- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3939

Wanguo Gold Group (SEHK:3939) Valuation in Focus After Chairman’s Major Share Purchase

Reviewed by Simply Wall St

Wanguo Gold Group (SEHK:3939) caught attention after its founder and chairman, Mr. Gao Mingqing, boosted his stake by purchasing 1,010,000 ordinary shares. This move raises his total interest to around 26% of the company’s issued share capital.

See our latest analysis for Wanguo Gold Group.

After a stellar run-up earlier this year, Wanguo Gold Group’s share price has cooled off in recent weeks. The 30-day share price return sits at -24.2%, but the stock has still delivered a remarkable 230.81% total shareholder return over the past year. Momentum might be pausing; yet the significant insider buy underscores solid optimism about longer-term prospects.

If management’s confidence has you looking for other opportunities, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With insider confidence running high and shares still trading well below the average analyst price target, investors may wonder whether Wanguo Gold Group is set for a value-driven rebound or if the market is already factoring in the next stage of growth.

Price-to-Earnings of 33.8x: Is it justified?

Wanguo Gold Group’s shares are currently valued on a price-to-earnings multiple of 33.8x, well above not only its industry peers but also the level suggested by fair value estimates.

The price-to-earnings (P/E) ratio compares a company’s share price to its annual earnings per share. In the metals and mining sector, where profitability can be cyclical, a high P/E might reflect anticipated rapid growth, exceptional profitability, or high investor optimism.

Despite the company’s recent explosive profit growth and robust return on equity, its 33.8x P/E is sharply higher than the Hong Kong metals and mining industry average of 15.4x and the estimated “fair” P/E of only 18.9x. This suggests the market is factoring in ambitious future growth or assigning a premium well above sector norms, levels that often reset if future results or sentiment shift.

Explore the SWS fair ratio for Wanguo Gold Group

Result: Price-to-Earnings of 33.8x (OVERVALUED)

However, a sharp correction could occur if growth slows from its recent pace or if market expectations around profit margins and industry outlook become less optimistic.

Find out about the key risks to this Wanguo Gold Group narrative.

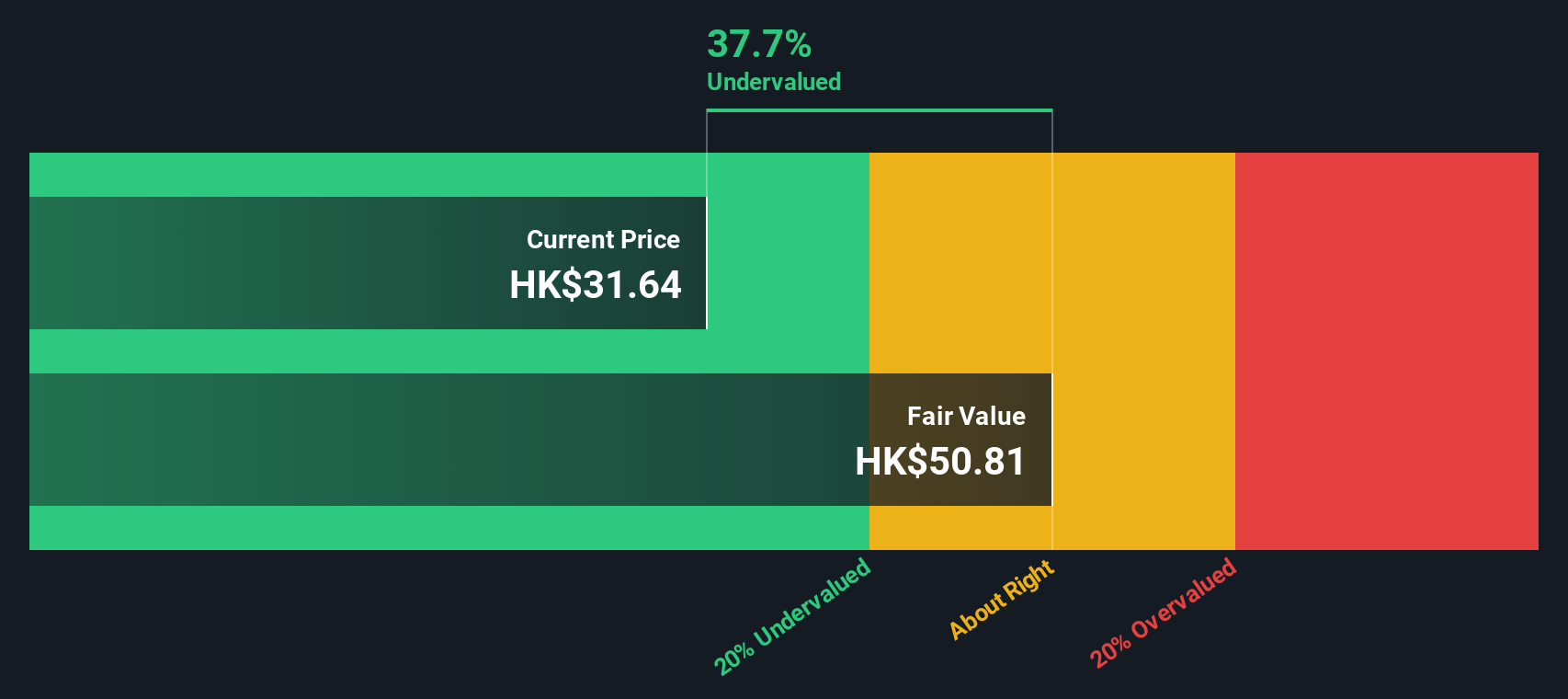

Another View: SWS DCF Model Points to Opportunity

While shares look expensive based on earnings multiples, our DCF model suggests a different story. According to our discounted cash flow analysis, Wanguo Gold Group is trading roughly 39.5% below its estimated fair value. This may indicate the possibility of significant long-term upside if assumptions hold true. Does this gap signal a hidden opportunity, or is the market right to be cautious on growth durability?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wanguo Gold Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wanguo Gold Group Narrative

If you see things differently or enjoy your own analysis, you can easily dig into the numbers and build a narrative yourself in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Wanguo Gold Group.

Looking for More Smart Investment Opportunities?

Why limit your potential? Give yourself every advantage by checking out tailored lists of stocks that target growth, resilience, and tomorrow's trends, all waiting for you.

- Pounce on tomorrow’s tech wave by scanning these 25 AI penny stocks. Rapid innovation and artificial intelligence prowess are driving new leaders in this space.

- Tap into robust income streams with these 17 dividend stocks with yields > 3%, which features high-yield stocks that aim to keep your returns steady even in volatile markets.

- Seize an edge with deep value picks by finding companies currently priced attractively on these 857 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wanguo Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3939

Wanguo Gold Group

An investment holding company, engages in mining, ore processing, and sale of concentrate products in the People’s Republic of China and Solomon Islands.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives