading of copper, cobalt, molybdenum, phosphates, and other base and rare metals.

Solid track record with excellent balance sheet.